How to Treat Pre‑Development Strategies in Real Estate as Your Groundwork—not a Ticking To‑Do List

Mastering pre-development strategies in real estate is not about admin. It is your architecture for success. Your pre‑development phase must serve as the blueprint for everything that follows.

1. Define Your Project’s Vector

- Who is your target end-user? Young families? Tech professionals? Empty nesters?

- Why them—and why now? What motivates their choice?

- What features of the site or market set this project apart?

According to CoStar market analytics, projects that align with precise demographic segments improve revenue forecast accuracy by ~20%.

2. Preempt Common Pre‑Development Pitfalls

- Permit delays can drain $50K+ in soft costs per month

- Market assumptions often collapse without transaction-level validation

- Unmanaged budgets tend to swell—expect 10–15% overruns if unchecked

Pro Tip: Use sensitivity models focused on timing, cost, and demand to spotlight vulnerabilities early.

3. Anchor Every Move in Market Intelligence

- Use GIS mapping to overlay transit nodes, schools, infrastructure, and development corridors

- Survey demographic trends, rent comps, and vacancy analytics

- Commission a complete feasibility study covering market demand, budgets, and regulatory requirements

The ULI Real Estate Development Fundamentals guide demonstrates how layered analysis grounds every strategic move and avoids costly missteps.

Tip: Read How To Unlock 7× Profit: Real Estate Development Lifecycle Mastery

Final Takeaway

Final Takeaway

Pre‑development isn’t a checklist. It’s your project’s strategic bedrock. It clarifies who wins, why they’ll choose you, and how you reduce risk before breaking ground. That’s the difference between starting and succeeding.

Access the most comprehensive real estate development success kit for free, including step-by-step strategies, high-impact templates, and $35,000 worth of expert insights to help you develop smarter, cut costs, and lead with confidence—whether you’re planning your first project or scaling your next big move—the Real Estate Development Guide.

Book Your 1:1 Strategy Session for direct value creation.

How to Situate Pre‑Development as Your Strategic Launchpad

Pre‑development strategies in real estate don’t just prepare—they launch. This phase sets the trajectory—without precision, you drift. With intention, you dominate.

1. Think Chess, Not Checkers

- Every pre-development decision is a strategic move—zoning insights, infrastructure positioning, timelines

- Consider the long game: exits, entitlement speed, tenant gravity

- Example: Targeting an urban transit corridor accelerates absorption and long-term rent growth

The Urban Land Institute Emerging Trends Report highlights how strategic pre-development decisions in high-growth nodes yield outsized returns.

2. Deconstruct Common Developer Pitfalls

- Permitting delays costs time, money, and lender confidence

- Market assumptions fail without validated demand sets

- Early budget skews often compound—without contingency, the risk becomes real

Pro Tip: Use a structured Permit Readiness Scorecard to benchmark every precursor path before design sketches begin.

3. Align Stakeholders Around a Shared Path

- Investors need clarity on entitlement timelines and pre-development milestones

- Architects and engineers require budget and regulatory precision before design starts

- Authorities appreciate early engagement—it reduces red tape later

AGC’s Guide to Pre-Construction Risk Management shows how proactive stakeholder alignment reduces approval delays.

Final Takeaway

Final Takeaway

Pre‑development strategies in real estate are not preparation—they’re strategic launchpads. They define your project’s course and rally stakeholders toward a shared vision. That precision separates generic builds from market-defining assets.

How to Validate Your Vision with Feasibility Study & Risk Assessment

Feasibility isn’t a checkbox—it’s a proving ground. In pre‑development strategies in real estate, your feasibility study and risk assessment shift ambition into actionable confidence.

1. Treat Feasibility as a Strategic Lens

- It answers, “Should we build this?” not just “Can we?”

- Covers demand, budget, environmental, and regulatory realities

- Converts optimism into data-driven decisions that elite developers trust

The ULI Real Estate Development Fundamentals guide defines feasibility studies as core to value creation and risk reduction.

