Why real estate asset management is the Key to Long-Term Profitability

The Real Challenge Beyond Property Ownership

Buying real estate is easy. Owning property? Also easy. Turning that property into a thriving, high-performing asset? That’s where most investors fail.

To effectively engage in real estate asset management, investors must understand the dynamics of their investments. This means recognizing that real estate asset management is not merely about property ownership but involves strategic planning to maximize asset performance.

In the realm of real estate asset management, a focus on long-term profitability is crucial. Investors who prioritize real estate asset management are more likely to see sustained returns and asset appreciation over time.

A staggering number of real estate owners focus on acquisitions but neglect the one thing that truly matters—how to maximize and sustain Profitability. Without a strategicasset estate management approach, even the best-located, high-potential property will bleed Money, lose Value, and underperform.

Successful real estate asset management requires adaptability to changing market conditions, ensuring that the properties remain competitive and profitable.

Why Some Investors Struggle While Others Succeed

What separates successful investors from those who watch their properties decline?

They don’t adapt. Market conditions shift, and tenant expectations evolve. Yet, many investors continue to use outdated real estate management strategies that no longer work.

Effective real estate asset management includes optimizing financial structures and leveraging data analytics to drive investment decisions.

They operate reactively. Instead of proactively optimizing cash flow, expenses, and tenant retention, they wait until vacancies rise or maintenance costs spiral out of control.

They fail to position their assets. Without strong branding, market positioning, and operational efficiency, a property will be lost in a sea of competition.

Meanwhile, the top 1% of asset managers and investors do things differently. They treat real estate like a business, not just an investment. They strategically position, optimize, and future-proof every asset to increase Value and maximize ROI—even in turbulent markets.

Understanding the principles of real estate asset management allows investors to navigate market fluctuations effectively, ensuring their portfolios remain resilient.

What This Guide Will Teach You (Actionable Takeaways)

This isn’t a theoretical lecture. It’s a battle-tested playbook for real estate development professionals who want to stop leaving Money on the table.

You’ll learn:

![]() How to position and brand assets for stronger market demand and higher rental income.

How to position and brand assets for stronger market demand and higher rental income.

![]() The secret to tenant retention is that it slashes turnover costs and increases long-term revenue.

The secret to tenant retention is that it slashes turnover costs and increases long-term revenue.

![]() Which operational inefficiencies are quietly eating away at your profits—and how to fix them?

Which operational inefficiencies are quietly eating away at your profits—and how to fix them?

![]() How innovative renovations boost asset value without overspending.

How innovative renovations boost asset value without overspending.

![]() Why portfolio diversification is your best hedge against economic downturns.

Why portfolio diversification is your best hedge against economic downturns.

![]() How to optimize leasing and exit strategies for peak profitability.

How to optimize leasing and exit strategies for peak profitability.

The cost of poor real estate asset management can significantly impact an investor’s bottom line, making it imperative for stakeholders to prioritize effective strategies.

![]() The latest real estate tech & AI trends reshaping real estate asset management.

The latest real estate tech & AI trends reshaping real estate asset management.

Real estate asset management should always aim to enhance the tenant experience, as satisfied tenants lead to higher retention rates and ultimately better asset performance.

By the end of this guide, you’ll have a clear, actionable roadmap to transforming underperforming properties into high-value assets that generate maximum ROI.

Investors must recognize that real estate asset management is an ongoing process, one that requires vigilance and proactive measures to sustain profitability.

Your real estate investments should work for you—not vice versa. Let’s get started.

Access the most comprehensive real estate development success kit for free, including step-by-step strategies, high-impact templates, and $35,000 worth of expert insights to help you develop smarter, cut costs, and lead with confidence—whether you’re planning your first project or scaling your next big move—the Real Estate Development Guide.

Book Your 1:1 Strategy Session for direct value creation.

To gain a comprehensive understanding of post-development strategies in real estate, consult How to Master Post-Development Strategies in Real Estate, our definitive guide to mastering post-development optimization to equip professionals with actionable insights and strategic frameworks.

The High Cost of Poor Real Estate Asset Management: Risks & Consequences

How Mismanagement Can Destroy Property Value

Neglect is expensive.

Not today. But in six months? A year? A mismanaged property bleeds Value.

The paint fades. The HVAC system groans. Tenants leave, and replacements don’t come fast enough. Before you know it, your once-thriving investment is an underperforming liability.

And here’s the brutal truth: Bad real estate asset management doesn’t just stall profits—it actively destroys them.

The Hidden Costs of High Vacancy & Turnover

Vacancy isn’t just space—it’s lost revenue, mounting expenses, and a silent threat to Profitability.

Every month, a unit sits vacant; you’re not just missing rent. You’re paying:

Marketing costs to attract new tenants.

Agent commissions to fill the space.

Cleaning and repairs to make it move-in ready.

Administrative expenses from lease processing to background checks.

And that’s if you even find a quality tenant. Rushed leasing leads to the wrong tenants, evictions, damages, and legal fees.

Unless you break it with proactive real estate asset management, it’s a vicious cycle that eats into your ROI.

In the context of real estate asset management, leveraging technology and data analytics can provide a competitive edge, enhancing decision-making capabilities.

Poor asset management leads to more than just operational headaches—it invites financial collapse. The Urban Land Institute outlines this in detail, including liquidity constraints, pricing inconsistencies, and unsystematic risks that drain returns over time. Read more in “Managing a Modern Commercial Real Estate Portfolio”:

Missed Market Opportunities & Operational Inefficiencies

A mismanaged property isn’t just failing—it’s falling behind.

Markets shift. Tenant expectations evolve. Yet too many investors hold onto outdated strategies that no longer work.

What happens when you don’t adapt?

You miss the surge in demand for flexible workspaces, co-living, or short-term rentals.

You fail to adjust pricing to match market trends, leaving Money on the table.

You ignore operational inefficiencies and overspending on maintenance, utilities, and staffing.

And while you wait? Your competitors optimize, upgrade, and take your market share.

The Bottom Line: You Can’t Afford to Ignore real estate asset management

A failing property doesn’t announce itself. It declines quietly—until it’s too late.

Bad real estate asset management isn’t just a mistake. It’s a choice.

But here’s the good news: So is fixing it.

The best investors don’t wait for losses to pile up—they get ahead of them. In the next section, we’ll dive into how real estate asset management works—and why it’s the key to turning struggling properties into high-performing investments.

Real Estate Asset Management vs. Property Management: The Key Differences

What is real estate asset management?

Think of a real estate asset manager as a professional running a business—because that’s precisely what it is.

It’s not about fixing leaky faucets or collecting rent checks. It’s about increasing property value, maximizing cash flow, and making strategic decisions that grow wealth over Time.

It’s the difference between owning a building and managing an investment portfolio.

Property Management vs. Real Estate Asset Management: The Crucial Divide

Most investors confuse real estate asset management with property management—that’s where they go wrong.

Here’s the distinction:

INSERT TABLE

Owning real estate without a real estate asset management strategy is like owning a Ferrari but never taking it out of first gear. You have the potential, but you’re leaving Money on the table.

How Real Estate Asset Management Drives Profitability Beyond Daily Operations

Want higher returns? Lower risks? You don’t get there by just maintaining a property. You get there by optimizing it.

![]() Market Positioning and branding ensure that your property stands out, attracts premium tenants, and commands top dollar.

Market Positioning and branding ensure that your property stands out, attracts premium tenants, and commands top dollar.

![]() Portfolio Optimization – Deciding which assets to hold, upgrade, reposition, or sell based on market data.

Portfolio Optimization – Deciding which assets to hold, upgrade, reposition, or sell based on market data.

![]() Lease Strategy & Revenue Growth – Structuring leases for higher rents, lower vacancies, and longer tenant retention.

Lease Strategy & Revenue Growth – Structuring leases for higher rents, lower vacancies, and longer tenant retention.

![]() Expense Control & Financial Oversight – Cutting unnecessary costs while improving asset value and operational efficiency.

Expense Control & Financial Oversight – Cutting unnecessary costs while improving asset value and operational efficiency.

![]() Future-Proofing Investments – Staying ahead of market shifts, not reacting to them.

Future-Proofing Investments – Staying ahead of market shifts, not reacting to them.

The distinction between asset and property management isn’t trivial—it’s transformational. ULI’s specialized workshop explores how elite managers reposition distressed properties, model financial outcomes, and structure portfolio-wide upgrades.

Explore the program here:

A property manager keeps the lights on. An asset manager makes sure the lights are worth paying for.

So, the real question is, are you just managing your property or maximizing your investment?

