Financial Feasibility Studies That Tell the Truth — Not Just a Story

Why Your Spreadsheet Isn’t Enough

Because a pro forma is only as honest as the hands that build it.

Let’s be blunt.

Most feasibility studies for real estate development aren’t real.

They’re hopeful math dressed up in formatting.

Slide decks get polished. Risk gets shaved. The model works… because you need it to.

But here’s the truth seasoned developers, private equity firms, and institutional investors know:

If your financial feasibility study for real estate development doesn’t scare you a little, it’s lying.

An actual feasibility study isn’t built to make a deal look good.

It’s built to show what it takes to survive.

And the gap between “good-looking” and “survivable”?

That’s often the difference between a profitable real estate project… and a painful post-mortem.

This article breaks down:

- Why conventional feasibility frameworks create blind spots

- Five core risks most models ignore

- How to run a feasibility study for real estate development that attracts capital

- How to test your financial model before the market does

If you’re developing without asking the hard questions upfront…

You’re not building. You’re gambling.

Let’s fix that—with feasibility studies for real estate development that tell the truth, not just a story.

To understand the Real Estate Pre-Development Process comprehensively, consult How to Master Pre‑Development Strategies in Real Estate: A Comprehensive Guide, our definitive guide to mastering pre-development optimization, which equips professionals with actionable insights and strategic frameworks.

Access the most comprehensive real estate development success kit for free, including step-by-step strategies, high-impact templates, and $35,000 worth of expert insights to help you develop smarter, cut costs, and lead with confidence—whether you’re planning your first project or scaling your next big move—the Real Estate Development Guide.

Book Your 1:1 Strategy Session for direct value creation.

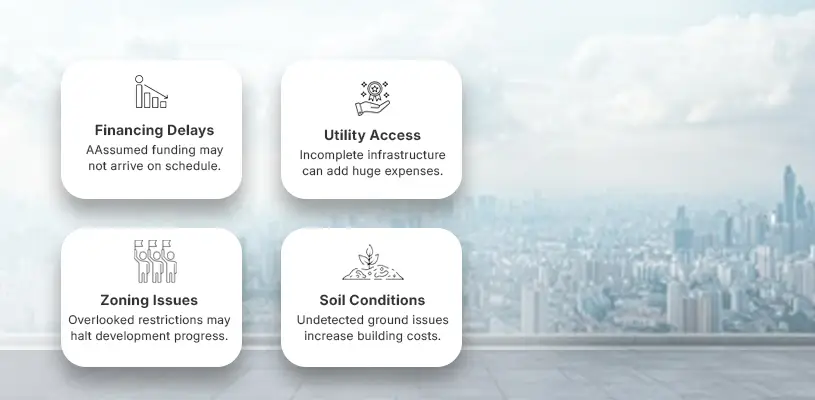

The Hidden Risks Most Feasibility Studies For Real Estate Development Miss

Because spreadsheets rarely prepare you for lawsuits, delays, or interest rate spikes.

The Danger Isn’t in the Costs You See — It’s in the Ones You Didn’t Model

Let’s get real.

Every spreadsheet looks like a winner when:

- Rent growth is linear

- Absorption is instant

- Interest rates stay flat

- Construction costs don’t move

- The exit cap compresses magically

Sound familiar?

That’s not a market analysis. That’s fantasy with formulas.

Most feasibility studies for real estate development fail not because they miss the obvious, but because they dodge the uncomfortable:

- What if rent softens halfway through lease-up?

- What if your real estate project timeline slips six months and rates jump 100 bps on your financial projections?

- What if the contractor overshoots the budget by 12% and blames your spec sheet?

- What if a new city fee hits mid-approval for your proposed development?

Actual feasibility doesn’t just model profit.

It models pressure. And then stress tests that pressure.

Build Feasibility Like a Risk Map, Not a Sales Pitch

If your financial model doesn’t generate tension, it’s useless.

You’re not just testing numbers. You’re testing resilience.

Here’s how experienced developers structure their feasibility studies:

- High/medium/low revenue bands — not best-case only

- Stress test construction costs at 5%, 10%, and 15% increases

- Model interest rate movement across the entire build cycle

- Simulate a 25% slower absorption rate

- Built-in delays from legal, consultants, or planning approvals

This doesn’t kill deals.

It saves capital by killing the wrong ones early.

Real Estate Development Stat:

According to RICS, over 70% of development cost overruns are due to under-modeled risks during the feasibility phase, not mistakes made during execution.

Feasibility isn’t optimism in Excel.

It’s your financial model’s first honest conversation.

From Model to Money: What Real Investors Want to See

Because if your feasibility can’t raise capital, it’s just paperwork.

