Why Feasibility Is the True Gatekeeper of Development Success

The real estate development feasibility phase is where good ideas go to die—or transform into viable, fundable projects.

Skip it, and you’re not just risking your investment—you’re gambling the time, credibility, and capital of everyone backing the deal.

Feasibility isn’t a formality. It’s the filter that turns assumptions into facts—and ideas into bankable blueprints.

What You’re About to Learn

- A six-test system used by elite developers to interrogate viability before they commit

- How to run real-world scenarios through IRR models, market absorption forecasts, and cost stress tests

- The foundational insights every serious investor needs to go from site concept to shovel-ready confidence

From Foundational, Trusted Industry Resources

- Marsh Partners defines real estate development feasibility as the clarity between ambition and action

- Altus Group outlines financial planning and feasibility testing as pillars for success

- U.S. EPA Brownfield Toolkit reinforces environmental feasibility as critical to site viability

What This Article Covers

Each section is a feasibility test—a brutal, essential checkpoint:

- Market demand & absorption logic

- Highest-and-best-use alignment

- Financial model viability (IRR, NPV, DSCR)

- Construction and build cost assumptions

- Regulatory, political, and entitlement clarity

- Exit planning and break-even positioning

You’ll get models, benchmarks, red flag indicators—and strategic questions every developer must ask before they sign.

What to Do Now

Read precisely. Don’t skim. If a test raises concerns for your current deal—pause that deal.

If you want full access to feasibility templates and modeling tools, download the Real Estate Development Guide or book a Strategy Session for direct application.

To understand the Real Estate Development Process comprehensively, consult How To Master The Real Estate Development Process — The Complete 36-Step Blueprint From Concept To Boost Your Legacy our definitive guide to mastering post-development optimization to equip professionals with actionable insights and strategic frameworks.

Market Demand & Absorption Test

No feasibility model survives first contact with a weak market.

This is the foundation of your real estate development feasibility strategy: validating not just who might want your product but also whether they’ll buy it fast enough and at scale.

1. Measure Net and Gross Absorption Correctly

- Gross absorption: All space leased or sold during a period.

- Net absorption: Gross minus vacated space—a more accurate demand signal.

NAIOP’s Research Report suggests net absorption above 15% annually or 1–2% monthly indicates sufficient velocity to support development.

2. Define Your Market Catchment Precisely

Broad MSAs don’t cut it. Use:

- 30-minute drive sheds

- Walkability indexes for urban infill

- Demographic heat maps

Use tools like ESRI Business Analyst to build a boundary where buyers originate—not where you hope they exist.

3. Build a Data-Sourced Demand Forecast

Pull insights from:

- U.S. Census Bureau (or the equivalent in your county)— for household formation, income trends

- CoStar Market Analytics (or the equivalent in your county)— for absorption, vacancy, and delivery timelines

- Urban Land Institute Reports (or the equivalent in your county) — for long-term absorption dynamics

Cross-reference all three to triangulate demand patterns and pressure points.

4. Run Absorption Scenario Stress Tests

Don’t assume smooth selling.

Model 3 scenarios:

- Optimistic: 2% monthly absorption

- Base: 1% monthly

- Conservative: 0.5% monthly

Then, tie each to sales/lease-up periods and how extended equity stays locked.

5. Compare to Market Benchmarks

Live residential deals average 3–5% unit sales per month.

Office? Aim for 0.8–1.5%, depending on city and class.

See the 2024 NAIOP Office Space Demand Forecast for benchmarks.

For a deeper breakdown of absorption metrics and methodology, refer to ULI’s Market Analysis for Real Estate.

Key Takeaway

Key Takeaway

No matter how pretty your renderings are or how strong your capital stack is, it all collapses without absorption. This is the first, most brutal gate of real estate development feasibility. And it doesn’t care about your optimism.

Highest-and-Best-Use Alignment Test

After validating demand, your next checkpoint in real estate development feasibility is to ensure the proposed use fits the land—legally, physically, and financially. This is the highest-and-best-use alignment test.

1. Check Legal Permissibility via Zoning and Entitlement

- As-of-right use guarantees predictability

- Conditional or special approvals introduce delay and uncertainty

- Overlay zones may cap height, density, or environmental impact

Use Municode or local planning portals to verify whether your intended use matches zoning categories before acquisition.

2. Ensure Physical Possibility Through Site Analysis

- Confirm building scale and orientation fit topography

- Assess infrastructure placement, setbacks, and FAR limitations

Use tools like AutoCAD Civil 3D or site evaluation studies to test physical feasibility before layout plans.