Data-Driven Strategies: How to Measure & Maximize Asset Performance

What Gets Measured, Gets Optimized

Most investors guess how their properties are performing. They check rent rolls, look at bank statements, and assume Everything’s fine—until it isn’t.

The best asset managers don’t guess. They track, measure, and adjust.

Why? Because making Money in the real estate industry isn’t about buying and hoping. It’s about buying and optimizing.

Data tells you:

![]() Where is your asset leaking Money?

Where is your asset leaking Money?

![]() Which tenants are profitable—and which ones aren’t?

Which tenants are profitable—and which ones aren’t?

![]() When to raise rents, refinance, or reposition a property.

When to raise rents, refinance, or reposition a property.

![]() How to improve cash flow without increasing expenses.

How to improve cash flow without increasing expenses.

Ignoring data is like driving blindfolded. You might survive for a while, but eventually, you’ll crash.

Key Financial Metrics Every Asset Manager Must Track

Numbers don’t lie—but you need to know which ones matter.

These are the non-negotiable metrics for real estate asset managers:

Insert Table

You wouldn’t invest in stocks without checking earnings, revenue, and P/E ratios. Why would you invest in real estate without knowing NOI, IRR, and DSCR?

Using Market Data for Smarter Decision-Making

Real estate is not a gut-feel business. It’s a data business.

![]() What if you could predict the next high-growth area before the market catches on?

What if you could predict the next high-growth area before the market catches on?

![]() What if you knew when rental demand would spike—before your competitors?

What if you knew when rental demand would spike—before your competitors?

![]() What if you could adjust pricing based on real-time market conditions?

What if you could adjust pricing based on real-time market conditions?

You can if you leverage data.

The best asset managers use:

![]() Comparable Market Analysis (CMA) – Are your rents in line with the market? Are you charging too little? Too much?

Comparable Market Analysis (CMA) – Are your rents in line with the market? Are you charging too little? Too much?

![]() Demographic & Economic Trends – Which neighborhoods are seeing job growth? Migration booms? Rising homeownership rates?

Demographic & Economic Trends – Which neighborhoods are seeing job growth? Migration booms? Rising homeownership rates?

![]() Tenant Demand & Preferences – Do your properties cater to the right audience? Are you offering the amenities that drive lease renewals?

Tenant Demand & Preferences – Do your properties cater to the right audience? Are you offering the amenities that drive lease renewals?

Most investors react to the market. The smartest ones stay ahead of it.

The Bottom Line: Asset Performance is a Choice

Failing properties don’t just happen. They result from neglect, insufficient data, or worse, no data.

![]() You can manage your assets based on assumptions, or you can manage them based on facts.

You can manage your assets based on assumptions, or you can manage them based on facts.

![]() You can let the market dictate your returns or use data to control them.

You can let the market dictate your returns or use data to control them.

![]() You can wait for performance to decline or optimize before it happens.

You can wait for performance to decline or optimize before it happens.

ULI and Heitman’s joint research proves the point: data beats intuition. Their climate risk disclosure report shows how predictive analytics is now core to protecting—and growing—real estate portfolios.

The winning real estate investors don’t just own assets; they measure, track, and improve them.

The following section explores how market positioning and branding can elevate your property’s Value, attract premium tenants, and command higher rents.

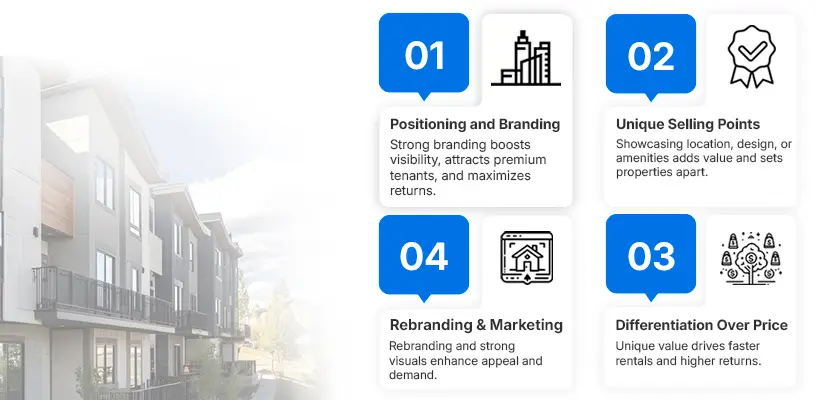

Positioning & Branding: How to Make Your Property Stand Out

Why Market Positioning is the Ultimate Asset Multiplier

Your property is competing for attention against other buildings, against new developments, against shifting market trends.

Without a strong market position, you’re invisible. And invisibility is expensive.

Branding isn’t just for corporations. It’s the difference between:

![]() A luxury high-rise that commands premium rent

A luxury high-rise that commands premium rent

![]() A retail space with a waitlist of tenants

A retail space with a waitlist of tenants

![]() An office building filled with long-term, creditworthy occupants

An office building filled with long-term, creditworthy occupants

The most profitable real estate investments aren’t just well-located—they’re well-positioned.

Identifying & Leveraging Unique Selling Points (USPs)

Not all properties are created equal. But most investors treat them like they are.

Winning asset managers do the opposite. They highlight what makes their property different—and amplify it.

Your property’s unique selling proposition (USP) could be:

![]() Location dominance – Is it in a high-demand district? Near a transportation hub? Inside a booming business zone?

Location dominance – Is it in a high-demand district? Near a transportation hub? Inside a booming business zone?

![]() Architectural identity – Does it have a sleek, modern design? Historic charm? Eco-friendly innovations?

Architectural identity – Does it have a sleek, modern design? Historic charm? Eco-friendly innovations?

![]() Premium amenities – Smart home integration? Rooftop lounges? Wellness spaces?

Premium amenities – Smart home integration? Rooftop lounges? Wellness spaces?

![]() Tenant-first policies – Flexible lease terms? Co-living or hybrid workspaces? On-demand concierge services?

Tenant-first policies – Flexible lease terms? Co-living or hybrid workspaces? On-demand concierge services?

People don’t pay for square footage. They pay for perceived Value. What does your property offer that others don’t?

How Rebranding & Digital Marketing Can Increase Property Value

Real estate asset management is crucial for maximizing returns, as it involves not just monitoring but actively enhancing the value of each asset.

Reputation matters. A generic apartment complex is just another rental. A branded living experience commands premium rates.

How do you shift from a property that exists to a property people seek out?

![]() Rename & rebrand. A commercial plaza can become a “business hub.” A struggling hotel can be repositioned as a “boutique lifestyle retreat.”

Rename & rebrand. A commercial plaza can become a “business hub.” A struggling hotel can be repositioned as a “boutique lifestyle retreat.”

![]() Upgrade your visual presence with high-end photos, drone videos, and virtual tours. Why would anyone else if you wouldn’t live or work there based on your listing?

Upgrade your visual presence with high-end photos, drone videos, and virtual tours. Why would anyone else if you wouldn’t live or work there based on your listing?

![]() Dominate online visibility. Your property should appear in searches on Google, Zillow, and every central listing platform. If tenants can’t find you, you don’t exist.

Dominate online visibility. Your property should appear in searches on Google, Zillow, and every central listing platform. If tenants can’t find you, you don’t exist.

![]() Tell a story. Show success stories. Happy tenants. High returns. The transformation from an overlooked space to a prime asset.

Tell a story. Show success stories. Happy tenants. High returns. The transformation from an overlooked space to a prime asset.

A property without positioning is a commodity. A property with branding is a competitive advantage.

The Bottom Line: Differentiate or Disappear

![]() If your property doesn’t stand out, it competes on price, and competing on price is a losing game.

If your property doesn’t stand out, it competes on price, and competing on price is a losing game.

![]() If you don’t define your asset’s Value, the market will—and it won’t be in your favor.

If you don’t define your asset’s Value, the market will—and it won’t be in your favor.

![]() If you don’t build a brand around your investment, you leave Money on the table.

If you don’t build a brand around your investment, you leave Money on the table.

A well-positioned asset doesn’t just rent faster—it rents smarter. ULI’s guide to repositioning B/C office buildings outlines how to rebrand outdated spaces into high-yield performers.

Real estate isn’t about who owns the most properties. It’s about who maximizes the most Value.

In the next section, we’ll uncover how operational efficiency turns suitable investments into great ones—and how to slash costs without sacrificing quality.

Maximizing Operational Efficiency for Higher Returns

The Hidden Leak in Real Estate Profits

Profits don’t just disappear. They leak.

A slow, steady drip of inefficiencies—high maintenance costs, wasted utilities, sluggish leasing, outdated processes.

Individually, these seem small. But if you stack them together, you have an asset that should thrive instead of bleeding cash.

The worst part? Most investors don’t even realize it’s happening.