2. Build a Multi-Dimensional Financial & Environmental Feasibility

- Financial Analysis: Break down soft costs, hard costs, and revenue streams, and include 10–15% contingency

- Environmental Feasibility: Conduct Phase I/II ESAs to uncover hidden liabilities—soil contamination, flood risk

- Regulatory Overlay: Map zoning constraints, setback requirements, and utility availability

Pro Tip: Model worst-case cost escalation and regulatory delays to stress-test viability.

3. Quantify Risk with Structured Sensitivity Testing

- Run dynamic financial models that adjust for material cost increases, delay timelines, or demand drops

- Include stakeholder engagement scenarios—investor pullback, authority objections, community resistance

- Use a risk matrix to prioritize mitigation plans, not just identify problems

According to AGC’s Risk Management Guide, proactive risk quantification reduces approval delays by up to 40%.

Final Takeaway

Final Takeaway

Feasibility studies and risk assessments aren’t admin—they’re your early warning system. Integrated into pre‑development strategies in real estate, they turn uncertainty into opportunity and guesswork into high-probability execution.

How to Fortify Your Project with Financial Planning & Funding Strategy

Money isn’t just a resource—it’s the lifeline of your pre‑development phase. Real estate’s most powerful pre‑development strategies anticipate cash flow, diversify Funding, and buffer the unknown before the ground breaks.

1. Build a Detailed, Purpose-Driven Budget

- Itemize direct costs: land, construction, design, permits

- Include indirect costs: legal fees, marketing, taxes, insurance

- Embed 10–15% contingency to capture unseen risks

- Use dynamic budgeting tools—rolling forecasts keep projections alive

The ULI Real Estate Development Fundamentals underscores the importance of proactive budgeting in controlling capital and mitigating overruns.

2. Diversify Funding into a Resilient Stack

- Combine equity, construction loans, and pre-sales or JV capital

- Explore green project incentives or tax credits for sustainable features

- Avoid over-reliance: balance high-cost debt with lower-risk capital

DSIRE (Database of State Incentives for Renewables & Efficiency) lists hundreds of incentives that can materially improve project financing.

3. Manage Cash Flow Like a Surgeon

- Use real-time tracking (QuickBooks, Yardi Pro) to monitor inflows and outflows instantly

- Phase financing—align draw schedules with design, entitlement, and construction milestones

- Run “what-if” stress tests for interest rate spikes or lender delays to safeguard runway

AGC’s risk framework shows that live cash tracking reduces surprise shortfalls by up to 35%.

Final Takeaway

Final Takeaway

Strong pre‑development strategies in real estate plans keep capital lean, stack stable, and runway clear. When Funding falters ahead of construction, strategy crumbles, too.

How to Anchor Stakeholder Alignment & Risk Resilience Early

In top-tier pre‑development strategies in real estate, stakeholder collaboration and early risk management are strategic levers—not afterthoughts. When done well, they shorten timelines, strengthen approvals, and build trust before the first foundation is poured.

1. Map Your Stakeholder Ecosystem

- Identify and list key players: investors, regulators, local authorities, community leaders, future tenants, and contractor teams.

- For each, define their degree of influence, primary concerns, and decision-making thresholds.

- Assign accountable liaisons and establish a precise communication rhythm—weekly check-ins, milestone reviews, and live updates.

The AGC’s Risk Management Guide shows early stakeholder alignment can cut approval delays by up to 40%, keeping your project on track.

2. Build Consensus, Don’t Just Race for Consent

- Host vision-setting workshops with live design tools like 3D renders, pivot tables, and financial snapshots that speak stakeholder language

- Frame feedback loops neutrally: ask, “What risk do you see here that I haven’t?” rather than, “Here’s our plan.”

Pro Tip: Using stakeholder insights early turns resistance into advocacy—so your execution feels community-backed.

3. Build a Living Risk Register & Mitigation Action Plan

- Catalog every risk—regulatory, budget, environmental, schedule, design, permit, or legal

- Prioritize using a matrix: impact vs. Probability

- Assign an owner, a deadline, and a mitigation strategy—track changes weekly

The ULI Real Estate Development Fundamentals guide advocates for formal risk registers, which boosts project certainty and stakeholder confidence.

