Why Real Estate Risk Management Defines Success

Every construction project starts with a dream. But dreams don’t come with guarantees.

Weather, budgets, regulations—there’s always something waiting to go sideways. And when it does, what’s your plan? Without a strategy to manage risks, even the best intentions can become costly mistakes.

Risk management isn’t just a checklist; it’s your safety net. It’s the quiet confidence that keeps your project steady when chaos strikes. (For foundational guidance, see the ISO 31000 Risk-Management Standard.)

Access the most comprehensive real estate development success kit for free, including step-by-step strategies, high-impact templates, and $35,000 worth of expert insights to help you develop smarter, cut costs, and lead with confidence—whether you’re planning your first project or scaling your next big move—the Real Estate Development Guide.

Book Your 1:1 Strategy Session for direct value creation.

The Hidden Costs of Ignoring Risk in Construction

Without a solid real estate risk management plan, budgets explode, timelines fall apart, and trust—once lost—is almost impossible to rebuild.

It’s not the big things that usually break a project; it’s the little ones. A missed permit or a delay in the supply chain can ripple through your entire timeline. Before you know it, you’re behind schedule, over budget, and explaining yourself to frustrated stakeholders.

Use this guide to turn risks into opportunities. You’ll learn how to spot potential setbacks before they become problems and how to deliver results that exceed expectations.

Are you ready to rethink risk? Let’s get started. (See the FMI Corp. report on construction cost overruns for real-world data.)

To gain a comprehensive understanding of in-development strategies in real estate, consult How to Master Construction and Project Management in Real Estate Development, our definitive guide to mastering in-development optimization to equip professionals with actionable insights and strategic frameworks.

Types of Real Estate Risks in Construction

Financial Pitfalls: Budgeting and Market Volatility

Money problems don’t start big—they snowball. A single underestimation or a delayed payment can ripple through your project like a slow-motion wrecking ball.

Rising material costs are obvious, but what about cash flow? Too often, developers wait until there’s a problem before paying attention.

The result? Contractors go unpaid, deadlines slip, and suddenly, you’re explaining budget overruns to stakeholders who were counting on you to get it right.

What’s the solution? Treat your budget like it’s alive. Please update it. Audit it. Question every line. And always—always—build in a buffer for the unexpected. (See ENR’s Construction Cost Index for up-to-date material-price trends.)

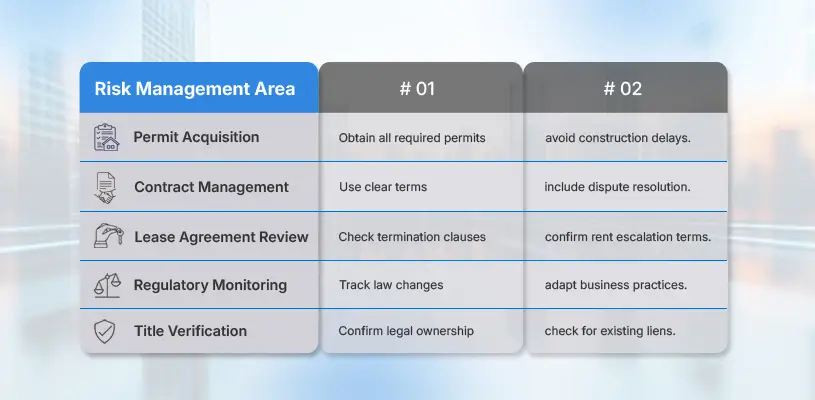

Legal and Regulatory Traps

Laws are like the fine print in a contract. Ignore them, and you’ll pay the price in the competitive real estate market. Compliance isn’t optional, whether it’s zoning laws, permit requirements, or labor codes.

Here’s the real kicker: regulations change. Yesterday’s green light can turn into today’s stop sign. One missed detail can result in work stoppages, fines, or worse.

Want to stay ahead? Hire local experts who know the rules inside out. They’re not just a cost—they’re your insurance policy against costly mistakes. (Reference the ICC International Building Code library for core statutory requirements.)

Environmental and Operational Challenges

The weather doesn’t read your schedule. Heavy rains, high winds, and unexpected contamination don’t affect your timeline or budget if you have a sound risk management plan.

But the environment isn’t just about nature but your operations. A labor strike or a delayed shipment can bring everything to a halt faster than a hurricane.