Operational inefficiency is silent—until it isn’t. Until expenses spike, occupancy drops, and the balance sheet tells a story of missed opportunities.

How Inefficiencies Kill Profitability (and What to Fix)

What’s the difference between a high-performing asset and one struggling to stay afloat?

It isn’t a location. It isn’t the market. It’s how well it’s run.

![]() Delayed maintenance = Higher long-term repair costs.

Delayed maintenance = Higher long-term repair costs.

![]() Vacancy gaps = Lost rental income that can never be recovered.

Vacancy gaps = Lost rental income that can never be recovered.

![]() Manual processes = Money wasted on outdated systems.

Manual processes = Money wasted on outdated systems.

![]() Overpaying for services = Hidden costs eating into NOI.

Overpaying for services = Hidden costs eating into NOI.

Your property is a business. And every business needs efficiency to thrive.

Automating Property Management for Smarter Operations

Why are you still doing things manually?

Technology isn’t just a nice-to-have anymore. It’s a profit driver.

![]() Automated work order systems – Fix problems before tenants complain.

Automated work order systems – Fix problems before tenants complain.

![]() AI-driven lease management – Optimize renewals, track rent trends, and eliminate guesswork.

AI-driven lease management – Optimize renewals, track rent trends, and eliminate guesswork.

![]() Predictive maintenance – Reduce unexpected failures and extend asset lifespan.

Predictive maintenance – Reduce unexpected failures and extend asset lifespan.

![]() Smart energy management – Cut utility costs with automated efficiency controls.

Smart energy management – Cut utility costs with automated efficiency controls.

Think about it: Every hour saved is an expense reduced. Every process optimized is revenue gained.

Cost-Reduction Tactics Without Sacrificing Quality

Slashing costs is easy. Slashing them without damaging tenant satisfaction and asset value? That’s the real skill.

Here’s what the most innovative asset managers focus on:

![]() Vendor renegotiation – Are you overpaying for Cleaning, security, or landscaping? Get competitive bids and cut waste.

Vendor renegotiation – Are you overpaying for Cleaning, security, or landscaping? Get competitive bids and cut waste.

![]() Bulk service contracts – Leverage multiple properties for better pricing.

Bulk service contracts – Leverage multiple properties for better pricing.

![]() Energy efficiency upgrades – LED lighting, smart thermostats, water-saving systems. Small investments, long-term savings.

Energy efficiency upgrades – LED lighting, smart thermostats, water-saving systems. Small investments, long-term savings.

![]() Outsourcing non-core functions – Let specialists handle it—at a lower cost and higher efficiency.

Outsourcing non-core functions – Let specialists handle it—at a lower cost and higher efficiency.

The Bottom Line: Efficiency is a Competitive Advantage

![]() If your property isn’t running at peak efficiency, it’s underperforming.

If your property isn’t running at peak efficiency, it’s underperforming.

![]() If you aren’t optimizing, you’re losing Money—whether you see it or not.

If you aren’t optimizing, you’re losing Money—whether you see it or not.

![]() If you don’t invest in more intelligent systems, your competitors will.

If you don’t invest in more intelligent systems, your competitors will.

Asset performance isn’t just about revenue—it’s about waste. ULI’s thought leadership on emerging market risk and resilience highlights how high-cost inefficiencies, tenant attrition, and deferred maintenance erode NOI.

The best real estate investments aren’t just bought well. They’re managed well.

In the next section, we’ll explore how strategic upgrades and innovative renovations can unlock hidden Value and increase asset appreciation without overspending.

Innovative Renovations & Upgrades: Boosting Value Without Overspending

The Renovation Trap: Spending Without Strategy

A cover-up paint coat will not fix a lousy investment, and marble countertops will not improve tenant retention in a property.

Too many investors waste Money on the wrong upgrades, hoping aesthetics will drive returns. The truth is that renovations don’t create Value, but innovative renovations do.

Every dollar spent should have a purpose. Why are you paying if it doesn’t increase rents, reduce costs, or boost Occupancy?

Which Renovations Yield the Highest ROI?

Not all upgrades are created equal. Some are cosmetic distractions. Others are value multipliers.

The best asset managers focus on ROI-driven renovations—the ones that:

![]() Command higher rent – Tenants pay premiums for well-designed, functional spaces.

Command higher rent – Tenants pay premiums for well-designed, functional spaces.

![]() Reduce operational costs – Energy-efficient systems cut long-term expenses.

Reduce operational costs – Energy-efficient systems cut long-term expenses.

![]() Improve tenant retention – Better amenities = fewer vacancies.

Improve tenant retention – Better amenities = fewer vacancies.

What moves the needle

Insert Table

The goal isn’t just to renovate. It’s to reposition your property for higher long-term returns.

The Role of Sustainability & Green Upgrades

Sustainability isn’t a buzzword. It’s a financial strategy.

Investors and tenants alike are willing to pay more for eco-conscious properties. Governments are also offering incentives for energy-efficient upgrades that lower long-term costs.

Competent asset managers invest in:

![]() LED lighting, smart thermostats, and HVAC optimization – Cutting energy costs while increasing tenant appeal.

LED lighting, smart thermostats, and HVAC optimization – Cutting energy costs while increasing tenant appeal.

![]() Water-saving technologies – Lowering utility bills and reducing environmental impact.

Water-saving technologies – Lowering utility bills and reducing environmental impact.

![]() Green certifications (LEED, ENERGY STAR) – Attracting ESG-focused investors and high-end tenants.

Green certifications (LEED, ENERGY STAR) – Attracting ESG-focused investors and high-end tenants.

Case Study: A 40-year-old commercial building in London retrofitted with solar panels, smart HVAC, and LED lighting. Energy costs dropped by 35%, and Occupancy increased by 18% within a year.

Sustainability isn’t an expense. It’s an investment in lower costs and higher demand.

Repositioning & Adaptive Reuse: Maximizing Value Without Demolition

Instead of tearing down, what if you transformed?

Not every property needs a full-scale redevelopment. Sometimes, an innovative pivot unlocks trapped Value.

![]() Convert outdated office spaces into hybrid coworking hubs.

Convert outdated office spaces into hybrid coworking hubs.

![]() Reimagine vacant retail into last-mile fulfillment centers or medical facilities.

Reimagine vacant retail into last-mile fulfillment centers or medical facilities.

![]() Turn an underperforming hotel into short-term rental apartments.

Turn an underperforming hotel into short-term rental apartments.

Example: A struggling shopping mall in New York repurposed empty anchor stores into fitness centers, pop-up experiences, and coworking spaces—increasing revenue by 28% in one year without a major rebuild.

Real estate doesn’t fail because the structure is outdated. It fails because of the vision for it.

The Bottom Line: Spend Smarter, Not Bigger

![]() Not every upgrade adds Value—focus on strategic, revenue-driving renovations.

Not every upgrade adds Value—focus on strategic, revenue-driving renovations.

![]() Sustainability isn’t just good for the planet—it’s suitable for your NOI.

Sustainability isn’t just good for the planet—it’s suitable for your NOI.

![]() Repositioning and adaptive reuse can transform underperforming assets without costly overhauls.

Repositioning and adaptive reuse can transform underperforming assets without costly overhauls.

Sustainable upgrades don’t just check ESG boxes—they drive rent premiums and investor interest. ULI’s climate risk research with Heitman underscores the ROI of energy efficiency, green certifications, and smart building systems.

Real estate isn’t about spending more. It’s about investing better.

In the next section, we’ll explore why portfolio diversification is essential—and how the most intelligent investors hedge risk while maximizing Growth.

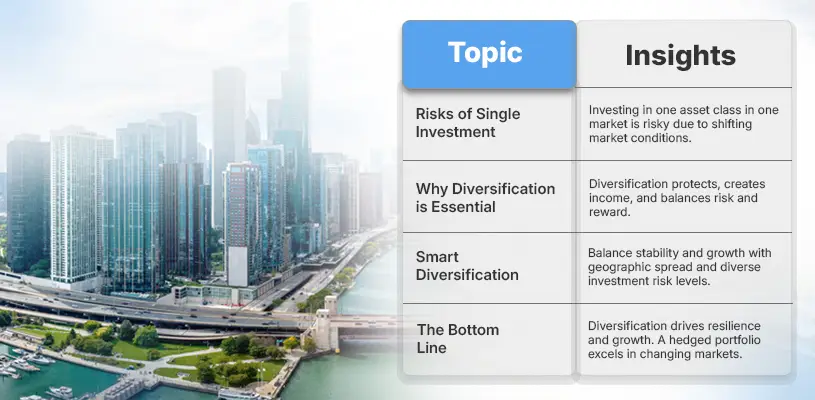

Portfolio Diversification: Reducing Risk & Expanding Growth

The Danger of Putting All Your Capital in One Basket

Owning a single asset class in a single market? That’s not real estate investing. That’s gambling.