3. Evaluate Financial Viability via Use Case Comparison

- Compare expected returns across residential, commercial, and mixed-use models

- Match development yield to capital return benchmarks

- Factor typical absorption, construction costs, and risk-adjusted IRRs

See ULI’s Guide on Highest-and-Best-Use Analysis for structured frameworks on evaluating use-case ROI.

4. Align With Market Demand and Demographic Trends

- Ensure the use case aligns with buyer and tenant profiles

- Track demand for target asset type in your catchment

- Determine whether the local demographic supports your model

Use Census data and brokerage reports to confirm your projected site use resonates with market conditions.

5. Watch Political and Community Thresholds

- Slight use-case shifts (e.g., retail to flex) can trigger public resistance

- Respect contextual cues such as scale, architecture, and public space

- Identify municipal hot-button issues like parking, stormwater, or density

This is where entitlement risk bleeds into feasibility—control or pay for it.

Key Takeaway

A commercially viable project must pass this alignment test:

It must be legal. It must be buildable. It must be profitable. It must be welcome.

Fail any of these—and your real estate development feasibility crumbles before construction drawings print.

Financial Model Viability Test (IRR, NPV, DSCR)

Cash, leveraged strategically, is the pulse of your real estate development feasibility model. This test dives deep into returns—and whether they hold when stress is applied.

1. Internal Rate of Return (IRR) – Return Speed Test

- IRR measures project return over time

- Best-in-class developers require 15–25% for mid-market deals, higher for opportunistic plays

- Be wary: IRR can be boosted by shortening timelines—without increasing cash returns

Reference: MIT Center for Real Estate emphasizes long-term IRR sustainability over short-cycle gains.

2. Net Present Value (NPV) – Absolute Value Indicator

- NPV shows the total dollar value generated, not just the rate of return

- A project with positive NPV at 8–10% discount rates indicates underlying value

- Prefer NPV over IRR when evaluating reuse, recap, or phased-sale scenarios

See Harvard GSD’s guide on discount rate selection linked to risk profiles.

3. Debt Service Coverage Ratio (DSCR) – Cash Flow Durability

- DSCR = Net Operating Income ÷ Debt Service

- Lenders expect 1.25x–1.4x during hold phases

- During lease-up, maintain above 1.1x baseline to avoid a covenant breach

Study: Urban Institute financing models show DSCR holds firm even under conservative scenarios and outperforms credit triggers.

4. Equity Multiple – Total Capital Return

- Equity Multiple = Total cash distributed ÷ Equity invested

- Targets: 1.5x–2.5x for core/mid-tier; 3x+ for value-add or opportunistic plays

- A high multiple with low IRR = slower capital velocity; a low multiple with high IRR = small absolute gain

5. Sensitivity Analysis – Stress Test Your Model

- Vary inputs by +/-10–20%: rent, costs, delays, hold periods

- A robust model stands up to conservative scenarios without slipping below the hurdle IRR or DSCR

- Excel data tables or Argus make this easy—and necessary

CoStar Group emphasizes that elite feasibility models feature multiple sensitizations for robust underwriting.

Key Takeaway

Key Takeaway

Your real estate development feasibility model must pass three tests:

- IRR shows return speed

- NPV confirms the absolute value

- DSCR proves cash-flow resilience

Anything less—and your capital deploys with risk, not conviction.

Construction Cost Realism Test

The fastest way to blow up a deal? Underestimating construction costs.

This feasibility test injects hard truth into your real estate development feasibility model—grounded in real-world benchmarks and risk-adjusted assumptions.

1. Break Down Costs by Unit Price and Quantity

Itemize:

- Excavation, foundation, structure

- Envelope, interiors, systems (HVAC, MEP)

- Landscaping, utilities, site works

Use RSMeans Construction Cost Database for city-specific cost-per-square-foot rates. This is the industry standard for unit-based feasibility modeling.

2. Factor in Construction Cost Inflation

Construction costs rise faster than CPI.

- Apply 3–5% annual escalation

- Factor in volatility for materials like steel, glass, and lumber

See the Turner Construction Cost Index to track national and regional escalation trends.

3. Include Contingency Based on Risk Class

Rule of thumb:

- 5–10% for greenfield/flat land

- 15–20% for brownfields, infill, or complex urban projects

McKinsey Global Institute recommends tiered contingencies based on construction complexity and site condition.

4. Benchmark Against Comparable Projects

Reference per-square-foot and per-unit costs:

- Match typology, timeline, delivery method

- Compare at least 3 local comps

Use CoStar Market Analytics or Dodge Data & Analytics for comparable project data.

5. Don’t Forget Soft Costs and Finance Charges

Soft costs = 15–25% of total construction budget:

- Architecture, engineering, permits

- Legal, insurance, taxes during construction

- Construction loan interest, reserves, draw fees

Learn more from NAIOP’s Development Budget Guidelines.