4. Make Adaptation Part of Your Rhythm

- Integrate stakeholder and risk feedback into every design, budget, and permitting cycle

- Build decision milestones—if feedback exceeds X, pause and recalibrate

- Pitch adjustments as proactive shielding, not reactive fix-ups

Example: When a municipal authority flagged traffic safety concerns, an early pivot in design and circulation routing saved 3 months in permit delays—before drawings were finalized.

Final Takeaway: Embed Stakeholder Engagement & Risk Discipline in Every Move

Final Takeaway: Embed Stakeholder Engagement & Risk Discipline in Every Move

This is your pre‑development lifeline: early alignment plus structured risk management. When stakeholders are heard, and risks are documented—and adjusted—your project doesn’t just start right—it stays right.

How to Use Technology & Sustainable Innovation as Your Competitive Advantage

Innovation isn’t optional in elite pre‑development strategies in real estate—it’s the edge. Technology boosts precision, cuts waste, and accelerates approvals. Sustainability builds resilience and unlocks incentives. Combined, they make your project smarter—and more defensible.

1. Leverage GIS Mapping & Predictive Analytics

- GIS mapping visualizes transit, utilities, zoning boundaries, environmental constraints, and future urban expansion

- Predictive analytics use AI models to forecast demographic shifts, rent trends, and material price volatility

- Digital twins simulate performance—testing layout, energy use, and permitting needs before breaking ground

Resources like Esri’s GIS for Real Estate show how location intelligence gives early project clarity.

2. Embrace Sustainable Design for Market & Regulatory Edge

- Integrate green infrastructure: bioswales, solar orientation, energy-saving HVAC systems

- Use eco-friendly materials: recycled steel, sustainably sourced timber, low-carbon concrete

- Aim for LEED, WELL, or BREEAM certification—increasing asset value and opening ESG incentives

The U.S. Green Building Council details how sustainable certifications boost returns and align with community expectations.

3. Automate Pre-Development with Advanced Tech

- Use 3D modeling and VR walkthroughs for immersive stakeholder feedback and zoning validation

- Implement blockchain-based smart contracts for rapid document exchange, deed tracking, and escrow processes

- Centralize communication with Agile PM tools (Asana, Monday.com, Procore) to reduce misalignment

A Deloitte Real Estate Digitalization report shows that digital adoption increases project speed by 20% and significantly reduces errors.

4. Tap Incentives for Green Innovation

- Source federal & state grants for solar, water efficiency, and EV infrastructure

- Explore tax credits like 179D deductions or investment tax credits for renewable features

- Catalog incentives using DSIRE while designing for qualification thresholds

Final Takeaway

Final Takeaway

In today’s landscape, pre‑development strategies in real estate demand more than good ideas—they require innovative tools. When you combine cutting-edge tech, sustainability, and incentive intelligence, you don’t just build—you lead.

How Case Studies & Tactical Lessons Cement Your Real Estate Pre‑Development Strategy

Real-world examples become proof points—they elevate a strategy from theory to conviction. The most elite pre‑development strategies in real estate rely on showing outcomes. Below are five transformative case studies illustrating how clear pre-development thinking overcame complexity and delivered success.

