How Financial Projections in Real Estate Build Confidence

Financial projections aren’t spreadsheets. It is your project’s blueprint before brick meets mortar. Treat it as the project’s narrative told in numbers, revealing your path, your pitfalls, and your profit potential.

Without it, you’re guessing—and guesswork is a fast way to lose credibility with investors, blow through budgets, and miss opportunities. With them? You’re commanding confidence, managing risk, and aligning every decision with real-world impact.

This guide unfolds nine essential steps to build projections that do more than forecast—they persuade, protect, and perform.

We start here because you can’t calculate profit without first understanding the market.

To understand the Real Estate Pre-Development Process comprehensively, consult ‘How to Master Pre-Development Strategies in Real Estate: A Comprehensive Guide,’ our definitive guide to mastering Pre-development optimization, which equips professionals with actionable insights and strategic frameworks.

Access the most comprehensive real estate development success kit for free, including step-by-step strategies, high-impact templates, and $35,000 worth of expert insights to help you develop smarter, cut costs, and lead with confidence—whether you’re planning your first project or scaling your next big move—the Real Estate Development Guide.

Book Your 1:1 Strategy Session for Direct Value Creation.

How to Anchor Financial Projections in Market Analysis

Building financial projections in real estate begins with data—not wishful numbers. Without a foundation rooted in market reality, your projections collapse under scrutiny. This section shows how to ground your model from the first cell.

1. Analyze Demand, Supply & Absorption

- Measure absorption rate: How many units are leased or sold monthly?

- Rising absorption = healthy demand.

- Stagnation = caution.

- Track vacancy and supply: Compare available vs obsolescing inventory.

- Higher vacancy = opportunity or warning?

- Adjust for seasonality: Recognize timing trends: cities with winter slowdowns behave differently than year-round markets.

Utilize CoreLogic Market Trends to gain regional insights into demand and supply dynamics.

2. Benchmark Pricing with Precision

- Pull current and historical rent/sales data from nearby developments.

- Price your projections using both average and edge-case data.

- Map trends using 6–12 months of data to understand market velocity.

Leverage CoStar pricing & velocity reports to confirm current market positioning.

3. Correlate Macroeconomic Indicators

- Analyze regional job growth, unemployment rates, and infrastructure investments.

- Understand local construction pipeline: Are you in a boom or bust phase?

- Watch consumer confidence—buyer mindset can shift fast.

Reference Bureau of Labor Statistics (BLS) regional data for credible employment and economic context.

Final Insight

Anchoring financial projections in real estate with absorption, pricing, and macro data does more than inform—it connects your model to reality. Stakeholders now see a model built on evidence, not hope.

