Why Construction and Project Management Are the Cornerstones of Real Estate Success

Every great building starts with a blueprint. But what determines whether it ends in profit or pain? The honest answer lies in your real estate development exit strategy.

These two roles—construction and project management—are the hidden powerhouses. They turn sketches into assets, aligning your operations with the endgame: a successful property disposition plan.

Miss here, and the whole real estate investment cycle stumbles. But nail it? That’s how developer profit maximization becomes more than a line on a spreadsheet. It becomes real.

Access the most comprehensive real estate development success kit for free, including step-by-step strategies, high-impact templates, and $35,000 worth of expert insights to help you develop smarter, cut costs, and lead with confidence—whether you’re planning your first project or scaling your next big move—the Real Estate Development Guide.

Book Your 1:1 Strategy Session for direct value creation.

Tip: Read How To Unlock 7× Profit: Real Estate Development Lifecycle Mastery

The Key Challenges to Managing Real Estate Projects Today

Let’s be honest—real estate development isn’t for dreamers. It’s for the strategic, the relentless, the ones who can align chaos into execution.

Budgets balloon. Timelines break. Teams clash. One misstep in construction and project management? It ripples all the way through your real estate development exit strategy.

And that’s not just a headache. It’s a failed property disposition plan, delayed capital returns, and missed opportunities in your real estate investment cycle—trends documented in McKinsey’s seminal report on construction-productivity challenges.

Actionable Insights for Real Results in Construction and Project Management

The good news? These problems are solvable. But only if you think beyond tools and timelines. The Project Management Institute’s PMBOK® Guide shows that success comes from framing every construction task and project decision as a move toward developer profit maximization.

This is about using systems, discipline, and tech to keep your real estate development exit strategy intact from day one. Whether you’re shaping a boutique hotel or a multi-phase mixed-use tower, this mindset turns you into a strategic executor. This kind delivers excellence and drives the real estate investment cycle forward, with a strong property disposition plan ready at the finish line.

Defining Construction and Project Management

What Is Construction Management? The Role on the Ground

Construction and project management isn’t just onsite oversight. It’s where the real estate development exit strategy becomes visible—brick by brick.

From coordinating teams to avoiding safety risks, this role defines quality, speed, and cost—three forces determining the strength of your property disposition plan.

Ignore construction management, and the asset depreciates before it hits the market. Nail it, and you’re already halfway to developer profit maximization—precisely what the CMAA Standards of Practice outline.

What Is Project Management? Strategy from Start to Finish

Construction and project management sees the whole arc—from concept to closeout. It aligns vision, financing, execution, and stakeholders around one outcome: a timely, profitable exit.

It keeps your real estate development exit strategy front and center, aligning timelines, risk, and returns across the real estate investment cycle. Think of it as steering the ship with a map that includes the final destination—and a countdown clock to get there on time, a view championed by PMI’s primer on project management fundamentals.

The Dynamic Duo: How Real Estate Construction and Project Management Work Together

This is where things move from theory to execution. Without this sync, developer profit maximization is impossible.

The project manager predicts what could go wrong. The construction manager ensures it doesn’t.

This partnership—spotlighted in the CIOB’s Code of Quality Management—ensures your real estate development exit strategy doesn’t crumble under execution pressures. It powers your property disposition plan to reality and keeps your place strong in the real estate investment cycle.

For more information check How to Streamline Real Estate Project Management Services for Flawless Execution

Core Pillars of Successful Real Estate Construction and Project Management

Clarity in Scope: Defining Success Before You Begin

Imagine planning a real estate development exit strategy without knowing the end goal. That’s what happens when scope isn’t clear.

The scope defines the project’s heartbeat—what’s in, out, and what the win looks like. Without it, your property disposition plan turns to dust, and the real estate investment cycle grinds to a halt.

Start with a detailed project charter. Break it down using a Work Breakdown Structure (ISO 21502). Review and reinforce it often.

