Introduction: Tax Isn’t a Cost—It’s a Strategic Lever

You’ve already lost if you’re still seeing taxes as a bill.

Taxes are where the margin is found in elite development circles, not lost.

The right real estate developer tax strategy reduces liability, structures IRR, liquidity, and reinvestment cycles.

The pros?

They don’t wait for their CPA to explain what they missed.

They structure deals from day one to win the tax game.

What You’ll Learn in This Guide:

- How to sequence cost segregation, bonus depreciation, and 1031 exchanges

- Why Opportunity Zones work—but only when done early and right

- How to avoid recapture traps and lock in capital gains deferral

- What separates passive deferral from real-time tax mitigation

- When to stack credits, deductions, and equity carve-outs for maximum efficiency

Anchored in These Trusted, Institutional Resources:

- IRS Cost Segregation Audit Techniques Guide

- U.S. GAO 1031 Exchange Compliance Overview

- Opportunity Zones Final Regulations Summary – U.S. Treasury

- Deloitte Real Estate Tax Strategy Insight

- NAIOP Developer Tax Optimization Guide

Why It Matters Now

With bonus depreciation phasing out, audit scrutiny rising, and capital flow tightening, having a strategic, front-loaded real estate developer tax strategy isn’t optional—it’s non-negotiable.

The question isn’t whether tax affects your return.

It’s whether you control the tax—or let it control you.

To understand the Real Estate Development Process comprehensively, consult How To Master The Real Estate Development Process — The Complete 36-Step Blueprint From Concept To Boost Your Legacy our definitive guide to mastering post-development optimization to equip professionals with actionable insights and strategic frameworks.

Cost Segregation—Accelerate Deductions and Early Cash Flow

Cost segregation is a core weapon in any top-tier real estate developer’s tax strategy. It slices your property’s cost into shorter-lived assets, supercharging depreciation and freeing up early-year cash.

1. What Cost Segregation Really Does

- It breaks property costs into 5-, 7-, or 15‑year depreciation buckets—beyond the standard 27.5 or 39 years.

- This front‑loads deductions, slashing early tax liability and boosting after‑tax IRR.

The IRS Audit Techniques Guide is the definitive source on how to structure cost Segregation for compliance and cash flow benefits:

2. Embed Studies into the Value‑Add Timeline

- Before improvements begin, conduct a study with engineers and appraisers

- Tie it to renovation scopes (HVAC, fixtures, hardscape, capex) for maximal impact

- Early studies anchor depreciation in audited detail—protecting your real estate developer tax strategy

Deloitte Real Estate Tax Strategy confirms early cost segregation can improve initial-year IRR by 1–2 percentage points:

3. Model Both Pre- and Post-Sale Depreciation Impact

- Run proforma scenarios: with and without cost segregation

- Adjust for bonus depreciation phases and impact on tax recapture

- Demonstrate to investors how early cash flow improves equity multiples

NAIOP’s tax optimization guide recommends modeling cost segregation carefully to align with exit timing: https://www.naiop.org/

Final Takeaway

Final Takeaway

Cost segregation is more than a tax play. It’s a value multiplier. When integrated into a polished real estate developer tax strategy, it accelerates cash, enhances return, and supports reinvestment.

Bonus Depreciation & Phase-Out Planning

Bonus depreciation is a turbocharger to your real estate developer tax strategy—but it’s on a countdown. Understanding phase-outs and timelines now is crucial to maximizing early-year returns.

1. Know the Bonus Depreciation Timeline

- The Tax Cuts and Jobs Act allows 100% bonus depreciation through 2022

- It phases down to 80% (2023), 60% (2024), 40% (2025), 20% (2026)

- After 2026, it lands at zero unless Congress acts

Refer to the IRS Section 168(k) Guidance for precise year-by-year bonus depreciation rules and phase-out dates: IRS Cost Segregation Audit Techniques Guide.

2. Align Projects With Phase-Down Calendars

- Prioritize asset acquisition, construction start, or renovation completion before the bonus dips

- Model IRR sensitivity by asset class, depreciation timing, and project schedule

- Tie delivery dates to bonus phase-out milestones for high-depreciable assets like appliances & fixtures

Deloitte’s Real Estate Tax Strategy Insights detail why aligning CPT (Placing in Service) dates with phase-down schedules can meaningfully lift returns: Deloitte Real Estate Tax Strategy.

3. Coordinate 1031 Exchanges with Bonus Timing

- Executing a 1031 exchange post-service date can let you claim the bonus depreciation on the new asset

- Account for like-kind exchange timelines and property qualification for bonus deductions

- Integrate bonus layering into your broader developer tax strategy for sequential projects

GAO’s report on 1031 compliance and interaction with bonus depreciation offers clarity on timing mechanics: U.S. GAO 1031 Exchange Compliance Overview

Final Takeaway

Final Takeaway

Bonus depreciation is a time-sensitive weapon.