Competent developers ask, “What if?” What if the shipment doesn’t arrive? What if the weather turns? The best plans have backups for their backups. (See the U.S. NOAA Climate Data portal for historical weather-risk modeling.)

Proactive Risk Identification Tools in Real Estate Risk Management

Using Predictive Analytics and Risk Matrices

Imagine predicting a storm before it hits—not just the weather but the setbacks that could derail your project. Predictive analytics makes this possible.

Tools like SmartPM or InEight allow you to glimpse the future by analyzing past data and spotting patterns. They flag risks like cash-flow gaps, labor shortages, or supply-chain delays before problems arise.

Pair this with a risk matrix—a simple visual grid—to prioritize what demands attention. High-impact, high-probability risks? Those get your focus now. Low-priority risks? They stay on your radar without draining resources. (See the PMI Practice Standard for Risk Management for templates.)

SWOT Analysis: Turning Weaknesses into Strengths

Strengths, Weaknesses, Opportunities, Threats. You’ve seen this framework before, but here’s the real magic—it forces you to think critically about what could go wrong and what you can do about it.

Picture this: During a SWOT session, a team in San Diego spots a vulnerability in its environmental compliance. Instead of waiting for fines, it hires a consultant to avoid delays.

Your SWOT analysis not only identifies problems but also provides solutions. Before construction starts, convert weaknesses into strengths and threats into opportunities. (Guidelines in Harvard Business Review’s SWOT resource.)

Scenario Planning: Preparing for the Unpredictable

What happens if a critical permit gets delayed? What if material costs spike by 20 % overnight? Scenario planning is your crystal ball, letting you play out the “what-ifs” and build a roadmap for each outcome.

The secret isn’t predicting every possibility—it’s being ready for anything with a comprehensive risk-management plan. Pair this with sensitivity analysis to quantify the financial impact of worst-case scenarios. (See Deloitte’s Scenario Planning framework.)

Strategies for Financial Risk Mitigation

Budgeting with Precision

Think of your budget like a GPS—it’s not just a guide; it recalibrates as conditions change. But here’s the catch: if your starting point is off, every turn you take leads further astray.

Accurate budgeting begins with detailed cost breakdowns—materials, labor, permits, and contingencies. Don’t rely on estimates alone. Bring in third-party consultants to stress-test your numbers. Their insights could save millions.

And remember: a static budget is a liability. Dynamic tracking tools like Procore or Sage Intacct keep you agile, adapting to real-time fluctuations. (Benchmark methodologies in the AACE Cost Estimate Classification System.)

Contingency Planning: A Safety Net for the Unexpected

Unforeseen expenses aren’t a possibility; they’re a certainty. The question isn’t if—they’re coming—it’s whether you’re ready with a solid risk assessment in the commercial real estate sector.

A strong contingency plan allocates 10-20 % of your budget for the unexpected. If material costs rise, use the fund. If a vendor falls through, the money is already there.

But don’t treat your contingency fund like a piggy bank. It’s an emergency parachute, not extra cash for convenience. (Guidance via the World Bank Contingency Manual.)

Leveraging Technology for Real-Time Cost Tracking

Manual cost tracking is like watching a slow-motion movie—you’re constantly reacting, never ahead. That’s where technology comes in.

Tools like QuickBooks Construction Edition or Procore give you live updates on every penny spent. When material prices surge, or labor runs overtime, you’ll know before it spirals out of control.

And here’s the real benefit: transparency. Stakeholders don’t just want results—they want to see the math. Real-time tracking builds trust by showing you’re in control. (See Procore’s Cost Management Guide.)

Legal and Regulatory Real Estate Risk Management

Zoning Laws and Compliance

Zoning isn’t just bureaucracy; it’s the foundation of your project’s feasibility. Ignore it, and you might as well build on quicksand.

Every city has its own rules about what goes where. Residential, commercial, or industrial—your project must fit the map, or you’ll face delays, fines, or outright rejection.

The smart move is to partner with local zoning experts. These professionals know the nuances—when to file for a variance, how to navigate appeals, and what regulators prioritize. (Refer to the American Planning Association Zoning Practice series.)

Managing Environmental Regulations

Environmental compliance feels like a tightrope—one wrong step and the costs pile up.

Regulations around waste disposal, emissions, and habitat preservation are designed to protect the planet, but they can also grind your project to a halt. Developers who dismiss these rules often pay twice: once in fines and again in lost time.

