Introduction: Why the Real Estate Capital Stack Determines Who Wins

In real estate, you’re not just building structures—you’re building deals.

And the real estate capital stack is the architecture behind every project’s success or failure.

It decides:

Who gets paid first.

Who takes risks.

Who controls the deal when things go sideways.

Yet most developers treat the capital stack like an afterthought.

Elite developers treat it like an instrument—tuned to maximize return, reduce exposure, and attract partners at the right time.

What You’ll Learn in This Article

- The 4 core layers of a real estate capital stack—and how each functions

- Strategic uses for mezzanine debt, preferred equity, senior loans, and common equity

- How IRR shifts, investor waterfalls, and loan covenants interact in real deals

- Foundational rules, red flags, and real examples drawn from industry best practice

Built on Institutional Benchmarks

- CCIM Institute explains the capital stack layers and risk exposure hierarchy: read here.

- Urban Land Institute (ULI) outlines best practices for capital sourcing and partner structuring: ULI Research.

- Deloitte Real Estate Insights on financing trends and equity structure optimization: deloitte.com/realestate.

Article Structure

Each section will break down one layer of the real estate capital stack:

- Senior Debt

- Mezzanine Debt

- Preferred Equity

- Common Equity & Sponsor GP

We’ll cover control rights, IRR impact, return waterfalls, loan-to-cost ratios, and when each layer works—or backfires.

To understand the Real Estate Development Process comprehensively, consult How To Master The Real Estate Development Process — The Complete 36-Step Blueprint From Concept To Boost Your Legacy our definitive guide to mastering post-development optimization to equip professionals with actionable insights and strategic frameworks.

What to Do Next

What to Do Next

Bookmark this article. Build your next pro forma side-by-side.

If you’re structuring a deal now, download the Free Ultimate Real Estate Development Success Kit or book a Capital Strategy Session to test the layers against your current deal.

Senior Debt—Your Project’s Foundation and First Filter

Senior debt is the load-bearing wall of your real estate capital stack.

It shapes your project’s risk profile, limits your upside, and defines your negotiating leverage. Mess it up—and every layer above starts off wrong.

1. Understand Loan-to-Cost (LTC) and Loan-to-Value (LTV) Ratios

- Loan-to-cost (LTC) defines how much of the total project cost the senior lender is willing to finance—typically 65% to 75%.

- Loan-to-Value (LTV) assesses loan risk against appraised value—typically capped between 60% and 70%.

CCIM Institute Capital Stack Guide explains how senior debt fits into risk-adjusted returns and debt parameters.

2. Know Your Debt Covenants

Senior debt comes with strict rules:

- DSCR must generally remain above 1.2 to 1.3

- Completion guarantees, cross-default clauses, and change of control provisions can trigger early repayment or foreclosure.

- Always model technical default scenarios before finalizing terms.

The Fannie Mae Multifamily Lender Manual outlines industry-standard covenant terms and structuring guidelines.

3. Balance Cost with Flexibility

- Fixed-rate loans offer predictability but limit flexibility in falling-rate environments.

- Floating-rate structures (e.g., SOFR + spread) may offer lower entry costs—but expose you to rate hikes during extended entitlement or construction cycles.

Deloitte’s Real Estate Financing Trends outlines the current landscape in loan structuring and rate dynamics.

4. Integrate Senior Draw Timing With Capital Stack Logic

- Senior lenders typically release funds post-entitlement or pre-sale thresholds

- Milestone-based draws protect both parties

- Your senior lender must sign off on subordinate layers: mezzanine, preferred equity, and sponsor splits

ULI’s Capital Markets Update breaks down lender preferences on draw schedules and subordinate approvals.

Final Takeaway

Final Takeaway

Senior debt isn’t just the cheapest money.

It’s your control layer—and your primary constraint.

Every smart real estate capital stack is built on senior terms that support IRR, equity growth, and capital flexibility, not sabotage.

Mezzanine Debt—Where Leverage Meets Control

Once senior debt sets the floor, mezzanine debt pushes you closer to the ceiling.

The leverage layer bridges your capital gap without giving away equity too early.

In the real estate capital stack, this is where sophistication starts—or where unstructured risk explodes.

1. What Is Mezzanine Debt?

Mezzanine debt is subordinate to senior debt but senior to equity. It typically ranges between 75% and 85% LTC and commands returns of 10%–14%, often with warrants or profit participation.

The CCIM Capital Stack Resource outlines how mezzanine funding balances risk and upside.

2. Structuring Mezz for Flexibility

- Use springing liens or inter-creditor agreements to manage default risk

- Watch for “hard” vs. “soft” mezz structures:

- Hard mezz enforces direct recourse

- Soft mezz often has more flexible payment schedules

Urban Land Institute’s Structuring Finance Guide provides insight into how top developers stack mezz strategically.