When leveraged smartly as part of your real estate developer tax strategy, it offers a one-time burst of deduction, compounding early cash flow and your next deal.

Section 179 Expensing & Immediate Write-Off Options

Section 179 provides a powerful flexibility tool in your real estate developer tax strategy. It enables immediate expensing of qualifying assets, reducing taxable income sharply early.

1. What Qualifies for Section 179

- Applies to tangible property such as site improvements, HVAC, security systems, and small equipment

- Limits are substantial: in 2025, up to $1.32M in total property, phasing out after $2.62M in purchases

The IRS Section 179 Deduction page explains what qualifies and how to claim it: IRS Section 179 Deduction.

2. Combine with Cost Seg & Bonus Depreciation

- Apply Section 179 to high-turnover assets (e.g., furnishings), then use bonus on remaining depreciable items

- This layering maximizes upfront deductions

- Be aware: Section 179 accelerates depreciation—so record-keeping must align

Deloitte Real Estate Tax Strategy shows how stacking Section 179 with bonus depreciation impacts IRR: Deloitte Real Estate Tax Strategy.

3. Mind State-Specific Rules and Limits

- Many states conform fully, partially, or not at all to federal Section 179 rules

- Some cap deduction amounts or exclude certain asset types

- Always check if your developer tax strategy gains or loses from state alignment

Final Takeaway

Final Takeaway

Section 179 is your fast-track deduction option—especially for capital-heavy systems.

When layered into your real estate developer tax strategy, it delivers immediate benefits. However, you must oversee limits and structure to stay compliant and maximize the upside.

1031 Exchange & Like-Kind Swap Planning

The 1031 exchange isn’t just a deferral tool—it’s a strategic lever in your real estate developer tax strategy. It lets you reposition capital while postponing taxes, enabling continuous portfolio growth.

1. Understand the Mechanics of Like-Kind Exchanges

- Defer capital gains by swapping investment/development property with “like-kind” real estate

- Follow strict timelines: 45-day ID window, 180-day completion deadline

- Use a qualified intermediary—no direct seller involvement

The U.S. GAO Report on 1031 Exchange Compliance outlines key requirements and common pitfalls:

U.S. GAO 1031 Exchange Compliance Overview

2. Layer 1031 Exchanges with Cost Seg and Bonus Depreciation

- Post-exchange, immediately apply cost segregation and remaining bonus depreciation to the new asset

- Start depreciation schedules tied to the new “placed-in-service” date

- This timing synergy accelerates early tax sheltering within your broader developer tax strategy

Deloitte Real Estate Tax Strategy highlights why strategic layering significantly enhances after-tax IRR: Deloitte Real Estate Tax Strategy.

3. Use Build-to-Suit and Ground-Up Projects in 1031 Structure

- Swap into a replacement property still under construction (like-kind exchange rules apply)

- Use “exchange accommodation funds” to handle timing gaps without jeopardizing compliance

- Align design and entitlement timelines tightly with the 180-day rule

IRS guidance offers clarity on build-to-suit structures and timeline triggers within 1031 exchanges.

Final Takeaway

Final Takeaway

The 1031 exchange is more than a tax deferral—it’s a capital recycling engine. Expertly timed alongside depreciation strategies, it transforms your real estate developer’s tax strategy into a perpetual growth model.

Opportunity Zone Investing with Strategic Stacking

Opportunity Zone (OZ) investing belongs in every top-tier real estate developer’s tax strategy. When layered correctly, it offers deferral, reduction, and potential elimination of capital gains.

1. Tap Into OZ Timing Benefits

- Reinvest any capital gain into a Qualified Opportunity Fund (QOF) within 180 days

- Defer capital gains until 2026; reduce the tax basis by 10% (5-year hold) or 15% (7-year hold)

- Avoid all tax on gains from the OZ investment if held for 10 years

To confirm timing requirements and investor eligibility, refer to the U.S. Treasury OZ Final Regulations: U.S. Treasury Opportunity Zones Final Regulations.

2. Stack OZ with Cost Segregation & Bonus Depreciation

- Deploy OZ funds into repositioning or ground-up projects

- Conduct cost segregation upon placement in service—magnifying early cash flow

- Use bonus depreciation on short-lived assets for immediate tax relief

Deloitte Real Estate Tax Strategy confirms that stacking OZ incentives with aggressive depreciation regimes meaningfully boosts IRR:

Deloitte Real Estate Tax Strategy

3. Build with Intent: Qualified Opportunity Zone Property Rules

- Ensure 90% of QOF assets are “qualified opportunity zone property”—real estate improvements inside OZ

- Construction must begin within 30 months (substantial improvement rule applies)

- Leverage adaptive reuse or redevelopment to meet substantial improvement criteria

The IRS QOZ Property Requirements clarify property standards and improvement timelines: IRS QOZ Property Regulations.