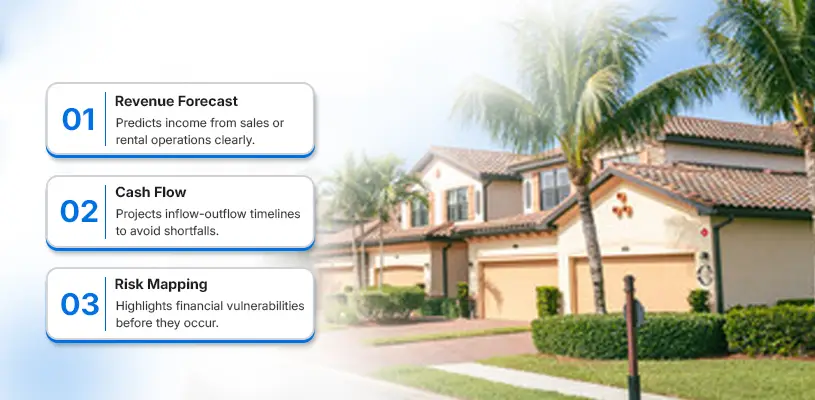

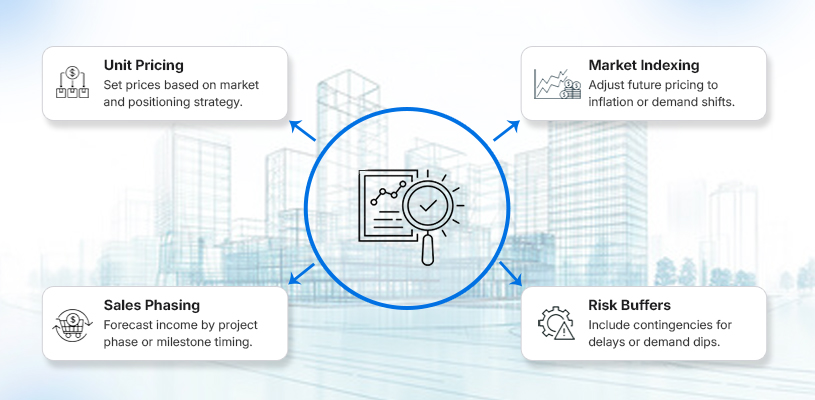

How to Forecast Revenue Streams with Clarity & Precision

Forecasting revenue is where financial projections in real estate transition from analysis to action. This step ensures your numbers reflect real-world expectations—and earn the trust of investors, lenders, and stakeholders.

1. Define Your Core Income Sources

- Sales or lease revenue: Segment by unit type, size, and price point.

- Ancillary income streams: Parking fees, retail leases, service charges, cell tower leases, and event space.

- Build a pipeline: model phased pre-sales or staggered leasing for multi-use developments.

Use National Real Estate Investor (NREI) data on retail and office rent trends to validate potential ancillary revenue.

2. Ground Your Prices in Market Reality

- Pull comparable price data from the nearest active developments.

- Adjust for market shifts: inflation, premium positioning, or changing tenant preferences.

- Apply realistic occupancy assumptions, such as 80–90% for first-year leasing.

Access Zillow Research (or the equivalent in your country) for residential and rental market comparables.

3. Incorporate Seasonality & Lease-Up Velocity

- Estimate timing of income: rental revenue often lags behind construction closeout.

- Model holding period vs. lease-up velocity—most projects take 6–12 months to stabilize.

- Build-in ramp-up: initial leasing at 50–70%, scaling to 95%+ occupancy.

4. Model Escalations and Upside Potential

- Include annual rent escalations (CPI or fixed % increases).

- Identify upgrade opportunities, such as premium units, furnished options, and coworking amenities.

- Model bottom-line impact of adding rooftop amenities, retail kiosks, or additional parking, with realistic adoption rates (e.g., 15–20% uplift).

Refer to Cushman & Wakefield’s rent escalation studies as a benchmark for modeling increases.

Final Insight

Forecasting revenue isn’t guesswork—it’s strategic storytelling. By mapping multiple income threads grounded in comparables, volume, timing, and escalations, your financial projections in real estate become compelling and credible.

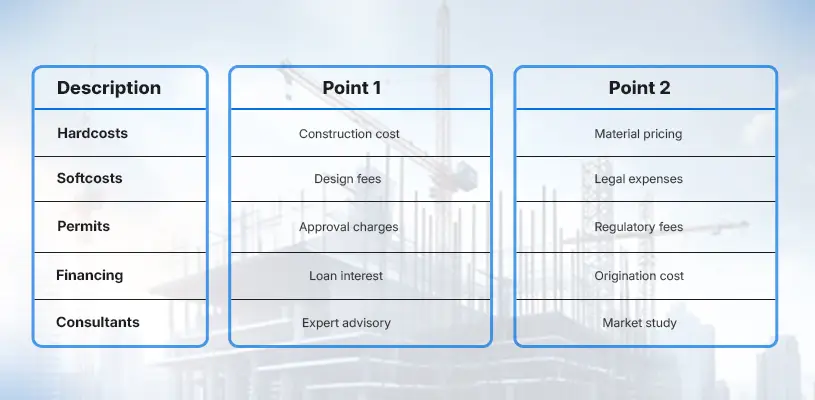

How to Estimate Expenses & Display Budgetsmanship

Estimating expenses with precision is the backbone of your financial projections in real estate. It’s where smart assumptions become fiscal armor. Underestimate costs, and you’re playing with fire. Do it thoughtfully, and your projections stand firm—even under pressure.