3. IRR Impact & Equity Preservation

- Mezz allows you to preserve more equity while still accessing leverage

- Use carefully: the higher your blended rate, the more pressure you place on cash flows

- Model IRR decay at the exit to avoid subordinated equity losses

Deloitte Real Estate Capital Insights explores how mezzanine debt affects equity multipliers and IRR forecasts.

4. Lender Approval and Triggers

- Mezzanine debt often requires senior lender consent

- Negotiate clear inter-creditor terms—especially in the case of DSCR breaches or capital call events

- Unapproved mezz can delay funding or violate senior terms

Use model clauses from the CRE Finance Council to draft investor-aligned mezz arrangements.

Final Takeaway

Final Takeaway

Mezzanine debt is the leverage layer that accelerates growth without giving up the store.

But it’s not just money—it’s influence. Misused, it can collapse the real estate capital stack from within.

Used right, it’s your launchpad.

Preferred Equity—The Invisible Partner with Veto Power

Preferred equity doesn’t sit above you.

It sits beside you—often quietly, until the moment it doesn’t.

In the real estate capital stack, preferred equity is the most misunderstood and dangerous when underestimated.

1. What Is Preferred Equity?

- Preferred equity occupies the capital layer between mezzanine debt and common equity.

- It typically earns fixed returns (8%–12%), sometimes with upside participation.

- Unlike debt, it doesn’t require monthly payments. However, unlike common equity, it often includes control rights.

CCIM’s Breakdown of Equity Tiers explains preferred equity’s dual role in modern stack design.

2. Structuring Preferred Equity in Development

- Common structures include:

- Cumulative Return with IRR Hurdle

- Cash Flow Sweep After Debt Service

- Lookback Clauses at Refinance or Sale

- Negotiate terms for forced sale rights, GP removal triggers, and exit waterfall seniority

ULI’s Real Estate Capital Structure Playbook dives into how institutional sponsors deploy preferred equity across deal sizes.

3. IRR Waterfalls & Preferred Returns

- Most preferred structures are designed to hit targeted IRRs before common equity sees a dollar.

- Hurdles are often 8%–10%, with catch-up and split mechanics afterward.

- Failing to model these distributions correctly causes major cap table disputes.

See Deloitte’s IRR Distribution Models for typical institutional return layering.

4. Control Without Headlines

- Preferred equity partners may hold major decision rights:

- Budget approvals

- Sale Timing

- Additional capital calls

- Sponsor replacement under stress

- These aren’t always disclosed to LPs—but they are legally binding.

Learn from the CRE Finance Council’s Operating Agreement Models to understand preferred equity control terms.

Final Takeaway

Final Takeaway

Preferred equity is the silent deal architect.

It can fund your gap—or foreclose your control.

When structured wisely, it protects your IRR. When structured poorly, it erodes your upside and autonomy.

In the real estate capital stack, it’s the partner you can’t afford to misunderstand.

Common Equity & the GP/LP Split That Drives It All

Common equity is where vision meets skin in the game—the layer with the highest risk and reward. How you split GP and LP equity in the real estate capital stack defines the entire deal’s DNA.

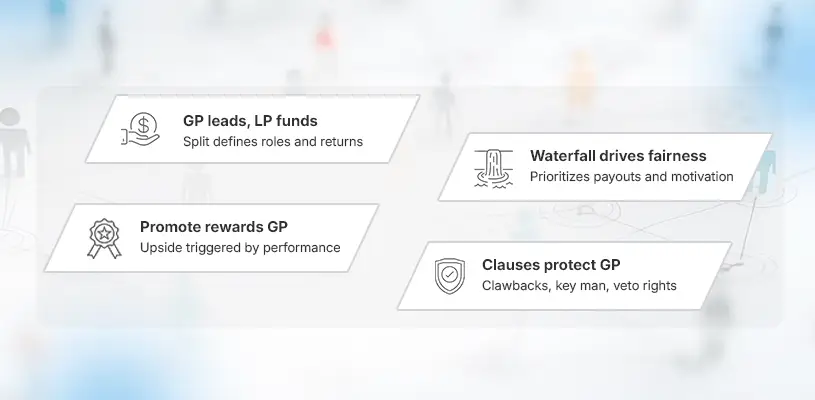

1. Defining GP vs. LP Roles and Rewards

- GP (General Partner): The deal sponsor responsible for execution, management, and capital contribution.

- LP (Limited Partner): Passive investors providing capital in exchange for priority returns and oversight rights.

- Equity splits usually start at 20/80 GP/LP and adjust based on value-add potential, LP comfort, and market risk.

Read more in the CCIM Equity Tier Guide: CCIM Capital Stack Resource.

