Why Land Acquisition Strategy Is the Developer’s First—and Most Permanent—Commitment

In any real estate development, your land acquisition strategy decides whether your project starts with momentum or misalignment.

It’s not just a piece of land. It’s a decision about risk, return, and regulatory exposure—baked in before the first dollar is spent on design or permitting.

Why Strategic Acquisition Matters

- Permanent Impact: Land isn’t liquid. Your flexibility vanishes if you misread zoning, entitlement risk, or community resistance.

- Invisible Risk Layers: Environmental issues, ownership history, and easement conflicts don’t appear on brochures—but they crush timelines.

- Cost of Ignorance: Overpay or misclassify land use; you’re already behind. Cheap land is often expensive once you factor in legal and development friction.

Strategic acquisition gives developers leverage, speed, and financing strength. Poor acquisitions lead to litigation, redesigns, and lost IRR.

What This Article Delivers

- A framework of 7 tactical moves that separate seasoned developers from speculators

- LSI-aligned knowledge of site selection, zoning, entitlement, and due diligence

- Access to global best practices from respected institutions, including GIS planning, title security, and risk modeling

Industry-Sourced Best Practices

ESRI Location Tools: Use ESRI’s Real Estate Solutions to visualize market demand layers

Urban Land Institute (ULI): Their Site Selection Framework shows how acquisition impacts long-term performance

EPA Brownfields Guide: Avoid environmental traps using the EPA’s redevelopment checklist

Final Thought Before You Begin

Final Thought Before You Begin

You’re not buying land. You’re purchasing the foundation of your development’s outcome.

Let’s start with the first move that defines long-term upside: location intelligence.

To understand the Real Estate Development Process comprehensively, consult How To Master The Real Estate Development Process — The Complete 36-Step Blueprint From Concept To Boost Your Legacy our definitive guide to mastering post-development optimization to equip professionals with actionable insights and strategic frameworks.

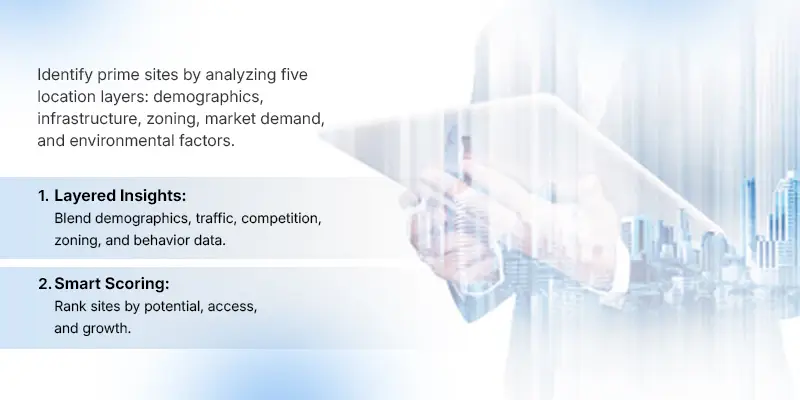

How to Identify Prime Sites Using 5 Layers of Location Intelligence

The best land acquisition strategy isn’t about luck or hunches.

It’s about layered intelligence—using data to predict where value will grow, not just where land is available.

1. Demographics – Know Who’s Coming, Staying, or Leaving

Track:

- Age and household size trends

- Household income and disposable spending

- Migration and employment corridors

Use tools like U.S. Census Data or ESRI Tapestry to detect micro-markets others overlook.

2. Traffic & Infrastructure – Follow the Flow

Growth follows roads.

Assess:

- New or upgraded highways, rail, or metro

- Last-mile infrastructure—power, water, fiber

- Planned logistics or transport hubs

McKinsey reports that sites within 1km of planned transit experience 15–30% higher absorption.