Final Takeaway

Final Takeaway

Opportunity Zones can turbocharge your real estate developer tax strategy.

Deferral, reduction, and elimination are powerful—but only when paired with cost segregation, proper structuring, and compliance.

Layer it right—and you’re not just building wealth—you’re accelerating legacy.

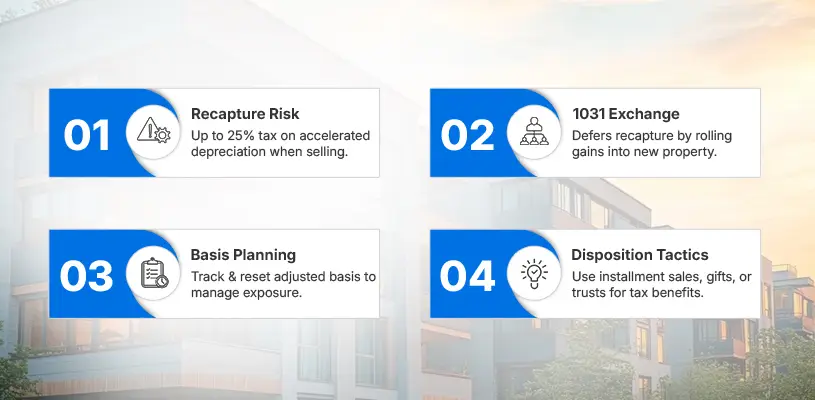

Depreciation Recapture Traps & Avoidance Tactics

You’ve accelerated deductions with cost segregation and bonus depreciation, but beware of the recapture tax that waits at the exit. If unaddressed, it can wipe out years of strategy.

1. Know Your Recapture Exposure

- Depreciation recapture is taxed at a 25% maximum rate, not a capital gains rate—up to that cap

- This applies when you sell within the asset’s depreciable life, including accelerated depreciation

- Short-term flips trigger full Recapture on all accelerated deductions

IRS Publication 544 explains the rules and calculation methods for recapture liabilities: IRS Publication 544—Sales and Other Dispositions of Assets.

2. Use 1031 Exchanges to Defer Recapture

- A well-executed 1031 exchange rolls your depreciation and recapture deferral into the new property

- Maintain cost segregation and bonus schedules post-exchange

- The deferral continues until the final sale and receipt of cash proceeds

The U.S. GAO 1031 Exchange Compliance Guide outlines how recapture deferral works within like-kind timing and structure: U.S. GAO 1031 Exchange Compliance Overview.

3. Plan for Tax Basis Management

- Track your adjusted basis accurately: original cost plus improvements minus year-to-date depreciation

- Reset basis during capital events like refinancing or additional investments to manage Recapture

- Use like-kind exchanges or partnership rollovers to preserve basis protection

The Deloitte Real Estate Tax Strategy highlights basis planning as essential to recapture management and long-term returns.

4. Use Disposition Structuring for Net-Basis Optimization

- Consider installment sales to spread the recapture liability across years

- Gift or estate planning can reduce or eliminate Recapture—but consult tax counsel

- Charitable remainder trusts may capture-recapture under different cost-basis rules

NAIOP’s Developer Tax Optimization Guide offers advanced strategies for managing Recapture at disposition: NAIOP Developer Tax Optimization Guide

Final Takeaway

Final Takeaway

Depreciation recapture is the cost of aggressive deduction tactics—unless you structure against it.

You protect the wealth you built by incorporating recapture avoidance into your real estate developer tax strategy through exchanges, basis planning, and disposition tools.

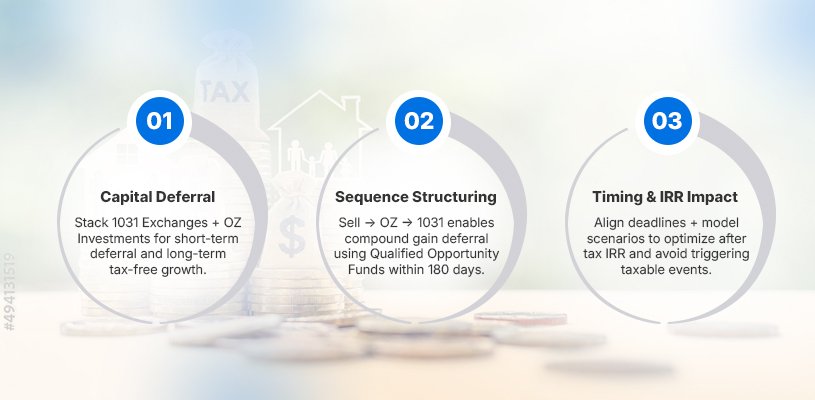

Capital Gain Deferral & Opportunity Zone Layering

Strategic deferral is the anchor of a strong real estate developer tax strategy. By combining cash-out events with Opportunity Zone (OZ) investments, you defer current tax liabilities and set the stage for long-term compounding gains.