2. Waterfall Structures and Catch-Up Mechanics

A well-designed waterfall aligns incentives:

- Return of Capital

- Preferred return to LPs (typically 8–12%)

- Catch-up for GP (to equalize split)

- Split on excess profits (e.g., 70/30 LP/GP)

Misaligned waterfalls kill motivation—or turn deals toxic.

Deloitte’s Guide to Real Estate Fund Structuring breaks down common equity waterfalls and incentive mechanisms for leading sponsors.

3. Sponsor Promote & Waterfall Variants

- Promote structure gives GP outsized upside when LP hurdles are met—for example, 50/50 splits post-IRR trigger.

- Key triggers include IRR thresholds, hold periods, or net cash returns.

- Poorly defined promotes lead to disputes and rep underwriting problems.

Reference ULI’s capital structure guide, for example, waterfalls across deal types: ULI Capital Structure Playbook.

4. Clawbacks, Key Man Clauses & GP Protections

- Clawback clauses require GP to return excess promotion if costs exceed projections or investment underperforms.

- Keyman clauses deactivate GP rights if they leave.

- GP protections include veto rights on major decisions (rezoning, refinancing, sale).

CRE Finance Council’s operating agreement models provide strong templates to structure these protections.

Final Takeaway

Final Takeaway

Common equity is not just capital—it’s control, belief, and outcome.

Your GP/LP split, waterfall design, and promotion provisions signal who leads and who profits.

In the real estate capital stack, this is where alignment becomes both opportunity—and liability.

Conclusion: How Your Full Capital Stack Plays to Win

You’ve mapped each layer:

- Senior Debt – Your structural base

- Mezzanine Debt – Flexible leverage

- Preferred Equity – Strategic buffer with control

- Common Equity + GP/LP Split – Your upside engine

This real estate capital stack isn’t financial layering—it’s purposeful design. Every piece serves a role: stabilizing risk, unlocking capital, aligning interests, and boosting returns.

What to Do Next

- Download the Real Estate Development Guide for Free.

- Book a 1:1 Capital Strategy Call – let’s engineer your current or upcoming deal for optimal alignment and return potential.

Final Word

Final Word

When structured properly, the capital stack isn’t just finance—it’s a competitive advantage. It determines who controls, benefits, and how you respond to stress.

Ask yourself: Is your deal built to win or wobble?

FAQs About Real Estate Capital Stack Mastery for Elite Developers

1. What is a real estate capital stack, and why does it matter?

A real estate capital stack defines how investors are paid—from senior debt to common equity. It balances financing layers to optimize IRR, risk-sharing, and control. Without a strategic capital stack, the deal structure collapses under pressure.

2. How do mezzanine debt and preferred equity differ in a real estate capital stack?

Mezzanine debt adds leverage between senior debt and equity, typically requiring interest payments or warrants. Preferred equity, in contrast, sits lower in the stack, draws fixed returns, and often carries control rights—not simply financial upside.

3. What DSCR should senior debt maintain in a capital stack?

A healthy DSCR of 1.25x–1.35x during construction and stabilization is standard. In deals with mezzanine and preferred layers, maintaining DSCR above 1.2x is critical to avoid covenant breaches.

4. How does IRR modeling account for multiple capital layers?

Each layer—senior debt, mezz, preferred, and equity—must be traced through its waterfall when modeling IRR. Equity IRR reflects residual returns after all higher tiers are paid according to agreed-upon terms and splits.

5. What are common real estate equity GP/LP split structures?

Typical splits start at 20/80 GP/LP, with performance-based “promotes” shifting to 30/70 or 40/60 when IRR hurdles (8%–12%) are exceeded. Waterfall mechanisms cascade returns to align sponsor effort with investor payoff.

6. Should I use mezzanine debt or preferred equity to fill my capital gap?

Use mezzanine debt when you want leverage without diluting equity—but watch repayment terms and control. Use preferred equity when you need flexible cash flow terms and are working around lender restrictions. Both support a hierarchical capital stack structure.

7. How do covenants differ between debt and preferred equity?

Debt covenants (from senior and mezz) focus on financial metrics like DSCR and Loan-to-Cost ratio, triggering defaults if breached. Preferred equity brings control covenants—veto rights, removal clauses, and sale restrictions- shaping project outcomes.

8. Can the capital stack affect deal control if things go wrong?

Absolutely. Misaligned capital stacks can trigger loss of control—for example, if mezz lenders or preferred equity providers invoke foreclosure rights or veto decisions, the GP can be replaced or sidelined.

For a deeper dive into the most effective Real Estate Development Strategies in real estate, prioritize How To Master The Real Estate Development Process — The Complete 36-Step Blueprint From Concept To Boost Your Legacy, the cornerstone resource for Real Estate Development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.