1. Break Down Hard Construction Costs

- Materials: Track recent cost trends for steel, concrete, lumber, and other relevant materials.

- Labor: Factor local wage rates and union/non-union variables.

- Contractor Markups: Include site management, safety, and profit margins.

- Verify using regional data.

Source regional cost benchmarks from RSMeans Construction Cost Data for credible reference pricing.

2. Capture Soft Costs, Permits & Professional Fees

- Architectural & engineering fees: Typically 5–8% of construction cost.

- Permits and Legal: Licensing, environmental filings, and zoning fees.

- Consultants: Environmental, traffic, design, and survey specialists.

- Don’t skip marketing, brokerage, taxes, insurance, and financing closing costs.

Refer to the American Council of Engineering Companies (ACEC) fee surveys for typical consultant cost benchmarks.

3. Anticipate Project Management & Holding Costs

- Project management: Salaries, office, software, site supervision.

- Hold costs: Carrying costs until stabilization—interest, property taxes, insurance, utilities.

- Match organizational structure to ensure realistic budgeting.

4. Build in Contingency & Schedule Risk Buffers

- Contingency: 10–20% of hard + soft costs to absorb inflation, scope changes, or shortages.

- Schedule overrun buffer: Add 2–4 months for potential permit or construction delays.

The Project Management Institute (PMI) Cost Risk Review outlines best practices for contingency planning and risk allocation.

Final Insight

Transparent budgeting is a sign of leadership—not caution. By wrestling every line item onto the forecast and building strategic buffers, your financial projections in real estate communicate control, discipline, and foresight.

How to Shape Cash Flow & Maintain Liquidity in Financial Projections in Real Estate

Cash flow is the pulse of your project—how every dollar moves defines success. Smart financial projections in real estate hinge not just on spreadsheets but on the rhythm of money coming in and going out.

1. Define Cash Flow, NOI & Debt Service

- Net Operating Income (NOI): Income after operating expenses—but before financing or taxes.

- Cash Flow Before Tax: NOI minus total debt service—what investors actually see.

- Debt Service Coverage Ratio (DSCR): Lenders require DSCR > 1 to confirm coverage.

- Explore lender requirements and the importance of DSCR via the Federal Reserve or Fannie Mae guidelines.

2. Model Timelines of Inflows and Outflows

- Align construction draws with cash reserves—draw schedules rarely match spending timelines.

- Build lease-up months into your model (typically 6–12 months), not just shrink-wrapped completion.

- Incorporate liquidity buffer zones—like preserving cash to cover 90 days of debt and expenses.

For financing and scheduling guidance, consult the Urban Land Institute’s Real Estate Cash Flow Management.

3. Run Cash Flow Stress Tests

- Analyze worst-case scenarios (e.g., –10 % rent, +15 % cost overruns).

- Highlight critical periods where cash coverage fails—identify warning signs early.

- Use waterfall schedules to simulate cash waterfalls or shortages precisely.

4. Optimize Liquidity Through Structure

- Consider DSCR-focused loans, which offer flexible payment structures tied to income performance.

- Check Fannie Mae Multifamily DSCR loan resources for terms.

- Layer complementary income streams (parking, NFT spaces, coworking amenities).

- Keep 10–20 % contingency lines as cash cushions for unexpected shifts.

For insights on financing single-family homes or small rental portfolios, refer to the analysis from BiggerPockets.

Final Insight

Cash flow isn’t just a line in a projection. It’s the story of your project’s financial health—writ large. With financial projections in real estate rooted in timing, buffers, and stress scenarios, you show everyone (investors, lenders, regulators) that you’re not guessing—you’re prepared.

How Profitability Metrics Build Stakeholder Trust in Financial Projections in Real Estate

When you share financial projections in real estate, stakeholders don’t care about opinions—they care about proof. Clear profitability metrics provide that proof. They show your project’s viability, not just your vision.

1. Focus on Three Core Metrics

- Net Operating Income (NOI): Critical for property valuation before debt.