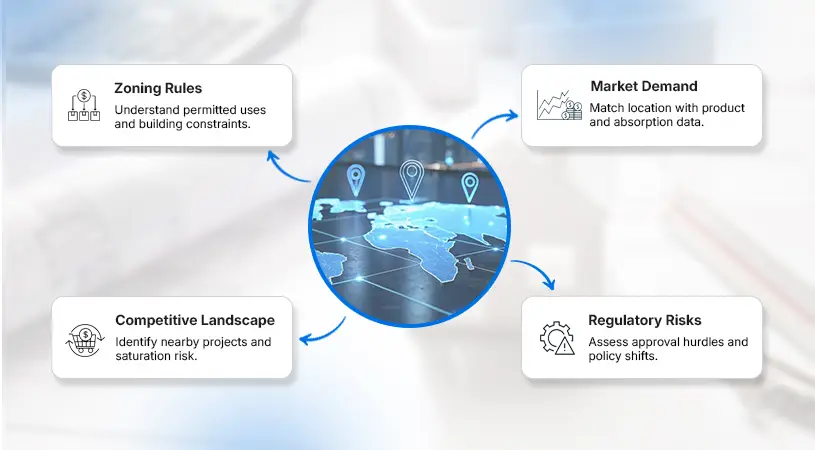

3. Zoning Regulations – Know the Boundaries Before You Build

Every land acquisition strategy must be filtered through zoning.

- Review base zoning codes and overlays

- Check FAR, height limits, setbacks

- Understand “by-right” vs. conditional approvals

Use public zoning portals or zoning.ai for overlays and upcoming reviews.

4. Surrounding Land Use – Know What’s Next Door and Down the Road

Great sites fail because neighbors ruin value.

Study:

- Adjacent property uses—industrial, toxic, obsolete retail

- Municipal development plans and public investments

- Schools, hospitals, and civic anchors nearby

Watch for signs of gentrification or deterioration—not just today’s values.

5. Topography & Environmental Constraints – Read the Terrain

Flat doesn’t mean ready.

Analyze:

- Slope, soil bearing, and drainage

- Floodplains, wetlands, and contamination

- Tie-ins to utilities and access roads

Overlooking site constraints is the top silent killer of land budgets.

Foundational Resource

Tap into ULI’s Complete Guide to Intelligent Site Selection for location-specific frameworks and case benchmarking.

Download the complete 36-step Real Estate Development Process Guide—it includes due diligence, regulatory red flags, political risk, and title clarity steps.

Summary: Location Intelligence Is a Competitive Filter

Summary: Location Intelligence Is a Competitive Filter

The right land acquisition strategy starts with knowing what’s below the surface—and beyond the borders.

Stack these five intelligence layers, and you’ll never guess again.

How to Evaluate Development Site Selection Criteria That Actually Impact Returns

Choosing land is more than its address—it’s about economics, regulations, and future value. Your land acquisition strategy must weigh criteria that drive project returns and risk directly.

1. Access & Visibility — Does the Site Command Attention?

- Road frontage & signalized intersections increase exposure

- Transit access widens buyer and financing pools

- Contextual relevance: Is the site inviting to target tenants or buyers?

Case in point: A mixed-use site without direct access to main roads underperformed on absorption by 12% despite premium finishes.

2. Shape, Slope, & Buildability — What the Graders Will Show

- Rectangular parcels reduce perimeter costs

- Slope ≤ 5° limits foundation work

- Uniform topography reduces risk and simplifies utility extensions

Use satellite tools and geotechnical pre-reports to avoid hidden grading costs, which can consume 5–8% of the cost budget.

3. Zoning Regulations & Highest-and-Best Use — Can You Build What You Need?

- Highest and best use must align legally, physically, and financially

- Check overlay zones—are there FAR caps, protected views, or design controls?

- Confirm as-of-right development vs. needing variances or conditional approvals.

A 2023 ULI case found that violating the highest-and-best use dropped ROI by 18% due to compliance delays and redesign costs.

4. Proximity to Economic Anchors — Where Value Resonates

- Close to schools, transit hubs, employment centers, hospitals

- The presence of new commercial or civic projects nearby

- Use city master plans and economic development reports for early detection

5. Utility Access & Infrastructure Capacity — Buildability Doesn’t End on Land

- Utility tie-ins—sewer, water, power, internet—are cost drivers

- Collect capacity and extension fee data pre-acquisition

- Tie utility milestones into your land acquisition strategy schedule

Quick Filter: The 5-Point Site Return Scorecard

Rank each item 1–5:

- Access & Visibility

- Slope & buildability

- Zoning & highest-and-best use

- Economic anchor proximity

- Infrastructure readiness

Sites scoring below 20/25 should trigger deeper due diligence or walk-away decision.

Foundational Resource

Leverage the National Association of Realtors’ Land Use and ROI report for benchmarks and comparisons: NAR Development Reports.

Key Takeaway: Filter by What Moves Returns — Not Just What Looks Good

Key Takeaway: Filter by What Moves Returns — Not Just What Looks Good

Competent developers choose sites that balance visibility, yield, buildability, and conformity.

Land isn’t just dirt—it’s potentially packaged in risk factors.