1. Understand Capital Gain Deferral Options

- 1031 exchanges allow the deferral of capital gains when swapping qualifying properties.

- Opportunity Zone investments defer capital gains until December 31, 2026, with potential step-ups.

- Stacking both provides short-term deferral and long-term tax-free growth.

U.S. GAO 1031 Exchange Compliance Overview clarifies deferral rules; U.S. Treasury OZ Final Regulations details Opportunity Zone benefits.

2. Structuring Your Sequence: Sell → OZ → Next 1031

- Sell and defer current gain via 1031 exchange into a replacement property.

- If immediate reinvestment isn’t feasible, park proceeds in a Qualified Opportunity Fund (QOF) within 180 days.

- Use the QOF investment to delay the gain or exit via 1031 into another like-kind property.

The Deloitte Real Estate Tax Strategy outlines the strategic layering of like-kind and OZ steps for compound gain deferral.

3. Manage Timelines and Investable Options

- A 180-day window applies to both 1031 ID and OZ investments separately.

- Ensure both deadlines align with your developer tax strategy and avoid triggering an early gain event.

- Coordinate with fund managers and title companies to honor legal timing.

IRS QOZ Property Regulations outline compliance criteria for layered events: IRS QOZ Property Regulations

4. Measure After-Tax IRR Impact

Model scenarios:

- Sell with 1031 only

- Sell → 180-day OZ deferral → 1031 into new property

- Compare after-tax IRR, liquidity timing, and future exit tax triggers

Prioritize structures that align with your investment timeline and refresh capital

Deloitte Real Estate Profitability Studies illustrate how advanced stacking strategies yield superior returns: Deloitte Real Estate Profitability Studies.

Conclusion: Turn Real Estate Developer Tax Strategy into Competitive Edge

You’ve explored:

- Cost Segregation to boost early-year deductions

- Bonus Depreciation timing & phase-out plays

- Section 179 Expensing for immediate write-offs

- 1031 Exchanges for tax-deferred portfolio repositioning

- Opportunity Zone Layering for deferral and elimination

- Depreciation Recapture Avoidance to protect gains

- Capital Gain Deferral Strategies that stack across tools

This is not tax planning—it’s real estate developer tax strategy, executed with surgical precision. When timed and layered correctly, each lever becomes part of your deal flow and portfolio engine. Missing one is leaving opportunity—and profit—on the table.

Next Steps to Operationalize

![]() Download the Ultimate and Free Real Estate Development Toolkit—with modeling templates, execution timelines, and compliance checklists.

Download the Ultimate and Free Real Estate Development Toolkit—with modeling templates, execution timelines, and compliance checklists.

![]() Book a 1:1 Tax Strategy Session—we’ll tailor these levers to your deals and roadmap your tax posture for 2025 and beyond.

Book a 1:1 Tax Strategy Session—we’ll tailor these levers to your deals and roadmap your tax posture for 2025 and beyond.

FAQs About Real Estate Developer Tax Strategy for Maximum Return

1. What is a real estate developer tax strategy?

A real estate developer’s tax strategy deploys tools like cost segregation, bonus depreciation, Section 179 expensing, 1031 exchanges, and Opportunity Zone structuring to optimize cash flow, IRR, and capital reallocation while managing tax liability.

2. How does cost Segregation fit into my developer tax strategy?

Cost Segregation breaks down property costs into shorter-lived categories. Your real estate developer tax strategy accelerates depreciation deductions, boosts early-year cash flow, and supports reinvestment in subsequent deals.

3. Why combine 1031 exchanges with Opportunity Zone investments?

Combining a 1031 exchange with an OZ investment layers both short—and long-term deferral. It supercharges your real estate developer’s tax strategy—rolled capital stays deployed, and exit gains potentially become tax-free.

4. How do I avoid depreciation recapture in my tax planning?

Avoiding Recapture in a real estate developer tax strategy means using 1031 exchanges to roll over assets instead of selling, tracking adjusted basis in cost segregation, and staging dispositions to manage or defer recapture events.

Final Word

Final Word

When wielded as part of a strategic system, each tool transforms taxes from a cost center into a growth accelerator.

If your tax planning isn’t as rigorous as your acquisition underwriting, you’re missing the point—and the profit.

For a deeper dive into the most effective Real Estate Development Strategies in real estate, prioritize How To Master The Real Estate Development Process — The Complete 36-Step Blueprint From Concept To Boost Your Legacy, the cornerstone resource for Real Estate Development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.