Because ambiguity is expensive in real estate. And precision is where developer profit maximization begins.

Pro Tip: Treat the scope like a contract. Clear goals. Clear limits. No surprises.

Time Is Money: Mastering Schedules and Timelines

Deadlines aren’t just calendar dates—they’re leverage points in your real estate development exit strategy.

Time is capital. Every delay eats into your upside. And in the real estate investment cycle, time lost is often value lost.

Gantt charts, critical-path methods, and other AACE-recommended practices help keep things moving. But tools don’t manage time—people do. It’s your responsibility to protect momentum and pivot quickly.

Case in Point: Adopting two-week Agile sprints cuts 15 % off a client’s timeline. That’s not just efficiency—it’s a direct hit to developer profit maximization.

The Budget Balancing Act: Keeping Costs Under Control

Your budget is the most fragile part of your entire property disposition plan.

One underestimated line item or a misstep in procurement, and the whole real estate development exit strategy is at risk.

The most competent developers build in contingency buffers (10–15 %), track costs in real time, and adjust constantly, as well as best practices championed in the AACE Cost Engineering guidelines.

Real-Life Insight: A retail project saved $2 million by flagging overspending early. That’s how you protect your place in the real estate investment cycle and stay on track for developer profit maximization.

Construction Management Best Practices

Pre-Construction Prep: Laying the Groundwork for Success

Before the first shovel hits dirt, your real estate development exit strategy is already being shaped.

If you skip pre-construction planning, you’ll build a skyscraper on sand. Proper prep locks in your property disposition plan, aligns stakeholders, and reduces risk. Feasibility reviews, precise scheduling, and early permitting aren’t luxuries—they’re lifelines, as outlined in CMAA’s guide to pre-construction planning benefits.

Pro Tip: Involve stakeholders early. Their insights now prevent detours later—and protect your path to developer profit maximization.

Onsite Excellence: The Daily Discipline of Staying on Track

The site is alive. It’s chaos—or clarity, depending on your leadership.

This is where construction and project management experts earn their legacy. Tracking timelines, resolving bottlenecks, and coordinating vendors all directly shape the real estate development exit strategy.

If you fall behind, your property disposition plan will become shaky. If you stay ahead, you set the stage for early returns and a stronger real estate investment cycle position—validated by the Lean Construction Institute’s Last Planner® System.

Quality Assurance and Safety: Building with Confidence

You can’t cut corners and expect long-term value. Rushed work and safety shortcuts wreck trust and undermine your real estate development exit strategy.

Build QA/QC systems, bring in third-party inspections, and make safety a culture, not a task. OSHA’s Recommended Safety Practices show that a safe, high-quality project sells faster, leases better, and maximizes developer profit.

Case in Point: Zero injuries during an extensive development weren’t luck—they resulted from mandatory daily briefings and onsite accountability.

For more in depth analysis read How to Perfect Construction Scheduling for Real Estate Development

Leveraging Technology for Real Estate Development

The Digital Toolbox: Must-Have Construction Management Software

Technology isn’t optional—it’s strategic. Platforms like Procore integrate schedules, budgets, and communication into one source of truth. That cohesion isn’t just operational—it secures your property disposition plan from preventable delays and miscommunications.

Why? The tighter your coordination, the smoother your real estate investment cycle. Smoother cycles mean faster, stronger developer profit maximization.

Quick Insight: Procore can reduce coordination lag by 20 %. That’s not a perk—it’s performance.

Game-Changers: How Drones, IoT, and VR Revolutionize the Job Site

The job site is evolving, and if your tools aren’t, your real estate development exit strategy is already falling behind. Deloitte’s engineering and construction outlook shows drones tracking progress, IoT sensors monitoring safety, and VR walking stakeholders through unbuilt spaces—the precision your property disposition plan needs.