Your Model Isn’t the Product — Trust Is

A clean IRR.

A believable exit cap.

A tidy capital stack with a sharp 8% pref and 30% promos.

It all looks good—on paper.

But serious investors? They don’t just back pro formas. They back the people who built them.

How you construct your feasibility studies for real estate development tells capital partners how you’ll run the entire project.

Your numbers don’t just have to look right.

They have to survive a stress test and still hold together.

Here’s what capital partners want to see:

- Scenario modeling: “What if NOI drops by 12% — are we still solvent?”

- Realistic funding structure: “Are you over-leveraged or propped up by equity fluff?”

- Capital stack transparency: “Where’s the cash going, when’s it coming back?”

- Exit flexibility: “If the market softens, can we hold, refi, or pivot?”

You’re not just raising capital.

You’re raising confidence.

Speak the Investor’s Language — Not the Architect’s

Feasibility isn’t just internal validation.

It’s your first sales tool.

But here’s where many developers fail:

They speak in square meters, while the investor thinks in IRR, yield, and downside protection.

Fix that disconnect with a financial model that communicates capital fluently:

- Break down costs by type: complex, soft, contingency, equity

- Use conservative benchmarks — and justify every deviation

- Present exit routes by timing, value, and tax exposure

- Include a capital events calendar showing money-in and money-out over the entire project timeline

Real Estate Industry Stat:

Preqin reports that 82% of institutional investors cite “overly optimistic assumptions” as the #1 reason they reject real estate development deals, even those with promising returns.

So before you pitch the upside…

Ensure your financial projections are accurate. Build your feasibility studies for real estate development for the downside.

That’s what unlocks the checkbook.

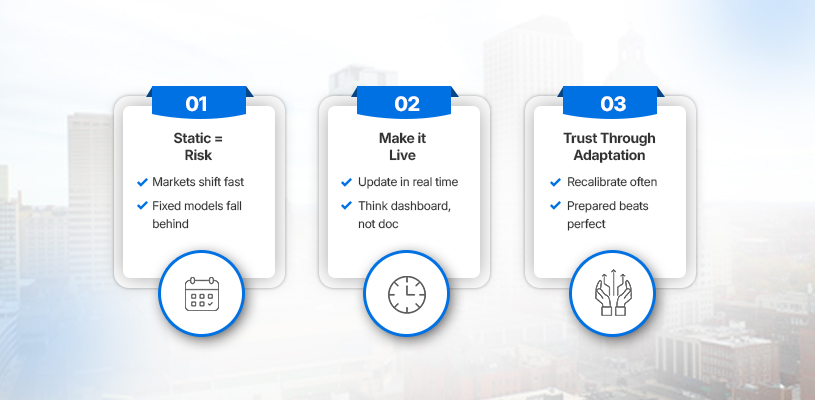

Your Financial Feasibility Is a Living System — Not a One-Time Exercise

Because development shifts fast, static models get blindsided.

If You Only Model Your Real Estate Development Project Once, You’re Already Behind

Here’s a brutal truth in real estate development:

The moment you finalize your feasibility studies for real estate development, it begins to expire.

Why?

Because the market moves.

Construction costs spike.

Interest rates shift.

Project timelines stretch or compress.

And if your model doesn’t evolve with reality, you’re gambling with millions.

A real feasibility strategy isn’t a file you finish.

It’s a dashboard you drive.

That means:

- Weekly or biweekly cost updates from QS and PMs

- Financial model updates based on yield curve changes

- Regular re-forecasts tied to leasing velocity

- Ongoing alignment between spending and forecast drawdowns

This isn’t just protection.

It’s proactive, data-driven decision-making before a single shovel hits dirt.

Treat Your Financial Model Like Mission Control

Picture your development like a spacecraft.

Feasibility studies for real estate development are your flight dashboard.

You wouldn’t fly blind.

So don’t build unquestioningly.

A dynamic model should show:

- Where you’re ahead or behind

- Which construction cost categories are bleeding

- When break-even shifts

- How changes affect debt covenants and investor returns

It’s not about being perfect.

It’s about being awake, fast, and financially fluent — in real time.

Make feasibility a habit — not a document.

Real Estate Expert Data Point:

JLL’s Global Development Risk Report shows that live feasibility recalibration projects reduce cost shocks by 42% and course-correct 30% faster than static models.

Great developers don’t’ wing it.

They lead with clarity, grounded in a living financial model.