Final Takeaway

Final Takeaway

The real estate development feasibility model lives or dies by cost realism. This test filters dreamers from developers:

You either build your project in numbers—or bury it in them.

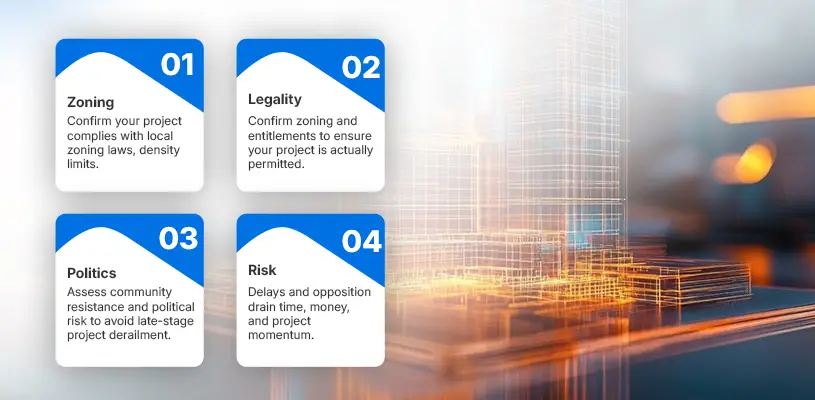

Regulatory & Entitlement Clarity Test

Entitlements are the unseen cliffs in every real estate development feasibility model.

You don’t fall off them until it’s too late.

This test uncovers whether you can legally build what your model promises and how likely delays, opposition, or political risk will reduce your margin.

1. Verify Zoning Compliance First

- Is your use as-of-right or discretionary?

- What are the maximum density, height, and FAR allowed?

- Are there overlay zones or design review boards?

Before moving forward, use the local municipal zoning code to confirm land use rights.

2. Understand Entitlement Path Complexity

Entitlements vary by municipality, but typically include:

- Rezoning

- Variances or conditional use permits

- Site plan approval

- Subdivision review

Reference Planetizen’s Planning Tools to understand entitlement pathways and their political dimensions.

3. Track Political Sensitivity and Community Risk

- Is your site in a NIMBY-heavy district?

- Have similar projects succeeded—or been blocked?

- What’s the voting record of planning commissioners?

Search ULI’s Entitlement Best Practices to learn how top developers engage early and avoid late-stage resistance.

4. Entitlement Timeline = Holding Cost Timeline

Every month of delay costs you:

- Loan interest

- Lost lease-up

- Idle Equity

- Political fatigue

Use EPA’s Smart Growth Scorecard to gauge how extended entitlement may take in your market.

5. Risk Mitigation Through Phasing & Pre-Entitlement

If the risk is high:

- Acquire land in phases tied to approvals

- Use options or delayed closing clauses

- Begin community engagement pre-submittal

Advanced feasibility models structure acquisition terms around regulatory hurdles—not despite them.

Key Takeaway

Key Takeaway

Feasibility without entitlement clarity is fiction.

If your project isn’t permitted, it isn’t real.

This test ensures your real estate development feasibility model doesn’t assume approvals—it earns them.

Exit Planning & Breakeven Positioning Test

A project without a clear exit isn’t a development—it’s a speculation.

In any real estate development feasibility plan, the end must be engineered into the beginning. This test validates how, when, and under what pressure you exit—and whether the economics hold if things go sideways.

1. Define the Primary Exit Type

Are you:

- Selling developed units?

- Selling the stabilized asset?

- Holding for cash flow?

- Selling land post-entitlement?

Each path affects:

- Project IRR

- Equity hold period

- Capital gains vs operational yield

See CCIM’s Investment Analysis Tools to map financial outcomes to different exit types.

2. Calculate the Breakeven Price per Unit

Know your:

- Total project cost (land + hard + soft + finance)

- Breakeven price per unit or square foot

- Minimum lease rate required for DSCR > 1.2

HUD’s Development Cost Models help calculate realistic breakeven points in multifamily and mixed-use projects.

3. Time Your Exit for Peak Value

Exits are time-sensitive.

- Don’t flood a soft market

- Don’t hold longer than capital markets can support

- Plan for early refi, JV buyout, or multi-phase liquidation if needed

Refer to ULI’s Emerging Trends Reports for timing insights and cycle-sensitive strategies.

4. Scenario-Test the Exit Window

Build downside cases:

| Case | Exit Cap Rate | Sale Price | IRR Impact |

|---|---|---|---|

| Optimistic | 4.5% | $34M | 18.2% |

| Base | 5.5% | $29M | 14.3% |

| Conservative | 6.5% | $25M | 9.7% |

Your model must work even if cap rates expand or buyers thin out.