Predictive Analytics and AI: Staying Ahead of the Curve

This is where you get your edge. AI predicts weather delays. Analytics flag resource bottlenecks. Together, they give you foresight—the fuel of any smart real estate development exit strategy. The World Economic Forum’s report on the Future of Construction positions AI as a decisive differentiator for developer profit maximization.

Lessons for Real Estate Investors and Developers

Case 1: Turning Delays into Opportunities with Agile Scheduling

The Story:

A $250 million mixed-use development in Dubai hit an early snag. The vision of towering residences, lush green spaces, and vibrant commercial hubs teetered on collapse as construction delays started eating into the investor’s budget.

The Fix:

We adopted a more agile construction and project management approach. We divided the project into two-week sprints, allowing the development team to concentrate on achieving short-term goals. The team also held regular progress reviews, enabling contractors to reallocate resources and adjust priorities in real-time.

The Result:

The project was completed three weeks early and achieved a 98% occupancy rate within three months. Investors celebrated a win, and the market took notice.

How This Applies to You:

Dynamic scheduling is helpful and essential in fast-paced regions where investor expectations are often sky-high. Agile sprints can prevent delays in mixed-use projects, whether a luxury development in Riyadh, a waterfront hub in Dubai, or a revitalized district in Baghdad. Flexibility and foresight turn roadblocks into milestones.

Case 2: Building Green, Building Smart

The Story:

In Abu Dhabi, we aimed for LEED Gold certification for a $1.2 Billion Mixed-Use complex. Sustainability was integral to the investor, but the dream felt distant as costs climbed.

The Fix:

We opted for prefabricated components to streamline construction and project management to cut development costs without sacrificing quality. Meanwhile, sustainability consultants guided every design choice, ensuring the building’s green credentials.

The Result:

The tower earned its LEED Gold badge, cut construction costs by 12%, and drew eco-conscious tenants who paid a premium for sustainable living.

How This Applies to You

Green development isn’t optional—it’s the future. Whether you’re designing an eco-friendly luxury high-rise in Dubai or a sustainable urban center in Riyadh, wise choices pay off. LEED standards—or similar certifications—aren’t just badges; they’re magnets for premium tenants and investors who demand a better planet alongside their returns.

Case 3: Prefabrication: The Cost Cutter That Delivers

The Story:

In Dubai, a real estate investor faced skyrocketing costs on a $380 million office park, which was a financial drain. Once again, prefabrication became the hero of the day.

The Fix:

We assembled components off-site to minimize delays, reduce onsite labor demands, and deliver consistently high quality.

The Result:

The costs dropped by $3 million, the timeline shrank by 6 weeks, and the project became an innovation case study.

How This Applies to You:

Do not underestimate construction and project management alternatives such as prefabrication. It may deliver wonders, especially on large-scale projects. Think of office parks in Riyadh or Baghdad. Off-site assembly is a game-changer in regions where weather extremes or labor shortages can stall progress. Beyond cutting costs, it showcases a forward-thinking approach that investors and governments applaud.

Your Tips for Effective Real Estate Construction and Project Management

The MENA markets demand strategy, not just ambition. Every move must serve your real estate development exit strategy. Deloitte’s regional GCC construction report reaffirms that execution excellence differentiates winners.

Key Takeaways from the Case Studies

Proactive Planning Pays Off, Sustainability Adds Value, Innovation Drives Efficiency—points echoed in the World Economic Forum’s global industry-transformation framework.

Managing Risks in Construction and Project Management

Financial Risks: Predicting and Preventing Budget Overruns

Budgets don’t just balloon—they burst. ISO’s 31000 risk-management guidelines advocate predictive analytics and 10–15 % contingencies to safeguard your property disposition plan.

Regulatory and Compliance Risks: Sidestepping Legal Snares

Regulators don’t care about your deadlines. The World Bank’s Doing Business indicators illustrate how early permitting strategies defend developer profit maximization.