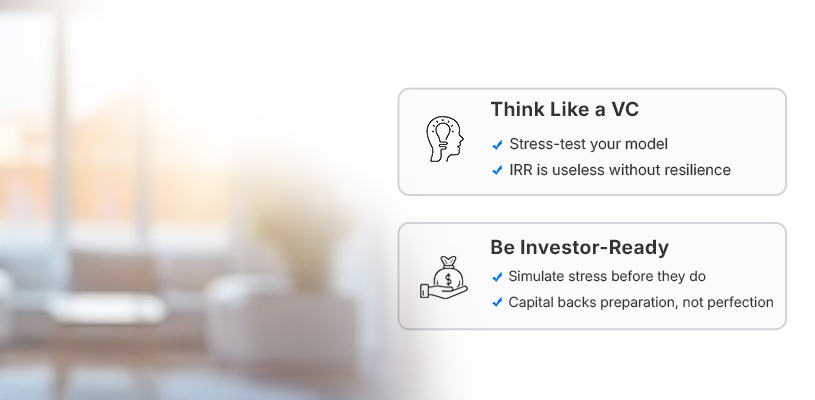

Build It Like a VC: Pressure-Test the Cash Flow Model Before the Market Does

Because raising money isn’t the hard part — keeping it is.

If Your Financial Analysis Can’t Survive Bad News, It Can’t Survive the Market

Let’s be honest:

A slick IRR won’t save you when things go sideways.

The real question every capital partner — mainly institutional or family office money — is asking:

“What happens when this project gets punched in the face?”

If your feasibility studies for real estate development can’t answer that clearly, you don’t have a plan. You have a fantasy.

Here’s how the best developers apply a real stress test:

- What if construction drags 4 months beyond schedule?

- What if rates jump 150 basis points mid-project?

- What if your anchor tenant pulls out post-LOI?

- What if absorption slows, inflating your carry costs?

- What if the exit cap you’re forecasting never materializes?

Pressure testing is how you turn your financial model into a weapon — not a liability.

Because when turbulence hits (and always does), you’ll adjust fast while others freeze.

Borrow the Investor Playbook — Before They Use It on You

You know what your capital partner is going to do?

They’re going to pull your model apart.

Line by line.

Assumption by assumption.

So why not beat them to it?

The top real estate development firms treat internal reviews like investor due diligence:

- Stress-test the model six different ways

- Simulate multiple exits across tax brackets and hold periods

- Anticipate every “what if”

- Back every claim with accurate comps and conservative data

Do that, and you walk into the room with leverage — not just hope.

Real Estate Investor Stat:

The Global Real Estate Investment Index reports that 67% of failed capital raises in development deals result from weak downside planning, not weak returns.

Capital doesn’t chase perfection.

It chases preparedness.

Test it hard.

Fix it fast.

Raise it clean.

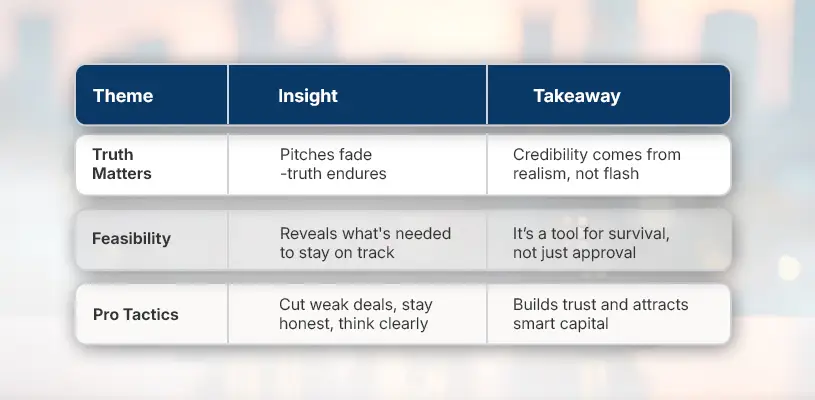

Conclusion: The Feasibility Lens That Separates Pros from Posers

Because this is where actual development begins.

You can fake a brochure.

Polish a pitch.

Sell a dream — once.

But do you want to stay in power in real estate development?

You need truth.

Proper feasibility studies for real estate development do not prove the deal will work.

It shows what it will take to keep it working when the real world pushes back.

That’s how pros operate:

- Kill bad deals early

- Build trust with honest numbers

- Create clarity that capital respects

- Stay strategic under pressure

Feasibility isn’t a spreadsheet.

It’s a leadership tool.

And when your model tells the truth, not just a story?

You don’t need luck.

You build with conviction.

Not just on this project.

But the next five.

Because when the market trusts your numbers…

It starts with trusting your name as a leading real estate developer.

Want more?

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now for direct value creation.