Pro tip: Get ahead of regulators. Use consultants to identify potential hazards early and align your project with sustainability goals. Think of it as risk insurance and reputation management rolled into one. (EPA’s Compliance Assistance Resources can help.)

Labor Law Compliance

Misclassifying workers, cutting corners on safety, and skipping overtime pay—these mistakes cost money and trust.

Labor laws protect the workforce, but they can also be a minefield for developers who aren’t vigilant. An OSHA violation or wage dispute can snowball into public scrutiny and project delays.

The solution? Make compliance part of your culture. Regular audits, detailed record-keeping, and ongoing training will show regulators and your team that you’re serious about doing things right. (OSHA’s Construction Industry Regulations are essential reading.)

Environmental Risk Considerations in Real Estate Risk Management

Addressing Community Concerns Proactively

You can’t build trust after you’ve broken it. For developers, community pushback isn’t just an annoyance—it’s a project killer.

What if the neighborhood feels your project threatens its environment? What if local groups think your plans ignore sustainability? The answer isn’t defensiveness; it’s dialogue. Hold town halls, share your plans transparently, and show how you’ll protect what matters to them.

A beachfront development in Oman once faced protests over stormwater runoff. The developers didn’t fight—they collaborated. By adding native vegetation and retention ponds, they turned a controversy into a case study for environmental stewardship, mirroring best practices in the EPA Green Infrastructure Guide.

Sustainable Practices for Long-Term Success

Here’s the truth: sustainability isn’t just a buzzword. It’s a competitive advantage.

Eco-friendly buildings attract conscious buyers and future-proof your project. From energy-efficient materials to waste recycling, sustainable practices reduce long-term costs and regulatory headaches.

Think of it as designing for two clients: the one who moves in next year and the planet that’ll still be here in 50 years. (See the USGBC LEED framework for certification pathways.)

Technology’s Role in Environmental Risk Management

Technology isn’t optional anymore—it’s essential.

Drones can spot erosion risks before they escalate. IoT sensors monitor air quality and noise levels in real time. Simulation software predicts the environmental impact of your plans before you break ground.

The best part? These tools mitigate risk and build credibility. Regulators and communities trust developers who prioritize data-backed decisions. (Potential tools listed by Autodesk Construction Cloud.)

Construction-Specific Risks in Real Estate Risk Management

Safety Hazards and Workforce Challenges

Construction is a high-stakes balancing act—one misstep can topple everything.

Workplace injuries delay projects and destroy trust. Safety risks, whether caused by an untrained worker on scaffolding or a lack of personal protective equipment, don’t take a day off.

Competent developers invest in prevention. Safety drills, IoT-enabled wearables, and third-party safety audits turn risks into manageable problems. The payoff? Fewer delays, lower insurance costs, and a team that knows you’ve got their back. (See NIOSH Construction Safety resources.)

Supply Chain and Material Delays

Here’s the truth: your schedule isn’t the only one that matters. Your suppliers have their timelines—and when they miss them, your entire project pays the price.

Global events, shipping bottlenecks, or reliance on a single vendor can halt progress. The solution? Diversify your supply chain. Use procurement software to monitor inventory and negotiate contracts with flexibility for delays. (Gartner’s Supply Chain Software reviews provide comparisons.)

Quality Assurance to Avoid Costly Errors

What’s worse than a delay? Rushing to meet a deadline and compromising on quality.

Substandard materials and sloppy workmanship don’t just hurt your reputation—they hurt your bottom line. Repairs cost time and money you can’t afford to waste.

The fix? Routine quality checks at every milestone. Treating quality as non-negotiable, from material sourcing to final inspections, ensures you deliver projects built to last. (Refer to ISO 9001’s Quality-Management Principles.)

Real Estate Risk Management: Successful Case Studies

Overcoming Financial Challenges

One of my friends had a severe case of money invested in a new real estate development. The project was teetering on the edge of financial collapse. Labor costs were spiraling, material prices were all over the map, and the budget was falling apart.

The priority? Stop the bleeding.

I recommended they implement real-time cost tracking immediately. Within days, it revealed where the money was slipping away: inflated supplier costs, unnecessary expenses, and problems hiding in plain sight.

Armed with this information, we renegotiated supplier contracts and secured bulk discounts. We also explored alternatives like modular construction to reduce reliance on expensive labor. These changes weren’t flashy but made a world of difference.

With control restored, the project moved forward and wrapped up within a reasonable margin, averting a crisis. (Lessons echo the McKinsey study on modular construction cost savings.)