Construction Delays: When the Unexpected Happens

Dynamic scheduling and strong vendor backups convert delays into footnotes, not headlines. AACE’s forensic schedule analysis offers the playbook.

Quality Risks: The Hidden Saboteur

Poor craftsmanship means lower valuations later. ISO 9001’s quality-management principles embed benchmarks that guard your exit.

Safety Risks: Protecting People and Projects

A safe site is a productive site. OSHA’s Safety Management Guidelines prove fewer incidents equal stronger exits in the real estate investment cycle.

Stakeholder Risks: Misalignment Destroys Momentum

Confused stakeholders stall projects. PMI’s stakeholder analysis toolkit aligns expectations and secures developer profit maximization.

Why Risk Management Is the Backbone of Success

Risks are inevitable. But failure isn’t. By preparing for threats and executing contingencies, you keep control.

The question is: Will you lead through risk? Or will risk lead your project?

For a more detailed analysis read How to Master Real Estate Risk Management for Seamless Construction.

Coordinating Stakeholders for Seamless Construction and Project Management

Identifying Key Players: Who’s on the Team?

Your team isn’t just on the payroll in real estate—they’re central to your real estate development exit strategy.

Investors, contractors, regulators, and end-users all have a stake. Knowing who influences your property disposition plan and when to engage them is half the game.

Use a stakeholder matrix to prioritize involvement. If you wait until tensions surface, your place in the real estate investment cycle might slip.

Pro Tip: Treat stakeholders as strategic allies—not just project participants. Their buy-in drives developer profit maximization. The RACI framework is a helpful mapping tool.

The Art of Communication: Keeping Everyone on the Same Page

Projects don’t fall apart because of concrete. They fall apart because of miscommunication.

Your real estate development exit strategy hinges on clarity. Centralize updates, tailor messages, and use tools like Slack, BIM, or PM software to cut through the noise. A Seattle office project avoided seven figures in rework by sharing truth via real-time dashboards on BIM 360.

Conflict Resolution: Navigating Disputes with Confidence

Conflict is inevitable. But letting it fester? That’s a threat to your exit.

Define roles early. Use mediation tools when needed. The Chartered Institute of Arbitrators’ Mediation Rules provide structure.

Building Trust Through Transparency

You don’t earn trust by talking—you earn it by showing. Show progress, show risk, show decisions.

Open dashboards. Candid updates. Clear next steps. The Lean Construction Institute’s Integrated Project Delivery model proves that transparency drives commitment.

Leveraging Technology for Better Stakeholder Collaboration

Forget emails. Use CRMs, BIM, and collaborative dashboards to streamline updates and preserve alignment on the property disposition plan. Procore’s Owners Network illustrates tech-enabled collaboration.

Why Seamless Collaboration Is Non-Negotiable

Poor collaboration is expensive. Strategic collaboration? It’s your edge.

Ask yourself this: Are you leading your team to the finish line—or just hoping they follow?

For more details check How to Master Stakeholder Management in Real Estate Development.

Sustainability and Compliance in Real Estate Development

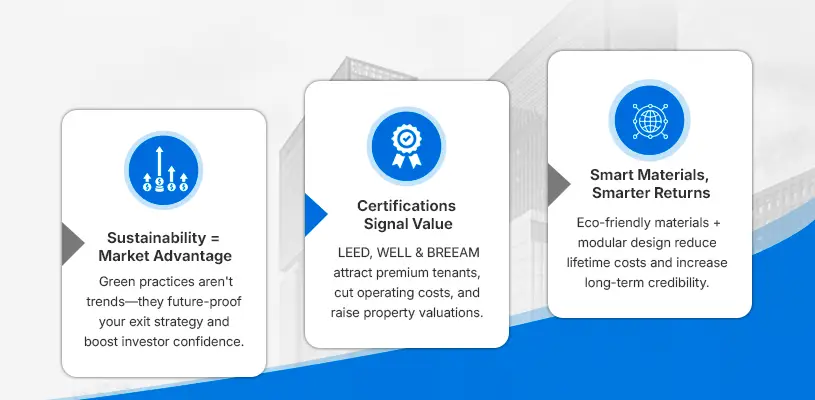

Building for the Future: Why Sustainability Matters

Sustainability is no longer a side quest. It’s a deal-breaker. Tenants demand it; investors prioritize it. The UN-backed Global ABC quantifies how green practices future-proof exit strategies.