Because markets shift, neighborhoods rise and fall. What worked yesterday might not work tomorrow.

The best investors don’t hope their assets perform. They hedge.

They diversify. Not randomly—strategically.

Why Diversification Isn’t Optional—It’s Survival

A well-diversified portfolio does three things:

![]() Protects against market downturns – When one sector struggles, others hold firm.

Protects against market downturns – When one sector struggles, others hold firm.

![]() Creates multiple revenue streams – Different asset classes generate income differently.

Creates multiple revenue streams – Different asset classes generate income differently.

![]() Balances risk and reward – Not every deal has to be high-risk, high-reward.

Balances risk and reward – Not every deal has to be high-risk, high-reward.

If your entire portfolio is luxury apartments in one city, what happens when rent caps hit? When does the local job market shrink? When a new development floods the market with supply?

Diversification isn’t about chasing new opportunities but protecting what you’ve already built.

Innovative Ways to Diversify a Real Estate Portfolio

Not all diversification is equal. Some strategies dilute the focus. Others amplify success.

Here’s what works:

1. Mix Asset Classes for Stability & Growth

Each asset class behaves differently. Balancing them reduces risk.

INSERT TABLE

2. Geographic Diversification: Spreading Risk Across Markets

Relying on a single city, state, or country? That’s a time bomb waiting to explode.

![]() Investing in different regions hedges against local market downturns.

Investing in different regions hedges against local market downturns.

![]() Balancing urban vs. suburban assets protects against shifting migration trends.

Balancing urban vs. suburban assets protects against shifting migration trends.

![]() Tapping into emerging markets offers lower entry costs with higher growth potential.

Tapping into emerging markets offers lower entry costs with higher growth potential.

Case Study: A Middle Eastern investment firm expanded into Southeast Asia’s tech hubs, capitalizing on rising demand for flexible office spaces, generating 18% annual appreciation while their home market slowed.

3. Risk Balancing: Core, Value-Add & Opportunistic Investments

The smartest portfolios include a mix of investment strategies:

![]() Core Investments (Low Risk, Steady Returns) – Stabilized multifamily properties, prime office buildings, and high-credit tenants.

Core Investments (Low Risk, Steady Returns) – Stabilized multifamily properties, prime office buildings, and high-credit tenants.

![]() Value-Add Investments (Moderate Risk, Higher Upside) – Older assets requiring renovation or Repositioning.

Value-Add Investments (Moderate Risk, Higher Upside) – Older assets requiring renovation or Repositioning.

![]() Opportunistic Investments (High Risk, High Reward) – Ground-up developments, distressed acquisitions, emerging market deals.

Opportunistic Investments (High Risk, High Reward) – Ground-up developments, distressed acquisitions, emerging market deals.

Example: A UAE developer held core luxury properties in Dubai while acquiring value-add mixed-use projects in North Africa—locking in stable cash flow while pursuing high-growth opportunities.

The Bottom Line: Diversify or Be Disrupted

![]() If all your assets move similarly in a downturn, you aren’t diversified—you’re exposed.

If all your assets move similarly in a downturn, you aren’t diversified—you’re exposed.

![]() If your portfolio doesn’t hedge against risk, it isn’t built for longevity.

If your portfolio doesn’t hedge against risk, it isn’t built for longevity.

![]() If you aren’t balancing stability with opportunity, you leave Money on the table.

If you aren’t balancing stability with opportunity, you leave Money on the table.

Geographic and sector diversification isn’t a hedge—it’s a necessity. ULI explains how spreading exposure across regions and asset types reduces systemic and unsystematic risks while unlocking growth opportunities.

The best investors don’t bet on one strategy. They build portfolios that thrive in every market condition.

In the next section, we’ll discuss asset managers’ financial strategies to maximize ROI so that your investments are diversified and highly profitable.

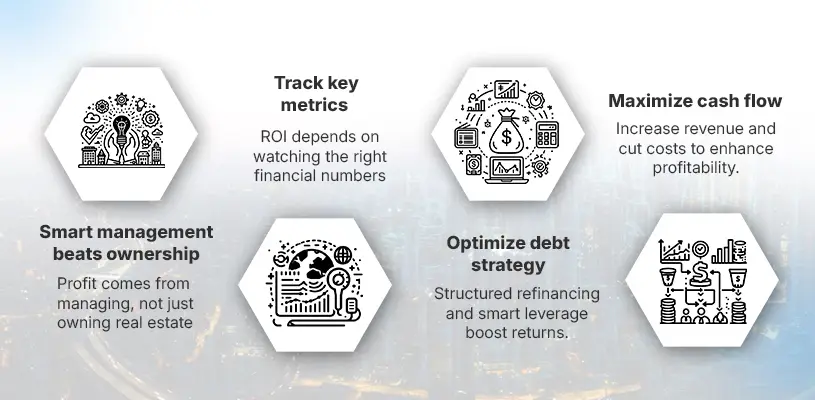

Advanced Financial Strategies: Maximizing ROI Through Smarter Real Estate Asset Management

The Difference Between a Property Owner and an Investor

Anyone can own real estate. The real question? Are you maximizing its financial potential?

The best asset managers don’t just collect rent. They engineer Profitability.

They know:

![]() How to structure debt for the lowest cost of capital.

How to structure debt for the lowest cost of capital.

![]() When to refinance to extract Value—without overleveraging.

When to refinance to extract Value—without overleveraging.

![]() How to optimize cash flow so every dollar works harder.

How to optimize cash flow so every dollar works harder.

In real estate, you don’t make Money when you buy; you make Money when you manage.

Key Financial Metrics Every Asset Manager Must Track

If you don’t track the correct numbers, you aren’t managing an asset—you’re just hoping for the best.

These are the must-watch metrics that separate profitable portfolios from struggling ones:

INSERT TABLE

Real estate is math first, emotion second.

Ignore the numbers, and you’ll bleed Money without even realizing it.

How to Optimize Financing & Debt Structuring for Higher ROI

Bad financing decisions destroy suitable investments.

Want to increase returns without taking on more risk? Optimize how you structure debt.

1. Refinancing for Cash Flow & Growth

![]() Lower interest rates = higher profits.

Lower interest rates = higher profits.

![]() Cash-out refinancing unlocks capital for new acquisitions.

Cash-out refinancing unlocks capital for new acquisitions.

![]() Debt restructuring improves DSCR and enhances lender confidence.

Debt restructuring improves DSCR and enhances lender confidence.

Case Study: A commercial landlord refinanced from 6.5% to 4.2% interest, saving $750,000 annually—boosting NOI without raising rents.

2. Leveraging Smart Debt vs. Risky Overleveraging

Debt can be a growth tool or a financial trap.

Smart leverage = Controlled debt that increases asset value.

Overleveraging = Risky debt that eats profits and creates instability.

![]() Fixed-rate vs. variable-rate debt – Align with interest rate trends.

Fixed-rate vs. variable-rate debt – Align with interest rate trends.

![]() Loan-to-value (LTV) optimization – Avoid excessive leverage that kills cash flow.

Loan-to-value (LTV) optimization – Avoid excessive leverage that kills cash flow.

![]() Revolving credit lines – Maintain liquidity without long-term liabilities.

Revolving credit lines – Maintain liquidity without long-term liabilities.

Example: A REIT strategically refinanced before interest rates spiked—locking in low rates and increasing investor returns.

Maximizing Cash Flow Through Smarter Real Estate Asset Management

If your property isn’t cash-flowing, you’re not investing—you’re speculating.

How do the best asset managers extract every ounce of profit?

![]() Increase revenue streams – Parking fees, premium tenant services, and coworking spaces.

Increase revenue streams – Parking fees, premium tenant services, and coworking spaces.

![]() Reduce operational expenses – Automate processes, negotiate vendor contracts, and cut waste.

Reduce operational expenses – Automate processes, negotiate vendor contracts, and cut waste.

![]() Optimize lease structures – Include rent escalations, pass-through expenses, and longer lease terms.

Optimize lease structures – Include rent escalations, pass-through expenses, and longer lease terms.

Case Study: A multifamily operator implemented utility bill-backs, premium parking, and AI-driven leasing strategies—increasing net income by 22% without significant renovations.

The Bottom Line: ROI Isn’t Luck—It’s Strategy

![]() If you aren’t tracking the right financial metrics, you’re flying blind.

If you aren’t tracking the right financial metrics, you’re flying blind.

![]() If your debt structure isn’t optimized, you’re losing Money.

