You Don’t Just Sell a Project — You Sell a Reputation

And what you do at the exit defines your next opportunity.

Let’s be clear:

Most developers treat the exit like a box to check.

Pros treat it like their most important move.

A great real estate development exit strategy doesn’t just end the project—it begins the next one.

Done right, it:

- Enables faster capital recycling in real estate

- Lowers your future cost of capital

- Attracts stronger LPs and better JV structures

- Turns a spreadsheet into a property investment exit plan that others want to back

Done wrong?

It’s a silent killer of trust, reputation, and deal flow.

Access the most comprehensive real estate development success kit for free, including step-by-step strategies, high-impact templates, and $35,000 worth of expert insights to help you develop smarter, cut costs, and lead with confidence—whether you’re planning your first project or scaling your next big move—the Real Estate Development Guide.

Book Your 1:1 Strategy Session for direct value creation.

Why Your Real Estate Disposition Strategy Shapes Your Future Capital

In this article, you’ll learn:

- Why most real estate development exit strategies are too late to matter

- The four types of exits — and how to pick the one that fits

- How capital gains tax structuring and clean reporting separate amateurs from pros

- Why your exit is your best marketing tool for future deals

- What capital partners look for when evaluating your track record

This isn’t about walking away.

It’s about showing up more substantial every time, with a real estate disposition strategy that closes strong and opens bigger doors.

To gain a comprehensive understanding of post-development strategies in real estate, consult How to Master Post-Development Strategies in Real Estate, our definitive guide to mastering post-development optimization to equip professionals with actionable insights and strategic frameworks.

Plan Your Real Estate Development Exit Strategy at the Beginning — Not the End

The Best Exit Is Baked Into the Feasibility

Here’s the uncomfortable truth:

Most developers don’t have a real estate development exit strategy.

They have hope.

But smart capital doesn’t back vague intentions—it backs a property investment exit plan with precision.

It expects feasibility models that include:

- Sell: Price target, buyer persona, broker roadmap

- Refinance: Stabilization plan, loan structure, DSCR cushion

- Hold: IRR over time, value uplift trajectory, cash-on-cash yield

- Recap: Preferred equity exits, LP buyouts, internal rate resets

Each path must be grounded in market precedent, explicit assumptions, and real data.

Once your capital is deployed?

Your exit options shrink.

Make Exit Scenario Modeling Part of Your Capital Recycling in Real Estate Strategy

Feasibility isn’t done until you ask:

“What if the market doesn’t give us the exit we planned for?”

You need to run scenarios like:

- 15% cap rate compression

- 12-month sale delay

- Refinance at a higher rate and lower LTV

- Alternate buyer profiles if institutional money pulls back

This isn’t fair.

It’s flexibility.

Because of the developer who models three exits…

…chooses the best one under pressure.

RICS Insight: Projects with multi-path exit modeling achieve 28% higher realized IRRs than those with a single exit scenario.

The 4 Exit Types That Shape Every Real Estate Development Exit Strategy

Selling Isn’t Always the Smartest Move

Selling looks clean.

A neat cap rate.

Fast capital back.

Everyone cheers.

But your real estate development exit strategy needs more than optics.

Ask yourself:

Does this deal want a buyer, or a balance sheet?

Let’s break down your core real estate disposition strategy options:

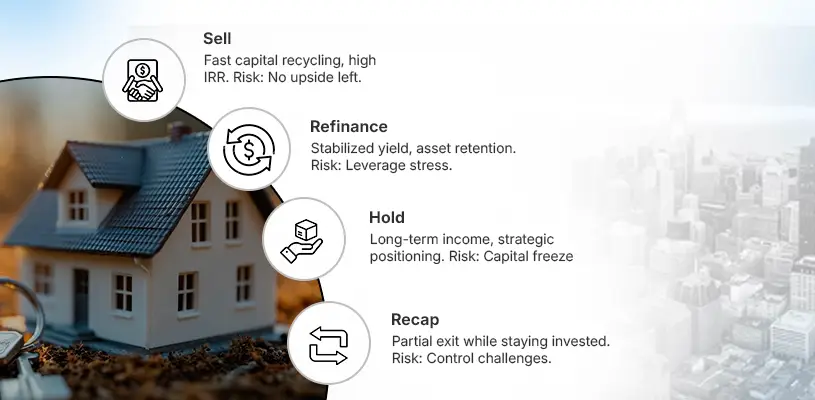

1. Sell The Property

Best for: Fast capital recycling in real estate, high IRR in hot markets

Watch for Transaction friction, shallow buyer pool, compressed pricing

Warning: No upside left — the asset is gone

2. Refinance Your Residential or Commercial Real Estate

Best for: Stabilized yield, asset retention, equity extraction

Watch for DSCR sensitivity, rate volatility, and lender fatigue

Warning: Leverage stress, tighter cash flow

3. Hold on to Your Real Estate Investment

Best for: Long-term income, legacy ownership, strategic positioning

Watch for: Opportunity cost, tax posture, depreciation drift

Warning: Capital freeze and liquidity drag

4. Recap or Partial Exit

Best for: Taking chips off while staying in the game

Watch for LP misalignment, valuation math, and governance risk

Warning: Complex mechanics and long-term control risk

Choose the Right Real Estate Disposition Strategy for the Market You’re In

Every exit must reflect the following:

- Your project’s product-market fit

- Your broader property investment exit plan

- Your capital stack’s targets for return and timing

Poor alignment?

It doesn’t just shrink profit—it burns trust.

📊 ULI Capital Markets Report:

65% of LP dissatisfaction is due not to returns but to unclear exit strategies, missed timing, and poor communication.

Turn Your Real Estate Development Exit Strategy Into Your Best Marketing Tool

A Clean Exit Builds More Than Profit — It Builds Permission

Capital partners don’t just want ROI.

They want clarity.

They want predictability.

They want a real estate development exit strategy that signals:

“This team knows how to finish strong.”

Your exit is your reputation.

When it’s clean, tax-efficient, and structured well?

You’re not just closing a deal but opening the next one.

You’re telling LPs, JV partners, and lenders:

“We’re ready for institutional scale.”

That’s what a property investment exit plan does when documented correctly.

Document the Real Estate Disposition Strategy Like It’s Your Next Raise

If you want follow-on capital, start building your proof now:

- “Deal DNA” files: investor memos, updates, negotiation notes

- Internal debriefs: lessons learned, decisions made, risks averted

- Proof stack: IRR, cap spread, equity multiple, valuation delta

- Tax summary: how much you saved, not just what you earned

That’s how competent developers scale.

That’s how capital recycling in real estate becomes real, not theoretical.

Bain Capital Insight:

Institutional LPs are 3x more likely to reinvest with developers who deliver clean, tax-optimized, well-documented exits.

Conclusion: A Real Estate Development Exit Strategy Is the Start of Your Next Raise

The Market Doesn’t Forget How You Exit

Ideas don’t judge developers.

Exits do.

Your real estate development exit strategy is more than a closing protocol—your calling card for capital.

When real estate investors ask:

“Can they do it again?”

They don’t want glossy brochures.

They want to close files.

They want timelines that are held, not excuses.

Your Investment Property Exit Plan Is Your Reputation in a Folder

Your proof isn’t in the pitch.

It’s in:

- Clean disposition documentation

- Aligned stakeholder payouts

- Exit timing that wasn’t luck

- A tax plan that preserved equity

- A structure that created more than just IRR

This is the real estate disposition strategy that gets funded again.

This is how capital recycling in real estate moves from concept to capital stack.

So, next time someone asks,

“What makes you different?”

Don’t talk.

Show them the file.

Bonus Resource:

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now for direct value creation.

FAQ: Real Estate Development Exit Strategy — The Investor’s Playbook for Getting Out With Profit

Why don’t you win when you build, but when you exit?

Because the work means nothing if the capital doesn’t return.

You don’t get paid for pouring concrete.

You get paid for executing your real estate development exit strategy with discipline.