FAQ on Feasibility Studies for Real Estate Development: Your Deal-Saving Diagnostic

Why every successful project starts before the site visit

Real estate doesn’t punish the uninformed.

It devours them.

One thing matters before the architect draws, before the first permit is pulled, before the capital stack is even built: feasibility.

Not a hunch.

It’s not a back-of-the-napkin estimate.

A complete, brutal, honest feasibility study.

Because you don’t get to learn lessons once $40 million is on the line.

What are the components of outsdanding real estate development feasibility studies?

It’s your truth serum — whether you like the truth or not

An actual feasibility study gives you:

- Market research: What people want, not what you wish they wanted

- Financial modeling: Project costs, cash flow, and Internal Rate of Return (IRR)

- Competitive analysis: Who’s already built, sold, failed, and why

- Site & zoning analysis: What’s allowed, what’s not, and how long it’ll take

- Stress tests: What happens when rents dip or interest rates spike?

It’s not a spreadsheet exercise.

It’s a decision-making system.

Why is conducting a feasibility study critical before a single shovel hits dirt?

Because vision without vetting is a gamble

The feasibility study filters fantasy from strategy.

It tells you:

- If your numbers survive market scrutiny

- If your timeline can meet entitlement delays

- If your IRR matches investor expectations

- If your capital stack stacks

In short, it saves your skin.

Most deals die in hindsight. This lets you kill them in foresight.

That’s the power.

How do you avoid mistakes during a development project?

Start with reality, not optimism.

What is the biggest mistake developers make?

Overconfidence in flawed assumptions.

Avoid it by:

- Validating rents with comps, not gut feelings

- Budgeting for cost inflation, not wishful thinking

- Modeling worst-case timelines, not best-case dreams

A well-built real estate development model shows you where your assumptions break — and gives you time to fix them.

And when the market shifts, adjust — don’t react

Markets move.

Feasibility isn’t one-and-done.

It’s a living framework you revisit constantly.

What’s the role of real estate feasibility studies in development?

It separates viable deals from beautiful disasters

It answers:

- What does construction cost, and how does it escalate over time?

- What’s the total equity required — and where does it sit in the capital stack?

- How does that IRR change if rents soften or interest rates rise?

If your financial model can’t survive a 10% cost overrun or a 6-month delay…

You’re not ready.

How does market research drive actual feasibility?

It replaces guesswork with demand-driven planning.

Market research doesn’t just confirm the need.

It identifies:

- Gaps competitors missed

- What product types are overpriced or underserved

- Rent premiums based on amenities, layouts, and location

The result?

You build what sells. Not what sits.

Data wins arguments and secures funding.

Lenders, partners, cities — they all want proof.

Your market research is your credibility.

What’s the deal with sensitivity analysis — and why should you care?

Because nothing ever goes exactly as planned

Sensitivity analysis asks:

- What if interest rates jump?

- What if the lease-up takes longer?

- What if construction costs blow past the budget?

It tells you how much slack you have in the rope before you tie it around your project.

It’s your safety net. Or the reason to walk away.

Why does the real estate development model matter so much?

It’s not a spreadsheet. It’s your second brain.

A solid model:

- Maps every dollar from site control to stabilization

- Aligns your equity and debt assumptions

- Tests yield, exit strategy, and refinance timing

Without it, you’re flying blind through a Category 5 market shift.

With it?

You’re building with confidence and clarity.

Which projects need a feasibility study?

All of them. No exceptions.

If you’re spending six figures or more, you need it.

Residential? Yes.

Mixed-use? Definitely.

Industrial? Without a doubt.

Feasibility is the gatekeeper.

It doesn’t discriminate by asset class — only by execution risk.

How do you protect your Return on Investment in a volatile market?

You plan before you build. Then, you re-plan as you create.

Return on Investment isn’t luck.

It’s a byproduct of:

- Pre-development discipline

- Capital stack clarity

- Cost control systems

- Exit strategy alignment

Feasibility studies don’t guarantee success.

They eliminate blind spots that guarantee failure.

Why conducting effective feasibility studies for real estate development isn’t a formality?

it’s your foundation

You wouldn’t build a tower without a soil test.

Don’t build a project without a feasibility study.

It’s not about spreadsheets.

It’s about survival, clarity, and leverage.

Ant better IRR?

Run tighter numbers.

Want more brilliant capital partners?

Show them a stress-tested model.

Want to sleep at night?

Make sure your deal holds up before you start.

For a deeper dive into the most effective Real Estate Pre-Development Strategies in real estate, How to Master Pre‑Development Strategies in Real Estate: A Comprehensive Guide, the cornerstone resource for Real Estate Pre-Development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now for direct value creation.