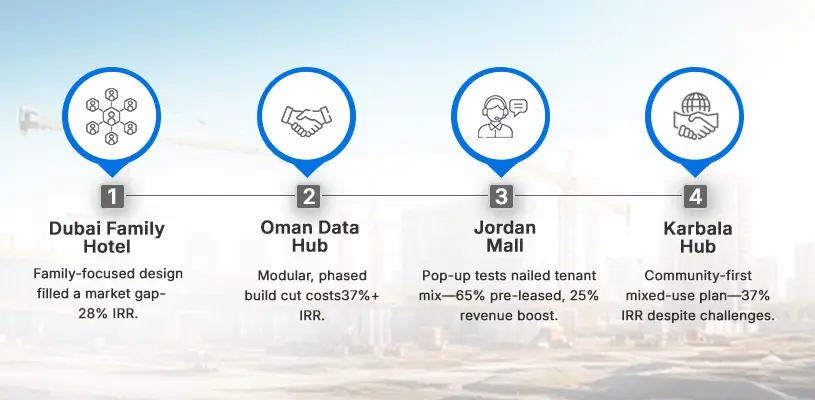

1. Family-Oriented Hotel, Dubai — Designing for Demand

- Challenge: A luxury-heavy market lacked family-focused hospitality

- Insight: Visitor data showed a consistent 6.7% annual rise in family tourism

- Move: Designed amenities like kids’ zones, secure spaces, and family lounges

- Result: Achieved 28% IRR and redefined Dubai’s hospitality niche

- UAE Tourism Statistics validate the family travel surge fueling asset repositioning

2. Modular Data Hub, Oman — A Phased, Scalable Strategy

- Challenge: Strong demand but high upfront capital required

- Insight: McKinsey forecasts predicted consistent growth in regional digital infrastructure

- Move: Phased modular build cut capital by 15% and allowed early market entry

- Result: Delivered $300M asset with 37%+ IRR and flexible expansion

- McKinsey Digital Infrastructure Report supports modular and scalable development

3. Retail Mall, Jordan — Testing Tenant Mix Early

- Challenge: Retail viability in emerging second-tier cities was uncertain

- Insight: Trade-area radius research revealed weak anchor tenant performance

- Move: Piloted pop-ups to test concepts and optimize the leasing mix

- Result: Secured 65% pre-leased space and 25% ahead-of-plan revenue

- ULI Retail Development Best Practices endorse early tenant mix validation in emerging markets

4. Community Hub & Mall, Karbala, Iraq — Aligning Stakeholders Under Pressure

- Challenge: Volatility and regulatory complexity in a sensitive market

- Insight: Community demand for public spaces outweighed retail alone

- Move: Blended schools, clinics, parks, and marketplaces through stakeholder collaboration

- Result: Delivered 37% IRR and established a resilient urban development

- World Bank Mixed-Use Development Insights highlight community integration best practices

5. Education Campus, Oman — Bridging Global Gaps

- Challenge: Local education supply lacked international academic standards

- Insight: UNESCO data confirmed 45% year-over-year growth in student enrolment projections

- Move: Partnered with global institutions, integrated housing, recreation, and modern classrooms

- Result: Achieved 30%+ IRR and positioned Oman as an emerging educational hub

- UNESCO Education Trends underline the rising need for global-standard education facilities

Final Takeaway

Final Takeaway

Each case shows how disciplined pre‑development strategies in real estate drive real-world results:

- Market clarity

- Early stakeholder testing

- Phased execution and budgeting

- Regulatory and community synchronization

These blueprint-plus-insight approaches don’t guess—they build certainty into execution and outcomes.

Conclusion: How to Turn Pre‑Development Strategies in Real Estate into Competitive Advantage

You’ve learned to:

- Treat pre‑development as strategic groundwork, not a checklist

- Launch your project like a chess master, not a checkers player

- Validate with Feasibility and structured risk

- Plan your finances and Funding like a CFO

- Engage stakeholders early—mitigating obstacles before they surface

- Use technology and sustainability to lead, not follow

- Cement your strategy with real-world evidence

This is the blueprint for Pre‑Development Strategies in Real Estate—not just ideology but execution-grade playbooks designed for elite outcomes.

What to Do Next

Download the Pre‑Development Master Toolkit, which includes Practical tools, checklists, budget templates, risk registers, and tech integration guides.

Book a 1:1 Strategy Session. Together, we’ll de-risk your next project, build your roadmap, and ensure your pre-development phase is bulletproof.