5. Build a Flexible Exit Strategy

Competent developers prepare to:

- Reposition if demand shifts

- Lease-up instead of sell

- Flip to institutional buyers or REITs

Explore Deloitte’s Real Estate Exit Strategy Toolkit for institutional-grade exit modeling.

Final Takeaway

Final Takeaway

If you can’t model your way out—you’ve trapped your capital.

Exit isn’t the last step of real estate development feasibility. It’s the most critical first assumption.

Conclusion: From Feasibility to Fundable Reality

Ideas don’t get built. Feasible models do.

Every seasoned developer knows real estate development feasibility isn’t about optimism but precision. The brutal, necessary discipline separates scalable projects from beautiful failures.

You’ve now seen the six non-negotiable tests:

- Market Demand & Absorption

- Highest-and-Best-Use Alignment

- Financial Model Viability (IRR, NPV, DSCR)

- Construction Cost Realism

- Regulatory & Entitlement Clarity

- Exit Planning & Breakeven Positioning

Each test is a filter. Together, create a fortress.

What to Do Next

If you’ve got a deal on your desk—or you’re crafting a pipeline for the next quarter—don’t guess.

Download the Ultimate Real Estate Development Guide to access feasibility templates, market checklists, and deal modeling tools built for real-world execution.

Or go further:

Book a 1:1 Strategy Call with Ahmad Khalaf—because elite developers don’t just assess feasibility.

They engineer it.

Final Word

Final Word

A pro forma isn’t a plan. A vision isn’t a strategy. Feasibility makes both real.

So, ask yourself:

Is your project truly fundable—or just imaginative?

The answer lies in your numbers.

FAQs About Real Estate Development Feasibility That Serious Developers Must Ask

1. What is real estate development feasibility, and why is it essential?

Real estate development feasibility is the disciplined evaluation of whether a project can be executed legally, physically, and profitably. It combines financial model testing, zoning reviews, construction cost estimates, and market absorption analysis. Developers face inflated risk, flawed assumptions, and capital erosion without a strong real estate development feasibility model.

2. How does a feasibility study differ from a business plan?

A feasibility study is the tactical, number-driven core of real estate development feasibility. It validates project viability through IRR sensitivity, breakeven analysis, and construction costs. A business plan, in contrast, lays out operations, marketing, and strategic vision—but without passing feasibility, it’s just a narrative.

3. What is the role of IRR in real estate development feasibility?

Internal Rate of Return (IRR) measures how quickly your capital grows. In real estate development feasibility, IRR tells you if the project meets your hurdle rate and how delays or cost overruns affect profitability. One of the three pillars—alongside NPV and DSCR—makes or breaks your model.

4. How do construction costs impact feasibility?

Construction costs are often underestimated. Accurate budgeting, factoring in material inflation, escalation, and soft costs, is critical. Realistic cost inputs protect your real estate development feasibility assumptions and directly influence development yield and project viability.

5. What is DSCR, and why does it matter regarding feasibility?

Debt Service Coverage Ratio (DSCR) measures whether your cash flow can cover debt payments. In real estate development feasibility, a DSCR below 1.25 signals risk. Most lenders require higher DSCRs to safeguard against lease-up delays or absorption risk.

6. How does zoning influence real estate development feasibility?

Zoning determines what can be built and how. Real estate development feasibility becomes fiction without clear entitlement paths and permitted uses. Confirming the highest-and-best-use alignment ensures project viability and speeds regulatory approvals.

7. What’s the difference between project viability and development cost analysis?

Project viability is the all-in test—does the project make sense across all dimensions? Development cost analysis tracks line-by-line inputs for construction, design, and holding. Both are critical to completing real estate development feasibility.

8. How do I conduct absorption forecasting for feasibility?

Start with demographic data, supply pipeline, and market absorption history. Test three absorption rates—optimistic, base, conservative—against your model. Absorption forecasts validate the speed of revenue and influence all breakeven analyses.

9. How do breakeven and NPV calculations inform feasibility?

Breakeven tells you the minimum sale or lease threshold for zero profit/loss. NPV calculates the total value generated above a risk-adjusted return. Together, they anchor real estate development feasibility in hard metrics, not hopeful projections.

10. Can feasibility help me secure financing or investors?

Absolutely. A rigorous real estate development feasibility model is your weapon during underwriting, pitch decks, and investor due diligence. It proves you’ve pressure-tested every risk—from IRR decay to regulatory delay.

For a deeper dive into the most effective Real Estate Development Strategies in real estate, prioritize How To Master The Real Estate Development Process — The Complete 36-Step Blueprint From Concept To Boost Your Legacy, the cornerstone resource for Real Estate Development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.