That’s the line between speculation and success.

What is a real estate disposition strategy, exactly?

It’s how you transform a building into balance sheet gains.

A smart real estate disposition strategy maps how and when you exit—before you build.

It drives:

- Timing

- Tax

- Risk

- Liquidity

If you don’t think you’ll exit from Day One, your property investment exit plan is just a guess.

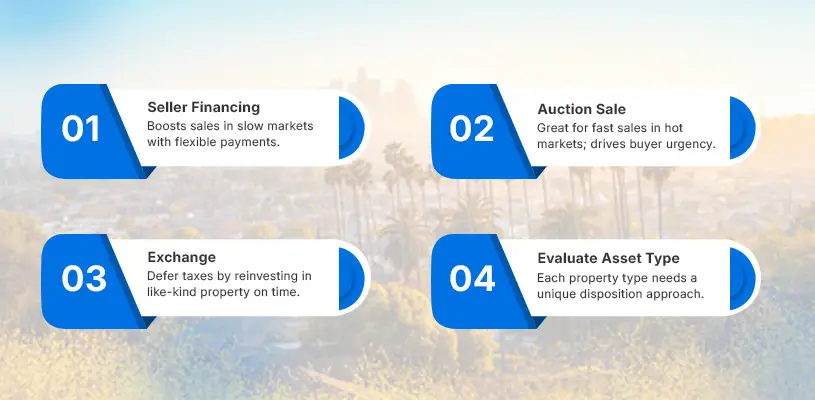

What are the most common real estate exit strategies in real estate investing?

- Sell and walk

- 1031 exchange

- Refinance and hold

- Seller financing

- Recap with a new LP

- Installment sales

- Portfolio packaging

Each one reflects a different capital recycling in the real estate approach.

You’re not just selling.

You’re creating velocity.

Why is a 1031 exchange so robust for real estate exits?

Because it’s a tax shelter in motion.

Used right, it lets you:

- Sell

- Reinvest

- Defer capital gains

Used wrong? It’s a liability.

Every real estate development exit strategy should consider 1031 as a tax deferral tool, not a default.

Why is skipping exit planning risky?

Because profit without a path is just paper.

Missed exits result in:

- Tax surprises

- Investor disappointment

- Stuck equity

- Liquidity failure

An actual property investment exit plan protects returns, regardless of the market.

When’s the right time to execute your real estate exit?

When the market says yes… and your numbers do too.

Ignore noise. Watch:

- IRR curve

- Buyer demand

- Debt windows

- Partner timing

And make sure your real estate disposition strategy aligns with your investment goals, not someone else’s clock.

What’s the role of due diligence in the exit process?

It’s everything.

Insufficient data = bad decisions.

You need a clean valuation, legal review, and buyer readiness.

Every innovative capital recycling in real estate strategy starts with due diligence that anticipates questions before they’re asked.

How does seller financing reshape real estate exits?

It lets you become the bank.

You keep control, stretch income, and defer taxes.

In tight credit markets?

Seller financing is a real estate disposition strategy that expands your buyer pool—and your margin.

What defines the right exit strategy?

Fit.

The right real estate development exit strategy is one that:

- Matches your risk

- Reflects your horizon

- Optimizes tax

- Open your next raise

No two deals should have the same exit.

Customize relentlessly.

How do real estate investors maximize the price when selling a property?

It’s not magic—it’s preparation.

To sell at top dollar:

- Make it turnkey

- Build a buyer-ready narrative

- Use elite brokers

- Control comps and urgency

That’s how a property investment exit plan becomes a premium outcome.

How do taxes shape exit decisions?

Every gain raises the same question:

Do I keep this or give it to the IRS?

Use tools like:

- 1031 exchanges

- Opportunity Zones

- Installment sales

- Long-term holds

Tax planning isn’t post-closing work.

It’s embedded in your real estate development exit strategy from the start.

For a deeper dive into post-development strategies in real estate, prioritize How to Master Post-Development Strategies in Real Estate, the cornerstone resource for post-development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.