If your debt structure isn’t optimized, you’re losing Money.

![]() If your asset isn’t cash-flowing at its highest potential, you leave ROI on the table.

If your asset isn’t cash-flowing at its highest potential, you leave ROI on the table.

Capital strategy is the hidden engine of ROI. ULI’s global capital markets research offers blueprints for refinancing, debt optimization, and financial structuring that elevate long-term returns.

Explore the financing guide (ULI login may be required):

The best real estate investors don’t just own property. They make every dollar work harder.

In the next section, we’ll explore how to optimize lease agreements and property sales for maximum Profitability so that every transaction adds long-term Value.

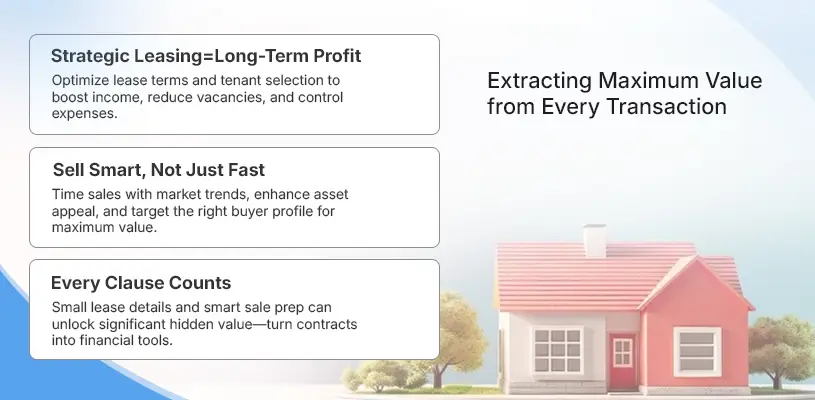

Lease & Sale Optimization: Extracting Maximum Value from Every Transaction

Why Every Dollar in a Lease Agreement Matters

A lease isn’t just paperwork. It’s a contract that dictates your asset’s Profitability.

A well-structured lease means:

![]() Higher long-term rental income – No underpriced units or stagnant lease terms.

Higher long-term rental income – No underpriced units or stagnant lease terms.

![]() Fewer vacancies – Secure, long-term tenants mean stability.

Fewer vacancies – Secure, long-term tenants mean stability.

![]() More control over expenses – Smart lease clauses ensure costs aren’t eating your profits.

More control over expenses – Smart lease clauses ensure costs aren’t eating your profits.

A bad lease? It locks in low rents, drains cash flow, and forces you into expensive turnovers.

To succeed in real estate asset management, one must think long-term and strategically position their assets in alignment with market trends.

In real estate, small percentage changes in lease terms = massive financial impact over Time to Optimize Lease Agreements for Maximum Profitability

Every lease has leverage points. The best asset managers use them.

1. Target High-Value Tenants for Long-Term Stability

Not all tenants are created equal. The goal? Secure tenants who bring financial and operational stability.

![]() Corporate tenants – Stable, long-term leases with credit-backed guarantees.

Corporate tenants – Stable, long-term leases with credit-backed guarantees.

![]() Premium residential tenants – Higher retention and lower maintenance costs.

Premium residential tenants – Higher retention and lower maintenance costs.

![]() Mixed-use flexibility – Adaptive leasing for changing market demands.

Mixed-use flexibility – Adaptive leasing for changing market demands.

Example: A Dubai office tower shifted its tenant mix to include tech startups and flexible coworking brands, boosting Occupancy from 68% to 95% in 12 months.

2. Structuring Lease Agreements for Profit Maximization

A lease should work for you, not just for the tenant.

![]() Rent escalation clauses – Built-in annual increases tied to inflation.

Rent escalation clauses – Built-in annual increases tied to inflation.

![]() Triple-net (N) leases – Shift property taxes, insurance, and maintenance to tenants.

Triple-net (N) leases – Shift property taxes, insurance, and maintenance to tenants.

![]() Longer lease terms with renewal incentives – Reduce vacancy risks.

Longer lease terms with renewal incentives – Reduce vacancy risks.

v Percentage rent clauses (retail assets) – Earn a cut of tenant revenues.

Case Study: A U.S. shopping mall implemented percentage rent clauses, increasing landlord revenue by 22% annually—without raising base rents.

Timing & Executing High-Value Property Sales

Real estate profits are made on the buy but captured on the sale.

When you sell Matt, market conditions shift, and selling at the Time leaves six or seven figures on the table.

![]() Watch for market demand cycles – Sell when liquidity is high and cap rates are low.

Watch for market demand cycles – Sell when liquidity is high and cap rates are low.

![]() Monitor interest rate trends – Low borrowing costs attract more buyers.

Monitor interest rate trends – Low borrowing costs attract more buyers.

![]() Optimize asset performance before listing – Higher NOI = Higher valuation.

Optimize asset performance before listing – Higher NOI = Higher valuation.

![]() Position the property for the right buyers – Institutions, REITs, and private investors look for different things.

Position the property for the right buyers – Institutions, REITs, and private investors look for different things.

Example: A New York investor sold an office tower at peak market demand, securing a 28% premium over its appraised Value.

Value-Enhancing Sale Preparation Strategies

Want top dollar? Don’t just list the property—position it.

![]() Make strategic upgrades – Lobby renovations, common area improvements, updated amenities.

Make strategic upgrades – Lobby renovations, common area improvements, updated amenities.

![]() Stabilize Occupancy – Properties with long-term tenants attract institutional buyers.

Stabilize Occupancy – Properties with long-term tenants attract institutional buyers.

![]() Use high-quality marketing – Professional photography, virtual tours, and drone videos drive demand.

Use high-quality marketing – Professional photography, virtual tours, and drone videos drive demand.

![]() Offer attractive financing terms – Seller financing or assumable loans can expand the buyer pool.

Offer attractive financing terms – Seller financing or assumable loans can expand the buyer pool.

Case Study: A Paris hotel underwent a minor rebranding and interior refresh, increasing its sale price by 15% within a year.

The Bottom Line: Leases & Sales Define an Asset’s True Value

![]() An outstanding lease isn’t just an agreement—it’s a financial strategy.

An outstanding lease isn’t just an agreement—it’s a financial strategy.

![]() A well-timed sale can differentiate between good profits and extraordinary returns.

A well-timed sale can differentiate between good profits and extraordinary returns.

![]() If you aren’t optimizing every transaction, you’re leaving Money behind.

If you aren’t optimizing every transaction, you’re leaving Money behind.

Every clause matters. ULI’s portfolio management research shows how optimized leases and timed exits unlock value and attract better buyers.

See how top asset managers structure for profit:

The following section will explore mitigating risks and future-proofing your real estate portfolio. Long—term success isn’t just about returns—it’s about stability.

Managing Risks for Long-Term Stability & Growth

Risk Isn’t the Enemy—Being Unprepared Is

Real estate isn’t risky. Ignoring risk is.

Markets shift, regulations change, and economic downturns occur. The investors who survive and thrive don’t avoid risk; they manage it.

They don’t guess. They anticipate.

The 3 Biggest Risks in Real Estate (And How to Control Them)

Not all risks are equal. Some are predictable and manageable—others can wipe out an entire portfolio.

Here’s where the most prominent threats lurk:

1. Market Volatility: The Hidden Time Bomb

The market is cyclical. What’s booming today could be struggling tomorrow.

How to hedge against market swings:

![]() Diversify across asset classes – Industrial, multifamily, mixed-use.

Diversify across asset classes – Industrial, multifamily, mixed-use.

![]() Expand across multiple locations – One city’s downturn won’t sink your entire portfolio.

Expand across multiple locations – One city’s downturn won’t sink your entire portfolio.

![]() Keep liquidity reserves – Cash-on-hand buys TimTimeen markets shift.

Keep liquidity reserves – Cash-on-hand buys TimTimeen markets shift.

Example: During the 2008 crash, investors who held only luxury condos suffered massive losses. Those with diverse assets—including stable rental properties and industrial holdings—stayed profitable.

2. Tenant & Occupancy Risk: The Silent Profit Killer

A vacant property isn’t just a lost rent check. It’s a cash drain.

Smart asset managers don’t just fill spaces—they secure the right tenants.

![]() Long-term leases with creditworthy tenants – Stability matters more than short-term gains.

Long-term leases with creditworthy tenants – Stability matters more than short-term gains.

![]() Flexible leasing strategies – Adapting to changing demand (coworking, pop-up retail, mixed-use).

Flexible leasing strategies – Adapting to changing demand (coworking, pop-up retail, mixed-use).

![]() Tenant experience investments – Better amenities = higher retention = fewer vacancies.