- Internal Rate of Return (IRR): Measuring long-term annual growth.

- Net Present Value (NPV): When discounted future cash flows exceed cost, you win.

- Compare how CRE professionals utilize these resources through the CCIM Institute.

2. Benchmark with Industry Standards

- IRR thresholds vary by risk profile, ranging from 12–15% for stabilized assets to 18–25% for ground-up development.

- NOI growth rates of 3–5% annually signal stability.

- NPV should be positive, ideally exceeding the initial equity investment.

Review national return data from PwC Real Estate CPPI to solidify benchmarks.

3. Frame Metrics with Context

- Explain how NOI funds debt, dividends, and reinvestment.

- Illustrate how IRR compounds value over the investment period.

- Demonstrate why NPV bridges time and return, ensuring you’re not paying for future gains today.

4. Package Metrics into Stakeholder Narratives

- Use one-page snapshots with clean visuals to highlight NOI, IRR, cash flow, and break-even points.

- Tailor your presentation:

- Lenders want DSCR and NOI reliability.

- Investors aim to minimize the IRR and downtime.

- Partners seek alignment between risk and reward.

For best practices in investor-ready reporting, refer to the Urban Land Institute guidelines.

Final Insight

Profitability isn’t speculation—it’s proven. When your financial projections in real estate deliver clear, benchmarked, and visually compelling metrics, you don’t ask for trust—you earn it.

How Risk Mitigation & Upside Potential Elevate Financial Projections in Real Estate

In financial projections in real estate, acknowledging risk and showcasing upside distinguishes a plan from a promise. Real estate is full of variables—your projections should reflect that. Show how you manage the downside while capturing value-enhancing opportunities.

1. Identify and Categorize Risks Early

Every development has inherent risks, including cost overruns, delayed occupancy, regulatory shifts, and interest rate spikes.

- Outline categories: market, financial, regulatory, environmental, and execution.

- Highlight the impact of each risk on key metrics, such as NOI, IRR, and cash flow timelines.

The Project Management Institute (PMI) Risk Framework can guide your classification structure with industry-standard rigor.

2. Build Strategic Contingencies & Buffers

- Cost Contingency: Allocate 10–20% to shield against unpredictable expenses.

- Time Buffer: Add 2–4 months to projected completion or lease-up schedules.

- Debt Gate Provisions: Build in DSCR triggers and repayment flexibility.

PMI’s Cost Risk Analysis Guide offers best practices for portfolio resilience.

3. Structure Mitigation Mechanisms

Plan your defense and offense:

- Lock prices and labor rates where possible.

- Use fixed-rate debt rather than floating-rate debt to lock in cost certainty.

- Diversify revenue: e.g., parking, service, retail, event space—spreading income across multiple sources.

Support these strategies with insights from Urban Land Institute financial resilience resources.

4. Highlight Upside Levers with Realistic Potential

- Rent escalation linked to CPI: Conservatively project 2–3% annual growth.

- Vacancy recovery scenarios: Model faster lease-up with targeted marketing or design improvements.

- Value-add opportunities: Extra penthouse units, rooftop amenities, or coworking setups that boost NOI by 5–15%.

Cushman & Wakefield’s value-added performance data supports benchmarking these opportunities.

5. Run Stress-Case vs. Upside Scenarios

- Model three trajectories:

- Base Case (planned execution)

- The downside (–10% rents, +15% costs, 3-month delay)

- Upside (+5% rents, faster absorption, ancillary income gains)

- Compare metrics (IRR, NPV, DSCR) across scenarios to demonstrate resilience and identify opportunities.

Final Insight

Balanced financial projections in real estate don’t just tell what could go wrong—they demonstrate how it’s managed and how value can be unlocked anyway. This dual narrative builds credibility and attracts confidence from investors and lenders alike.

How Tools, Tech & Continuous Monitoring Support Financial Projections in Real Estate

Your financial projections in real estate remain powerful only when they’re accurate and adaptive. Here’s how elite developers utilize technology and oversight to stay sharp.