Next, we’ll discuss due diligence and title review, building on this filtering process with legal and financial safeguards.

How to Structure Due Diligence Before You Lock In Land Risk

Due diligence isn’t paperwork—it’s the insurance policy for your land acquisition strategy. If you lock in without it, you’re buying blind with capital at risk.

1. Title Clarity & Ownership Chain

- Confirm land ownership history—at least 3 previous transfers

- Look for encumbrances: liens, easements, prior claims

- Check whether the seller holds full transfer rights

- Tool: Use registry portals or title search firms to secure title clarity.

2. Environmental & Soil Assessment

- Conduct Phase I Environmental Studies for contamination flags

- Follow with Phase II if needed, based on industrial history or landfill proximity

- Understand soil carrying capacity—critical for building foundations and costs

Pro tip: Red soil, acid soils, or infill sites often carry hidden remediation costs.

3. Utility, Access & Infrastructure Verification

- Confirm capacity and cost for water, sewer, power, gas, telecom

- Audit existing service providers and capacity constraints

- Map physical access routes—temporary vs permanent roads

4. Legal & Regulatory Obligations

- Cross-check zoning permits, entitlements, and overlay requirements

- Review municipal levies, exactions, or impact fees

- Anticipate future requirements (e.g., affordable housing set-asides)

Use local counsel and fee schedules to quantify regulatory exposure.

5. Survey & Boundary Precision

- Conduct boundary surveys to identify fence lines and encroachments

- Engage civil engineers to verify setbacks, flood zones, and topography

Due Diligence Workflow

| Step | Responsibility | Timeline |

|---|---|---|

| Retain counsel & survey | Legal/Civil | Week 1 |

| Phase I Site Assessment | Environmental Team | Week 2–3 |

| Title Search | Title Agent | Week 1–2 |

| Soil Testing (Phase II) | Geotech Engineer | Week 3–4 |

| Utility & Access Audit | Infrastructure Team | Week 2–3 |

| Fee and Regulation Audit | Legal | Week 3–4 |

Use the EPA’s redevelopment toolkit to guide environmental due diligence: EPA Brownfields Resources.

Download the complete 36-step Real Estate Development Process Guide—it includes due diligence, regulatory red flags, political risk, and title clarity steps.

Key Takeaway

Key Takeaway

Due diligence turns your land acquisition strategy into a defensible position. You move from the seller’s confidence to the developer’s conviction.

Next, we’ll explore negotiation tactics and term structures that lock in control and flexibility before closing.

How to Negotiate Land Terms That Reduce Capital Pressure

You don’t just negotiate price—you negotiate power, flexibility, and downside protection.

The most brilliant land acquisition strategy doesn’t depend on cost per square meter. It depends on terms that let you control the deal without assuming full responsibility too early.

1. Extended Due Diligence Periods = Time to Validate

Push for 90–180-day due diligence windows—longer for complex entitlement plays.

Use this time to:

- Secure zoning opinions

- Conduct environmental and soil tests

- Line up pre-financing soft approvals

- Run political and community risk scans

Every extra month gives you more certainty and reduces capital exposure.

2. Option-to-Purchase Agreements = Risk-Off Entry

Instead of buying upfront, secure an exclusive option to purchase land at a fixed price.

- Pay a non-refundable fee (often 1–3%)

- Define a clear exercise window (6–12 months)

- Make the option assignable if possible

This lets you:

- Lock the land while you finalize approvals

- Bring in investors or flip the option if needed

- Avoid debt or equity commitments until you’re ready

3. Phased Closings = Pay As You Entitle

Split large parcels into phased acquisitions tied to:

- Approvals

- Milestones

- Financing progress

Example: Acquire 25% of a logistics site post-entitlement; another 50% after lease commitments.

Why it works: You reduce cash drag and align payment with progress.

4. Seller Participation Structures = Shared Upside, Reduced Outlay

In some markets, landowners are open to JV structures or profit-sharing deals.

Options include:

- Ground lease with revenue share

- Seller equity stake in development SPV

- Deferred pricing based on appraisal uplift post-entitlement

This flips sellers into partners—and lets you allocate capital to entitlements and pre-development instead.

5. Built-In Extensions & Kill Clauses

Include:

- Automatic extension rights (for a pre-agreed fee)

- Termination clauses tied to findings in due diligence

- Force majeure protections (delays due to external shocks)

These terms don’t just protect you—they give you leverage with capital partners.