These aren’t trends for energy efficiency, low waste, and renewable integration—they’re investments in your future place within the real estate investment cycle.

Pro Tip: Integrate sustainability during design, not after. Retrofitting later won’t save your margins or support developer profit maximization.

Green Certifications: LEED, WELL, and BREEAM Demystified

Certifications aren’t paperwork—they’re market signals. LEED, WELL, and BREEAM boost credibility, attract top-tier tenants, and fortify your real estate development exit strategy.

- LEED measures sustainable building practices.

- WELL focuses on occupant health and well-being.

- BREEAM evaluates comprehensive environmental performance.

- Case in Point: By integrating solar, HVAC optimization, and rainwater harvesting, a LEED Platinum project saved 30 % in energy costs—and increased valuation by 15 %, reinforcing its property disposition plan and future position in the real estate investment cycle. For investors, LEED builds value.

Navigating Compliance: Aligning with Regulations Without Delay

Regulatory issues aren’t speed bumps—they’re barricades unless managed early. Permitting, zoning, and environmental compliance shape timelines and impact your exit. The U.S. EPA’s NEPA guidelines show why early audits matter.

Pro Tip: Partner with local legal consultants. What they prevent today saves your developer’s profit maximization margin tomorrow.

Sustainable Materials and Practices

Recycled steel, bamboo, and low-VOC adhesives aren’t just eco-materials—they’re building blocks of long-term credibility and lower costs. Pair them with modular construction and prefabrication, and your real estate development exit strategy becomes more innovative. The Carbon Leadership Forum’s material baselines prove that innovative materials cut lifetime costs.

Why Sustainability and Compliance Are Essential

Ignore sustainability and compliance; you’re planning a project no one wants to inherit.

Build with foresight. Build for market signals. Build with your developer profit maximization metrics front and center.

So here’s the question: are you building something that holds value, or something the future will tear down?

Follow up with How to Master Real Estate Project Execution That Delivers.

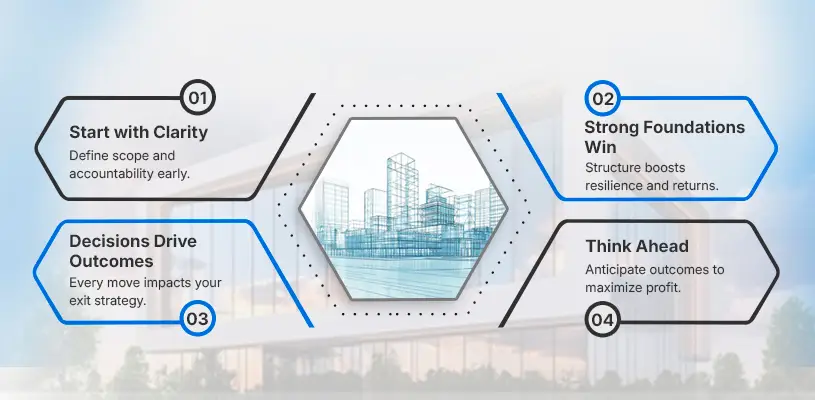

Key Takeaways for Real Estate Developers and Investors

What Every Developer Should Prioritize

In real estate, there are no do-overs. One wrong call can ripple through your entire real estate development exit strategy. ISO’s governance standard 37000 stresses scope clarity and accountability.

Start with clarity: What’s the project’s scope? Who’s accountable? How does this tie into the endgame—the property disposition plan?

The sharper the foundation, the more resilient the project. And the more predictable the return across the real estate investment cycle.