1. Deploy Industry-Leading Modeling Software

- ARGUS Enterprise: The global standard for commercial cash flow modeling and scenario analysis

- HouseCanary: Provides AI-driven valuation, forecasting, and property‑level insights

- Yardi Forecast IQ: Connects budget forecasting to live performance data—trusted by asset managers

These tools bring precision and speed. Choose based on project size and complexity.

2. Automate Real-Time Data Feeds

Connect forecasting platforms with your rent roll, accounting data, and market analytics.

- Yardi Forecast IQ auto-syncs rental and expense data directly from Voyager

- HouseCanary CanaryAI provides up-to-date valuation trends and forecasts

Automation ensures that your financial projections in real estate evolve in line with actual results.

3. Build a Live Monitoring Dashboard

Track these KPIs in real-time:

| Metric | Tool |

|---|---|

| NOI, Cash Flow, DSCR | ARGUS, Yardi |

| Market Shifts, Price Trends | HouseCanary |

| Timeline Progress, Milestone Tracking | Project management software |

- NOI, Cash Flow, DSCR via ARGUS and Yardi

- Market valuation shifts via HouseCanary’s HPI/RPI insights

- Project milestones via project management tools

Dashboards signal when forecasts drift—and help you steer with confidence.

4. Pair Data with Developer Judgment

Tools illuminate trends—but your insight closes the gaps. Ask yourself:

- Does lease activity match forecasted timelines?

- Are cost estimates still on track?

- Do valuation trends align with your leasing strategy?

Combine technology with a real-world perspective to keep projections grounded and reliable.

Final Insight

Sophisticated financial projections in real estate aren’t static—they evolve. With powerful tools, live data links, and developer-driven interpretation, your forecasts turn into dynamic decision-making engines. Stakeholders trust projections that are both precise and proactive.

Conclusion: Turning Projections Into Performance

Your financial projections in real estate are more than numbers—they’re strategic guides. By anchoring assumptions in market data, modeling cash flow meticulously, stress-testing, and using top-tier tools, you’re not just forecasting—you’re commanding. That’s the edge sophisticated investors expect.

Executive Toolkit

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now to create direct value.

FAQ: Mastering Financial Projections in Real Estate

Q: What makes a financial projection credible for real estate projects?

Credibility depends on 1)detailed assumptions backed by reliable data, 2) realistic cost buffers, 3) multi-scenario analysis, and 4) a transparent linkage between variables such as NOI, cash flow, and DSCR.

Q: How often should projections be updated?

Review monthly or at key milestones, such as leasing launches or major contract renewals. That regular rhythm ensures your financial projections in real estate stay accurate and actionable.

Q: Which KPIs matter most in financial projections?

Focus on NOI, cash flow before tax, Debt Service Coverage Ratio (DSCR), Internal Rate of Return (IRR), and Net Present Value (NPV). These reveal performance, risk, and value.

Q: How much contingency is essential?

Allocate 10–20% to absorb cost overruns, schedule delays, and scope changes. It’s standard for high-stakes developments and signals readiness to stakeholders.

Q: Can spreadsheets replace professional real estate tools?

Spreadsheets work for basic models—but once complexity grows, advanced tools like ARGUS, HouseCanary, and Yardi provide real-time insight and automation necessary for precision.

Q: How do you stress-test financial projections effectively?

Model 5–15% drops in revenue and comparable increases in costs. Evaluate how these shifts impact cash flow, DSCR, and IRR to anticipate stresses before they arrive.

Q: What’s the best way to maintain stakeholder trust through financial tools?

Host dashboards with live data, share monthly updates, explain variances, and proactively manage risks. Transparency builds the trust that opens doors to future capital.

Q: When should lenders be involved in the projection process?

Bring lenders in during early-stage modeling—before DSCR dips occur. Their input ensures financing timelines align with execution schedules.

For a deeper dive into the most effective Real Estate Pre-Development Strategies in real estate, How to Master Pre‑Development Strategies in Real Estate: A Comprehensive Guide, the cornerstone resource for Real Estate Pre-Development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now to create direct value.