Learn more from ULI’s Guide to Real Estate Transaction Structuring, including templates, market norms, and jurisdictional case studies.

Download the complete 36-step Real Estate Development Process Guide—it includes due diligence, regulatory red flags, political risk, and title clarity steps.

Final Takeaway: Price Is a Distraction—Control Is the Play

Final Takeaway: Price Is a Distraction—Control Is the Play

The best land acquisition strategy buys time, reduces upfront risk, and controls the deal structure—not just the square footage.

With the right terms, you turn uncertainty into options. With bad terms, you buy pressure before you pour a single slab.

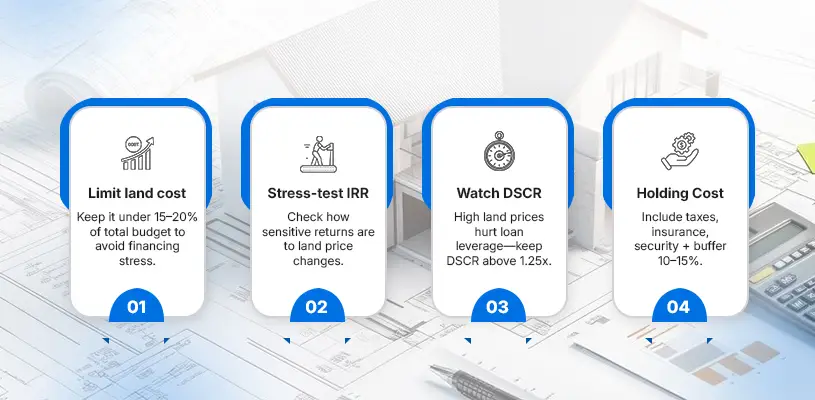

How to Model Acquisition Into Your Real Estate Investment Strategy

A good land acquisition strategy doesn’t just pick the right site—it integrates it into a capital model that protects IRR, eases financing, and supports long-term flexibility.

This isn’t about buying land. It’s about purchasing return potential—without buying exposure.

1. Start With the Land-to-Total-Cost Ratio

Most urban development models keep land under 15%–20% of total project cost.

Why?

- High ratios weaken debt coverage

- They amplify loss if entitlement or market timing fails

- Most lenders flag high land costs as speculative

Benchmark: In low-yield markets like Toronto or Sydney, land above 25% often triggers stress testing.

2. Model IRR Sensitivity to Land Price Volatility

Stress-test IRR by ±10% on land input.

- If IRR drops by more than 300 bps on a 10% land increase—you’re exposed

- If it holds, your land acquisition strategy has a margin of safety

Use Excel’s data table or Argus to simulate shifts and measure the IRR floor.

3. Track DSCR Impact at the Financing Stage

Higher land prices affect DSCR (Debt Service Coverage Ratio) in two ways:

- Reduces available leverage from banks

- Forces you to raise more equity at a lower ROI

Your model must show DSCR above 1.25x post-acquisition and pre-revenue.

4. Tie Acquisition Schedule to Capital Stack Flexibility

If you need a phased capital stack, tie land acquisition to:

- Pre-sales milestones

- Permit receipt

- First equity tranche deployment

Don’t trigger capital deployment too early. Land should follow feasibility, not the other way around.

5. Reflect Holding Costs in Your Financial Forecast

Don’t forget:

- Property taxes

- Financing interest during entitlement hold

- Insurance

- Security and maintenance

Add a 10–15% buffer above projected hold costs to offset delays or legal contingencies.

Build smarter with NAIOP’s Development Financial Models Toolkit, which top-tier developers use for land + cap stack forecasting.

Download the complete 36-step Real Estate Development Process Guide—it includes due diligence, regulatory red flags, political risk, and title clarity steps.

Takeaway: The Model is the X-Ray of Your Strategy

Takeaway: The Model is the X-Ray of Your Strategy

Competent developers model the land acquisition strategy not as a transaction—but as a lever that amplifies or breaks their investment logic.

Land is not the story. It’s the setup.