Tenant experience investments – Better amenities = higher retention = fewer vacancies.

Case Study: A struggling retail center in Dubai introduced experiential retail, fitness centers, and pop-ups—increasing foot traffic and securing longer tenant commitments.

3. Financial Risk: The Cost of Bad Debt Decisions

Debt is a lever or a liability. Used wisely, it multiplies profits. Used poorly, it destroys them.

How to avoid financial traps:

![]() Optimize loan structures – Avoid overleveraging with unsustainable debt.

Optimize loan structures – Avoid overleveraging with unsustainable debt.

![]() Stress-test cash flow – Ask: “What happens if rent drops by 10%? If interest rates jump?”

Stress-test cash flow – Ask: “What happens if rent drops by 10%? If interest rates jump?”

![]() Refinance before markets shift – Lock in low rates while they’re available.

Refinance before markets shift – Lock in low rates while they’re available.

Example: A hotel group refinanced at 3.8% before rate hikes, saving millions in annual debt costs.

The Bottom Line: Risk Management = Portfolio Longevity

![]() If you don’t have a plan for market downturns, you don’t have a plan at all.

If you don’t have a plan for market downturns, you don’t have a plan at all.

![]() If you aren’t thinking 5-10 years ahead, you’re already behind.

If you aren’t thinking 5-10 years ahead, you’re already behind.

![]() If you ignore tenant retention, you’re gambling with Occupancy.

If you ignore tenant retention, you’re gambling with Occupancy.

Great investors don’t fear risk. They control it.

In the next section, we’ll explore how technology and AI are revolutionizing real estate asset management—and why ignoring it is no longer an option.

Leveraging Technology & AI for Smarter real estate asset management

Technology Won’t Replace Asset Managers—But It Will Replace Those Who Don’t Use It

Real estate has always been about location. But today, it’s also about information.

![]() Whoever has the best data makes the best decisions.

Whoever has the best data makes the best decisions.

![]() Whoever adapts faster gains the competitive edge.

Whoever adapts faster gains the competitive edge.

![]() And whoever ignores technology? They get left behind.

And whoever ignores technology? They get left behind.

Tech isn’t a luxury anymore. It’s a necessity.

How Technology is Transforming Real Estate Asset Management

The best asset managers aren’t just collecting rent—they’re collecting insights.

Here’s how tech is reshaping the game:

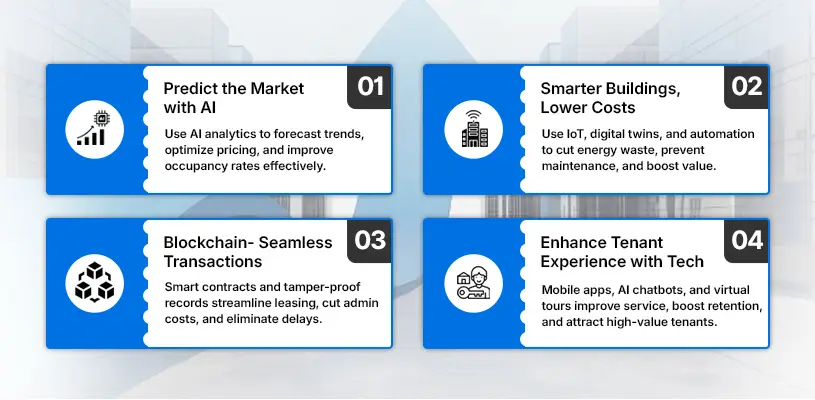

1. AI-Powered Predictive Analytics: See the Future Before It Happens

![]() AI spots trends before the market does.

AI spots trends before the market does.

![]() It analyzes historical data to forecast tenant demand, rental pricing, and property values.

It analyzes historical data to forecast tenant demand, rental pricing, and property values.

![]() It prevents surprises—because surprises cost Money.

It prevents surprises—because surprises cost Money.

Example: A commercial landlord in London used AI to analyze tenant behavior, optimizing lease renewals and increasing Occupancy from 78% to 94% in a year.

2. Smart Building Technology: Reducing Costs, Increasing Value

The best asset managers aren’t just increasing revenue but cutting waste.

![]() IoT-enabled buildings – Sensors track energy use, cutting utility costs.

IoT-enabled buildings – Sensors track energy use, cutting utility costs.

![]() Automated maintenance systems – AI detects issues before they become expensive problems.

Automated maintenance systems – AI detects issues before they become expensive problems.

![]() Digital twin technology – Virtual property models predict performance before making costly upgrades.

Digital twin technology – Virtual property models predict performance before making costly upgrades.

Case Study: A New York office tower installed IoT energy management systems, reducing annual expenses by 30%.

3. Blockchain & Smart Contracts: The Future of Leasing & Transactions

![]() No more lost paperwork. No more fraud. No more delays.

No more lost paperwork. No more fraud. No more delays.

![]() Blockchain creates tamper-proof records of leases, transactions, and ownership.

Blockchain creates tamper-proof records of leases, transactions, and ownership.

![]() Smart contracts automate payments, renewals, and legal compliance.

Smart contracts automate payments, renewals, and legal compliance.

Example: A Dubai-based real estate firm moved all leasing to Blockchain, cutting transaction times by 40% and reducing administrative costs by 25%.

4. AI & Tenant Experience: Because Retention = Profitability

![]() AI-powered chatbots – Handle tenant inquiries instantly.

AI-powered chatbots – Handle tenant inquiries instantly.

![]() Virtual leasing & AR/VR tours – Attract high-value tenants faster.

Virtual leasing & AR/VR tours – Attract high-value tenants faster.

![]() Mobile tenant portals – Rent payments, maintenance requests, and communication—all in one place.

Mobile tenant portals – Rent payments, maintenance requests, and communication—all in one place.

Case Study: A multifamily operator launched a tenant engagement app, boosting lease renewal rates by 18% and cutting service delays by 35%.

The Bottom Line: Adapt or Get Left Behind

![]() If you’re not using data to make decisions, you’re guessing.

If you’re not using data to make decisions, you’re guessing.

![]() If your building isn’t brilliant, you’re overpaying for inefficiencies.

If your building isn’t brilliant, you’re overpaying for inefficiencies.

![]() If your leasing process isn’t digital, you’re losing tenants to someone who is.

If your leasing process isn’t digital, you’re losing tenants to someone who is.

Technology won’t replace asset managers. But the ones who use it will replace those who don’t.

Next: Exceptional real estate asset management strategies that have turned struggling properties into top-performing investments.

Real-Life Case Studies: Lessons from Exceptional Asset Managers

The theory is excellent. But execution? That’s where real Value is created.

These aren’t just success stories. They prove that strategic real estate asset management turns struggling properties into cash-flowing powerhouses.

Because in real estate, profits don’t happen by accident—they happen by design.

Case Study #1: Turning a Struggling Office Tower into a High-Value Asset

🔹 The Problem:

A 1980s-era office tower in New York City faced declining Occupancy, outdated infrastructure, and rising maintenance costs. Tenants were leaving for newer, tech-enabled workspaces.

🔹 The Strategy:

![]() Upgraded common areas and lobby to modern corporate standards.

Upgraded common areas and lobby to modern corporate standards.

![]() Implemented AI-driven energy management, reducing operational costs.

Implemented AI-driven energy management, reducing operational costs.

![]() Converted vacant spaces into flexible coworking hubs, targeting startups and remote workers.

Converted vacant spaces into flexible coworking hubs, targeting startups and remote workers.

🔹 The Results:

Occupancy jumped from 72% to 98% in two years.

Energy savings of 25% lowered expenses.

Leasing revenue increased by 35%, attracting long-term corporate tenants.

Lesson: Repositioning an asset for modern demand is often more profitable than rebuilding from scratch.

Case Study #2: How a Failing Retail Plaza Became a Lifestyle Destination

🔹 The Problem:

A once-thriving shopping center in Dubai suffered from low foot traffic and high tenant turnover. Large anchor stores were leaving, and rental income was plummeting.

🔹 The Strategy:

![]() Rebranded the plaza as a premium lifestyle and entertainment hub.

Rebranded the plaza as a premium lifestyle and entertainment hub.

![]() Introduced experiential retail—pop-up stores, fitness centers, and dining experiences.

Introduced experiential retail—pop-up stores, fitness centers, and dining experiences.

![]() Launched a digital marketing campaign, driving high-income shoppers to the location.

Launched a digital marketing campaign, driving high-income shoppers to the location.

🔹 The Results:

Occupancy increased from 60% to 95% within 18 months.

Rental revenue grew by 28%.

The asset valuation surged by 30%, allowing the owner to refinance at better terms.

Lesson: Retail isn’t dying—boring retail is. People still spend Money where experiences are created.