Pro Tip: Think ahead. Anticipate outcomes, not just obstacles. That’s how you position for developer profit maximization.

Quick Wins: Tips for Practical Real Estate Construction and Project Management

- Embrace Technology: Tools like Procore and BIM reduce confusion and delays.

- Create Contingency Plans: Expect surprises. A built-in buffer protects your exit strategy.

- Engage Stakeholders Early: Early alignment strengthens the property disposition plan before problems arise.

- These tactics mirror AECOM’s Project Delivery Toolkit and trigger consistent real estate investment cycle wins.

The Big Picture: How to Build for Long-Term Success

Projects come and go, but reputations linger. Competent developers prioritize sustainability, use data to lead, and refuse to compromise quality—principles at the heart of McKinsey’s Reimagining Construction.

Every move adds or subtracts value from your developer’s profit maximization target.

Why These Takeaways Matter

This isn’t about theory—it’s about leverage. The in-development phase is where vision meets accountability. And your real estate development exit strategy lives or dies by execution.

So ask yourself: What will you do differently before the following project breaks?

Why Does Mastering Construction and Project Management Set You Apart?

Construction and project management aren’t just functions—they’re multipliers. Deloitte’s Future of Construction POV underscores disciplined execution as a market differentiator.

They determine whether you exit with profit or just paperwork, and whether your property disposition plan is strategic or speculative.

Final Thoughts: The Journey from Vision to Reality

Ideas don’t build buildings—execution does. The World Economic Forum calls this sector’s “long-overdue transformation” a defining leadership test (link).

Every Gantt chart, vendor call, and safety meeting either protects or weakens your real estate development exit strategy.

So ask yourself: Are you waiting for the market to reward you, or engineering the outcome? Developer profit maximization doesn’t happen by accident—it’s designed.

Your Next Move: Start Transforming Your Projects Today

What are you going to commit to tomorrow? Will you start tracking risk more closely? Will you align every task with your property disposition plan?

ISO 21502’s step-by-step framework (link) can turn intent into action. Whatever your answer, don’t sit on it. The future favors execution. Start now, start smarter, and own your role in the real estate investment cycle.

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now for direct value creation.

FAQ: Effective Real Estate Project Management

Q: What is construction and project management in real estate, and why does it matter?

A: It’s the engine of your real estate development exit strategy. From budget to ribbon-cutting, it aligns execution with value creation, as PMI’s global standard defines.

Q: What’s the secret to effective project management in real estate?

A: Clear goals and constant communication. Tools matter, but people and processes lock in your property disposition plan, principles mirrored in RICS’ Project Leadership guide.

Q: How do project managers keep budgets under control?

A: They track every dollar, forecast cash gaps, and adjust in real time—skills sharpened in AACE’s Cost Engineering courses.

Q: What does a real estate project manager do?

A: They’re the conductor—schedules, teams, quality, finance. They drive the real estate investment cycle, as described in CMAA’s role definition.

Q: Is project management certification worth it for real estate professionals?

A: Yes. It signals rigor and equips you with frameworks that support a solid exit strategy—see PMI’s PMP® credential.

Q: What makes construction and project management in commercial real estate successful?

A: Discipline, communication, and foresight—delivered via standards like ISO 21500 (link).

Q: How do management courses help real estate developers?

A: They sharpen leadership, strengthen planning skills, and deepen your role in driving long-term developer profit maximization—examples include Cornell’s Real Estate PM program.

Q: What challenges do project managers face in construction, and how do they overcome them?

A: Overruns, delays, surprises—the best managers beat them with agility, collaboration, and relentless focus on the exit, per the Lean Construction Institute’s practice library.

Q: What’s the difference between managing real estate development and commercial real estate?

A: Development builds; CRE management optimizes. Both succeed by owning the investment cycle and aligning actions with a viable property disposition plan, as framed in BOMA’s CRE standards.