FAQs: Pre‑Development Strategies in Real Estate That Top Developers Ask

1. What are pre‑development strategies in real estate?

A pre-development strategy in real estate includes early planning, market analysis, feasibility study, risk assessment, stakeholder engagement, financial planning, and technology integration—laying the groundwork before construction begins.

2. Why is stakeholder alignment so critical early on?

Early stakeholder engagement—whether with investors, authorities, or communities—enhances real estate pre-development strategies, reduces permitting delays, and turns resistance into advocacy.

3. How should feasibility studies inform strategy?

A detailed feasibility study tests market demand, cost projections, risk assessment, and financial planning—transforming pre-development strategies in real estate from assumptions into data-driven execution models.

4. What role does technology play in pre‑development strategies in real estate?

Technology integration—such as GIS mapping, predictive analytics, and digital twins—amplifies real estate pre-development strategies through more brilliant insights, virtual design, and improved stakeholder feedback loops.

5. Can sustainability actually improve pre‑development outcomes?

Sustainable innovation (like green infrastructure or LEED certification) enhances real estate pre-development strategies by reducing lifecycle costs, attracting incentives, and building long-term resilience.

6. How does market analysis shape pre‑development planning in real estate?

Market analysis feeds into real estate pre-development strategies by revealing demand gaps, demographic shifts, rent growth, and competitive landscapes—forming the backbone of any solidity-driven feasibility study.

7. What is a risk assessment framework for pre‑development strategies in real estate?

Risk assessment is a core component of real estate pre—development strategies. It involves identifying regulatory, financial, environmental, and stakeholder risks early to inform mitigation in Feasibility and financial planning.

8. How do I build a resilient financial plan in pre‑development?

A strong financial planning model for real estate pre-development strategies allocates cost lines, builds contingency reserves, forecasts cash flow across entitlement timelines, and aligns funding sources.

9. Why is cash flow modeling important before breaking ground?

Cash flow models help shape real estate pre-development strategies by timing capital needs, identifying funding gaps, stress-testing scenarios, and ensuring financing aligns with build schedules.

10. How do I engage local communities during pre‑development in real estate?

Community engagement is a tactical part of real estate pre-development strategies. It creates trust, reduces local resistance, and aligns design and sustainability goals with stakeholder input.

11. What is the role of ESG integration in pre‑development?

Environmental, Social, and Governance (ESG) frameworks are integral to real estate pre-development strategies. They guide sustainable design, build stakeholder trust, and unlock green incentives.

12. How does GIS mapping improve site selection?

GIS mapping supports pre-development strategies in real estate by visualizing transit corridors, utility access, environmental hazards, and demographic layers to inform site viability and risk areas.

13. When should I conduct Phase I and II environmental site assessments?

Conducting environmental due diligence—Phase I and Phase II ESA—early in real estate pre-development strategies allows developers to uncover contamination, flood risk, and remediation needs before design or acquisition.

14. How do finance tools help pre‑development in real estate decision-making?

Financial planning software enhances real estate pre-development strategies by enabling sensitivity analysis of cash flow, funding structures, fee schedules, and contingency buffers.

15. What tech tools aid stakeholder collaboration?

Platforms like digital twins, 3D models, VR walk-throughs, and Agile project management tools support pre-development strategies in real estate by aligning stakeholder vision and speeding decision-making.

16. How does a pre‑development in real estate risk register function?

A risk register centralizes the risk assessment process in real estate pre-development strategies, listing each identified risk, its owner, Probability, impact, and mitigation timeline—keeping the whole team aligned.

17. When does a pre‑development checklist become a strategic plan?

A checklist transitions to strategy once it incorporates market analysis, feasibility study results, cash flow modeling, stakeholder feedback, risk assessment, and technology integration—all hallmarks of elite pre-development strategies in real estate.

18. What metrics define successful pre‑development strategies in real estate?

Key performance indicators include entitlement timing, feasibility assumptions’ accuracy vs. realized market outcomes, variance in budget/cash flow forecasts, stakeholder approval rates, and sustainability benchmarks—metrics that distinguish top-tier pre-development strategies in real estate.

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now for direct value creation.