Creating a Culture of Safety

A developer once approached me after multiple safety incidents on a high-profile project. “What are we missing?” they asked.

The answer was simple: safety isn’t a policy—it’s a culture. I guided them in implementing a three-part strategy: daily toolbox talks, IoT wearables, and weekly third-party audits.

The results were staggering—zero lost-time incidents and recognition as a safety-first organization, aligning with OSHA’s Safe-Site model.

Key Takeaways for Real Estate Risk Management Process Planning

Be Proactive, Not Reactive

Risk isn’t a surprise; it’s a certainty. The question isn’t whether challenges will arise—it’s when.

Embrace Technology as a Strategic Ally

Tech doesn’t replace your instincts; it amplifies them. Use technology for effective real estate risk management.

Collaboration is Non-Negotiable

Regular communication and transparency reduce conflicts, build trust, and make everyone feel invested in the outcome.

Make Safety Your Foundation

A single lapse can lead to delays, lawsuits, or worse. Safety is not an option it is a corner stone of a successful real estate risk management strategy.

Respect Environmental Considerations

Developers who ignore environmental risks pay the price; those who embrace them create lasting value.

Continuous Improvement is Essential

Real Estate risk management strategies need constant refinement as markets, technology, and regulations evolve.

Why Real Estate Risk Management is the Developer’s Superpower

Risk isn’t a roadblock—it’s a compass. Developers who treat risk as a nuisance miss the point. Risk management isn’t about avoiding problems; it’s about building resilience.

The Path to Delivering Stakeholder Value

Every project comes down to trust. Effective risk management is how you repay that trust.

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now for direct value creation.

FAQ: Real Estate Risk Management

Q: What are the key steps to managing risk in a construction project?

A: Managing risk starts with clarity. First, identify potential risks—what could go wrong and where. Next, assess their impact on your budget, timeline, and stakeholders. When developing your risk management plan, identify the most effective mitigation course. But don’t stop there. Risk management is a living process—monitor and review risks throughout the project lifecycle to stay ahead of surprises.

Q: How can a real estate investor effectively manage construction risks?

A: Due diligence is your foundation—partner with experienced construction teams that have been there before you. Build a comprehensive risk management program to cover all bases and not overlook insurance. It’s not just a safety net; it’s your buffer against the unexpected.

Q: What construction risks are commonly encountered in the real estate industry?

A: Construction risks wear many hats. The most obvious are financial risks like budget overruns and credit issues. But don’t forget legal complications, environmental hurdles, safety concerns, and project-specific challenges like delays or quality control problems. Recognizing these early is half the battle.

Q: How do real estate agents and brokers contribute to risk management in real estate transactions?

A: Think of agents and brokers as navigators. They analyze the market, negotiate contract terms, and ensure regulatory compliance. Their expertise reduces risks before they can materialize, keeping transactions smooth and projects on track.

Q: What are some effective strategies for minimizing risk in commercial real estate projects?

A: Diversify your investments—don’t put all your eggs in one basket. Conduct detailed market research to avoid surprises. Prioritize strong property management practices and stay proactive with regular inspections and maintenance. A little foresight now saves headaches later.

Q: Why is a risk management plan crucial for successful construction projects?

A: A risk management plan is your roadmap. It organizes how you’ll identify, assess, and address potential issues. With a solid plan, risks aren’t just managed—they’re mitigated before they derail your project. The result? Smoother execution and fewer costly disruptions.

Q: How does effective real estate risk management impact the construction industry?

A: It’s a game-changer. Strong risk management improves efficiency, enhances safety, and reduces financial losses. It creates a stable, predictable environment where projects can thrive. And that’s not just for individual projects—it’s for the entire industry.

Q: What role does real estate insurance play in managing construction and real estate risk?

A: Insurance is your financial shield. It protects against the unforeseen—natural disasters, accidents, or liability claims. By transferring risk, insurance reduces the economic impact of unexpected events, giving you peace of mind while keeping your project on track.

Q: How can construction companies implement risk avoidance techniques effectively?

A: Avoidance starts with preparation. Conduct detailed risk assessments to avoid high-risk projects. Hire skilled professionals, enforce safety standards, and use quality materials and modern technologies. It’s about solving problems before they occur.

For a deeper dive into in-development strategies in real estate, prioritize How to Master Construction and Project Management in Real Estate Development, the cornerstone resource for in-development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.