Case Study #3: Revitalizing an Aging Hotel for Maximum ROI

🔹 The Problem:

A family-owned hotel in Paris was struggling with declining bookings and outdated branding. Competing boutique hotels were taking market share.

🔹 The Strategy:

![]() Rebranded the hotel into a high-end boutique experience for luxury travelers.

Rebranded the hotel into a high-end boutique experience for luxury travelers.

![]() Refurbished rooms and added innovative technology, enhancing guest experience.

Refurbished rooms and added innovative technology, enhancing guest experience.

![]() Strengthened direct booking strategies, reducing dependence on costly OTAs (Online Travel Agencies).

Strengthened direct booking strategies, reducing dependence on costly OTAs (Online Travel Agencies).

🔹 The Results:

Room rates increased by 20%.

Direct bookings grew by 40%, cutting commission costs.

The hotel’s valuation increased by 32%, allowing a profitable equity refinancing.

Lesson: Hospitality assets thrive when guest experience, branding, and Profitability align.

Case Study #4: Capitalizing on the E-Commerce Boom with Strategic Warehouse Investments

🔹 The Problem:

A logistics investor owned underutilized warehouses in a secondary market. Vacancy rates were rising, and rental income was stagnant.

🔹 The Strategy:

![]() Converted traditional warehouses into e-commerce fulfillment centers.

Converted traditional warehouses into e-commerce fulfillment centers.

![]() Partnered with last-mile delivery firms, increasing demand for industrial space.

Partnered with last-mile delivery firms, increasing demand for industrial space.

![]() Implemented automation and AI-driven inventory tracking, improving logistics efficiency.

Implemented automation and AI-driven inventory tracking, improving logistics efficiency.

🔹 The Results:

By focusing on real estate asset management best practices, investors can unlock the full potential of their properties, driving sustainable growth.

Rental rates increased by 22%.

Average lease terms extended from 3 to 7 years, securing long-term cash flow.

The asset’s NOI (Net Operating Income) grew by 30%, boosting overall portfolio value.

Lesson: The best asset managers don’t just respond to trends—they get ahead of them.

The Bottom Line: Every Asset Has Untapped Potential

![]() An underperforming asset isn’t a failure—it’s an opportunity waiting for the right strategy.

An underperforming asset isn’t a failure—it’s an opportunity waiting for the right strategy.

![]() The best investors don’t wait for the market to improve. They make the market work for them.

The best investors don’t wait for the market to improve. They make the market work for them.

![]() Small, strategic shifts can turn a struggling property into a high-performing one.

Small, strategic shifts can turn a struggling property into a high-performing one.

In the next section, we’ll distill this guide’s most critical takeaways—so you can apply them immediately.

Critical Takeaways: What Every Real Estate Investor Must Remember

Significant Returns Aren’t Accidents—They’re Engineered

Some investors get lucky. The best ones? They don’t need luck.

They don’t sit back and hope the market lifts their properties. They actively manage, optimize, and position assets for long-term Growth.

Let’s lock in the most significant lessons from this guide.

1. Real Estate Asset Management: The Difference Between Owning Property and Building Wealth

![]() Buying real estate isn’t enough. Managing it strategically is what creates real wealth.

Buying real estate isn’t enough. Managing it strategically is what creates real wealth.

![]() Every property should have a clear, evolving plan—because markets don’t stay the same.

Every property should have a clear, evolving plan—because markets don’t stay the same.

![]() A passive approach to real estate is just waiting for disappointment.

A passive approach to real estate is just waiting for disappointment.

Key Insight: The investors who win long-term are the ones who treat every asset like a business, not just an address.

2. Market Positioning Determines Whether Your Property Thrives or Struggles

![]() Your property isn’t just a building—it’s a brand.

Your property isn’t just a building—it’s a brand.

![]() The proper branding attracts premium tenants, higher rents, and stronger demand.

The proper branding attracts premium tenants, higher rents, and stronger demand.

![]() The wrong positioning leads to vacancies, discount pricing, and low market appeal.

The wrong positioning leads to vacancies, discount pricing, and low market appeal.

Case Study: A struggling retail plaza in Dubai was repositioned as a high-end lifestyle hub, driving a 30% increase in valuation within 18 months.

3. Operational Efficiency is the Fastest Way to Boost Profitability

![]() Expenses add up faster than most investors realize.

Expenses add up faster than most investors realize.

![]() AI-driven management, innovative leasing strategies, and predictive maintenance save millions.

AI-driven management, innovative leasing strategies, and predictive maintenance save millions.

![]() A well-run property isn’t just more profitable—it’s more valuable to buyers.

A well-run property isn’t just more profitable—it’s more valuable to buyers.

Case Study: A New York office tower cut energy costs by 25% with smart building tech, increasing NOI and attracting higher-quality tenants.

4. The Right Upgrades Pay for Themselves

![]() Not all renovations are worth the Money.

Not all renovations are worth the Money.

![]() High-impact upgrades (lobbies, energy efficiency, security tech) drive higher rental rates.

High-impact upgrades (lobbies, energy efficiency, security tech) drive higher rental rates.

![]() Tenant preferences are shifting—properties that don’t evolve will lose Value.

Tenant preferences are shifting—properties that don’t evolve will lose Value.

Example: A logistics investor repurposed outdated warehouses into e-commerce fulfillment centers, increasing rental rates by 22%.

5. Portfolio Diversification Protects Against Market Swings

![]() No market stays hot forever—spread risk across asset classes and locations.

No market stays hot forever—spread risk across asset classes and locations.

![]() Industrial, multifamily, and mixed-use developments provide different cash flow dynamics.

Industrial, multifamily, and mixed-use developments provide different cash flow dynamics.

![]() Real estate cycles are predictable—investors who diversify don’t just survive downturns; they capitalize on them.

Real estate cycles are predictable—investors who diversify don’t just survive downturns; they capitalize on them.

Investors must master real estate asset management strategies to ensure they are not just passive owners but active participants in their investments’ success.

Case Study: A real estate fund diversified into suburban rentals, logistics, and senior housing—boosting returns by 25% while competitors struggled.

6. Smart Financial Strategies Separate Survivors from Market Casualties

![]() Cash flow is key, but financial optimization is the key to sustainable Growth.

Cash flow is key, but financial optimization is the key to sustainable Growth.

![]() Leverage debt strategically, monitor key financial ratios, and refinance before market shifts.

Leverage debt strategically, monitor key financial ratios, and refinance before market shifts.

![]() Stress-test every asset: What happens if rents drop? If interest rates rise? If demand shifts?

Stress-test every asset: What happens if rents drop? If interest rates rise? If demand shifts?

Example: A hotel chain refinanced its debt before interest rate hikes, saving $750,000 annually in financing costs.

7. Lease & Sales Optimization Unlocks Hidden Value

![]() A well-structured lease generates higher revenue with less turnover.

A well-structured lease generates higher revenue with less turnover.

![]() Smart lease agreements include rent escalations, long-term commitments, and tenant-friendly flexibility.

Smart lease agreements include rent escalations, long-term commitments, and tenant-friendly flexibility.

![]() Knowing when to sell is as important as knowing what to buy.

Knowing when to sell is as important as knowing what to buy.

Case Study: A commercial landlord boosted NOI by 18% by restructuring leases, including rent escalations.

8. Risk Management Isn’t Optional—It’s Survival

![]() Ignoring risk is the fastest way to lose Money in real estate.

Ignoring risk is the fastest way to lose Money in real estate.

![]() Protect against market downturns with diversification and stress testing.

Protect against market downturns with diversification and stress testing.

![]() Financial reserves and strong lease structures create stability in volatile markets.

Financial reserves and strong lease structures create stability in volatile markets.

Example: A $500M real estate fund shifted capital into logistics properties before a market downturn, outperforming competitors by 12%.

9. Technology & AI Will Define the Future of Real Estate Asset Management

![]() AI-powered analytics predict market trends before they happen.

AI-powered analytics predict market trends before they happen.

![]() Blockchain leasing and digital transactions improve efficiency and security.

Blockchain leasing and digital transactions improve efficiency and security.

![]() Smart buildings reduce costs and increase NOI.

Smart buildings reduce costs and increase NOI.

Case Study: A REIT increased its portfolio valuation by 25% by adopting AI-driven real estate asset management tools.

The Bottom Line: Winning in Real Estate is About Strategy, Not Luck

![]() Great investors don’t wait for the market to improve—they improve their assets.

Great investors don’t wait for the market to improve—they improve their assets.

![]() A passive investor relies on appreciation. A savvy investor creates appreciation.

A passive investor relies on appreciation. A savvy investor creates appreciation.

![]() Everything in real estate is an opportunity—if you know how to optimize it.

Everything in real estate is an opportunity—if you know how to optimize it.

In the next section, we’ll summarize Everything with a final call to action so you can start implementing these strategies today.

How to Start Maximizing Your Real Estate Assets Today

Real Estate Wealth Isn’t Built by Chance—It’s Engineered

![]() Some investors sit and wait for appreciation. Others create it.

Some investors sit and wait for appreciation. Others create it.

![]() Some react to market shifts. Others position themselves ahead of them.

Some react to market shifts. Others position themselves ahead of them.

![]() Some guess. The best ones execute a plan.

Some guess. The best ones execute a plan.

You now have that plan.

This isn’t just a list of ideas. It’s a roadmap, a set of levers to increase asset value, cash flow, and long-term ROI.

The question is—what will you do with it?

The Blueprint for Real Estate Asset Optimization

Every winning asset manager follows the same principles:

![]() They position their properties for maximum demand.

They position their properties for maximum demand.

![]() They optimize operations to cut costs and boost profits.

They optimize operations to cut costs and boost profits.

![]() They invest in upgrades that increase Value, not just aesthetics.

They invest in upgrades that increase Value, not just aesthetics.

![]() They diversify smartly, balancing risk with opportunity.

They diversify smartly, balancing risk with opportunity.

![]() They leverage financial intelligence to maximize returns.

They leverage financial intelligence to maximize returns.

![]() They use tech to stay ahead of the competition.

They use tech to stay ahead of the competition.

And most importantly, they take action.

Waiting Costs More Than Action

![]() Every day a property is underperforming, Money is left on the table.

Every day a property is underperforming, Money is left on the table.

![]() Every lease that isn’t optimized is revenue lost.

Every lease that isn’t optimized is revenue lost.

![]() Every outdated strategy allows a competitor to take your market share.

Every outdated strategy allows a competitor to take your market share.

This is your moment if you’re an investor, developer, or asset manager.

Ready to Maximize Your Real Estate Assets? Here’s What to Do Next

Audit Your Portfolio Today

![]() Identify underperforming assets.

Identify underperforming assets.

Real estate asset management is an essential skill set for investors seeking to thrive in a competitive market.

![]() Pinpoint operational inefficiencies.

Pinpoint operational inefficiencies.

![]() Assess which properties need Repositioning, upgrades, or better financial structuring.

Assess which properties need Repositioning, upgrades, or better financial structuring.

Implement High-Impact Strategies

Ultimately, mastering real estate asset management allows for a deeper understanding of market dynamics, enabling informed, strategic decisions.

![]() Optimize leasing agreements for more substantial cash flow.

Optimize leasing agreements for more substantial cash flow.

![]() Invest in technology for more competent real estate asset management.

Invest in technology for more competent real estate asset management.

![]() Diversify and reposition properties for future-proofing.

Diversify and reposition properties for future-proofing.

Take Proactive Steps to Future-Proof Your Investments

![]() Use AI and data analytics to make decisions—not guesswork.

Use AI and data analytics to make decisions—not guesswork.

![]() Build a long-term risk management strategy to protect your portfolio.

Build a long-term risk management strategy to protect your portfolio.

![]() Stay ahead of market trends instead of reacting to them.

Stay ahead of market trends instead of reacting to them.

Let’s Take Your Real Estate Portfolio to the Next Level

![]() Need expert insights? A portfolio audit? A strategy session?

Need expert insights? A portfolio audit? A strategy session?

![]() Want to optimize your assets for maximum ROI?

Want to optimize your assets for maximum ROI?

![]() Looking for the most innovative next move in this market?

Looking for the most innovative next move in this market?

Let’s connect. Get in touch today and start making every asset in your portfolio work harder for you.

In real estate, the best Time optimization is yesterday. The second-best Time is now.

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now for direct value creation.

For a deeper dive into post-development strategies in real estate, prioritize How to Master Post-Development Strategies in Real Estate, the cornerstone resource for post-development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.

Frequently Asked Questions: Real Estate Asset Management, Simplified

Q: What does a real estate asset manager do?

A: They’re not just property overseers—they’re value creators. A real estate asset manager makes sure every property performs at its peak. They analyze financials, streamline operations, and position assets for maximum ROI. Think of them as the CEO of a real estate portfolio. Their job? To turn properties into long-term profit machines.

Q: How does commercial asset management differ from residential real estate?

A: Commercial real estate is about income optimization. It’s about leasing strategies, tenant retention, and squeezing every dollar of profit from the asset. Residential? It’s more about maintenance, tenant experience, and long-term appreciation. If commercial real estate is a business, residential real estate is a long-term investment play.

Q: What skills separate great real estate asset managers from the rest?

A: Numbers. Strategy. Negotiation. A great asset manager can:

![]() Read financials like a book, spotting inefficiencies before they become problems.

Read financials like a book, spotting inefficiencies before they become problems.

![]() Optimize leasing structures to lock in stable, long-term income.

Optimize leasing structures to lock in stable, long-term income.

![]() Stay ahead of market trends, ensuring properties evolve with tenant demand.

Stay ahead of market trends, ensuring properties evolve with tenant demand.

![]() Manage risk, protecting assets from economic downturns and market shifts.

Manage risk, protecting assets from economic downturns and market shifts.

It’s part finance, part operations, part crystal ball.

Q: How do you break into real estate asset management?

A: It’s not just about degrees—about a deep understanding of the real estate business and how Money moves throughout development. A finance, business, or real estate background helps, but the experience is gold. Want to stand out?

![]() Get hands-on property management experience.

Get hands-on property management experience.

![]() Learn financial modeling and market analysis.

Learn financial modeling and market analysis.

![]() Network with investors and asset managers.

Network with investors and asset managers.

![]() Pursue certifications (like CCIM or CPM) to sharpen your edge.

Pursue certifications (like CCIM or CPM) to sharpen your edge.

Real estate rewards action. Start where you are; learn as you go.

Q: What’s the outlook for a real estate asset manager job?

To fully capitalize on the potential of each property, a comprehensive grasp of real estate asset management principles is essential for every investor.

A: Strong. As real estate markets get more complex, investors need experts who know how to maximize Value. Demand for asset managers is rising, especially in commercial, industrial, and mixed-use real estate. If you understand finance, operations, and market strategy, you have a seat at the table.

Q: Why does financial analysis matter in real estate asset management?

A: Because gut feelings don’t drive profits—data does. Financial analysis tells you:

![]() Which assets to hold, upgrade, or sell?

Which assets to hold, upgrade, or sell?

![]() Where Moneyyy is leaking through inefficiencies.

Where Moneyyy is leaking through inefficiencies.

Investors who engage in real estate asset management are better equipped to build and sustain wealth through real estate investments.

![]() How to structure debt and cash flow for maximum ROI.

How to structure debt and cash flow for maximum ROI.

Numbers don’t lie. Good asset managers don’t guess—they calculate.

Q: What’s the typical real estate asset manager’s salary?

A: It varies—big Time: location, experience, and portfolio size matter. A junior asset manager might start at $80K, while a seasoned pro managing a billion-dollar portfolio can earn mid-six figures or more. The bigger the assets, the bigger the paycheck.

Q: How do property managers and asset managers work together?

A: Think of property managers as the boots on the ground and asset managers as the strategists behind the scenes, overseeing the big picture.

![]() Property managers handle maintenance, leasing, and tenant relations.

Property managers handle maintenance, leasing, and tenant relations.

![]() Asset managers focus on financial performance, market positioning, and long-term strategy.

Asset managers focus on financial performance, market positioning, and long-term strategy.

When they work in sync, assets don’t just operate smoothly—they grow in Value.

Q: What’s the fastest way to optimize real estate investments?

A: Three words: Smarter real estate asset management.

![]() Reposition properties to match market demand.

Reposition properties to match market demand.

![]() Lock in high-value leases with long-term escalation clauses.

Lock in high-value leases with long-term escalation clauses.

![]() Reduce inefficiencies with tech-driven operational improvements.

Reduce inefficiencies with tech-driven operational improvements.

![]() Use financial analysis to make better buying, holding, and selling decisions.

Use financial analysis to make better buying, holding, and selling decisions.

The best investors don’t sit back and wait for appreciation. They engineer it.

The Bottom Line: In The Real Estate Market, Your Assets Are Either Growing or Draining Value

![]() Own the strategy, not just the property.

Own the strategy, not just the property.

![]() Optimize what you have before chasing the next deal.

Optimize what you have before chasing the next deal.

![]() Turn passive ownership into active wealth-building.

Turn passive ownership into active wealth-building.

Real estate isn’t just about location—it’s about execution.