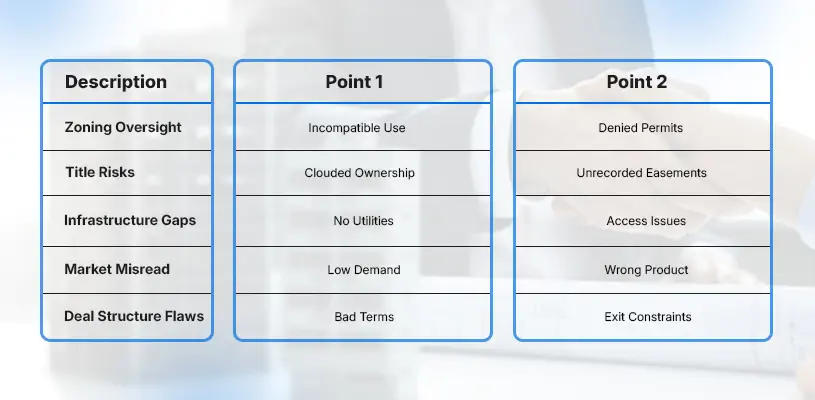

How to Avoid the 7 Deadliest Land Acquisition Mistakes Developers Make

A land acquisition strategy isn’t just about what you choose—it’s also about what you avoid.

The most common errors cost developers time, capital, credibility, and control. Avoid these, and your strategy will be innovative and survivable.

1. Buying Before Validating Feasibility

Acquiring land without a feasibility model is like ordering steel before drawing the building.

Fix: Run pro forma projections, site-specific constraints, and market absorption rates before you commit capital.

2. Ignoring Political and Community Dynamics

Local opposition, planning commission bias, or neighborhood groups can delay or kill your project—even if zoning permits.

Fix: Add a political risk scan and community outreach plan into your early acquisition review.

3. Overtrusting Brokers or “Inside Info”

Anecdotes aren’t analysis. Brokers rarely disclose zoning overlays, latent defects, or community opposition.

Fix: Verify all claims with independent legal, survey, and planning reviews. Assume nothing.

4. Underestimating Infrastructure Constraints

Just because the land is zoned doesn’t mean it’s buildable. Lack of sewer capacity or transformer access can stall you for months or years.

Fix: Confirm all utility tie-in capacities during due diligence—not after design.

5. Misjudging Timeline Risk

Even the best site becomes toxic if approvals take 24 months longer.

Fix: Model multiple approval scenarios and add a minimum 25% timeline buffer. Time is a cost—factor it in.

6. Missing Hidden Carry Costs

The land is not free while idle. Developers underestimate:

- Insurance

- Security

- Legal holding entities

- Financing interest accrual

Fix: Include these in your IRR model and cash flow tracking from Day 1.

7. Skipping the Exit Filter

Buying land without a defined exit strategy turns developers into speculators.

Fix: Build the exit into your acquisition logic—sale, JV, long-hold, or REIT. No exit = no strategy.

Download the ULI Land Acquisition Risk Mitigation Guide, which is packed with legal triggers, risk patterns, and deal examples from institutional developers.

Download the complete 36-step Real Estate Development Process Guide—it includes due diligence, regulatory red flags, political risk, and title clarity steps.

Final Takeaway: Every Land Mistake Happens in Silence—Until It Screams

Final Takeaway: Every Land Mistake Happens in Silence—Until It Screams

The best land acquisition strategy is defensive before it’s offensive. Avoid these 7 mistakes, and your project will have the space to perform.

Next, We wrap up with a conclusion that reinforces authority, drives downloads, and pushes for action.

Ready for the Final Conclusion: From Strategist to Builder?

FAQs About Land Acquisition Strategy for Real Estate Developers

1. What is a land acquisition strategy in real estate development?

A land acquisition strategy is a structured approach to identifying, analyzing, and securing development land. It accounts for site selection, due diligence, zoning regulations, entitlement risks, and investment feasibility. Without a defined land acquisition strategy, developers risk overpaying, underperforming, or facing costly delays due to overlooked variables.

2. How does location intelligence improve a land acquisition strategy?

Location intelligence uses demographic data, infrastructure insights, and urban planning overlays to identify high-potential sites. It transforms a land acquisition strategy from reactive guesswork to predictive, data-backed decision-making that aligns with market analysis and long-term growth patterns.

3. What zoning issues should be considered before acquiring development land?

Zoning regulations determine what can be built and how it can be used. A solid land acquisition strategy checks for permitted uses, density, height restrictions, and overlay zones. Conditional approvals, entitlement requirements, or political challenges can derail a project if not addressed early.

4. What is the role of due diligence in land acquisition?

Due diligence is essential for identifying property acquisition risks before closing. This includes title verification, environmental testing, soil analysis, and utility access. An effective land acquisition strategy embeds due diligence into every process step—avoiding surprises post-acquisition.

5. How do developers evaluate the highest and best use of land?

The highest and best use reflects the most legally permissible, physically possible, and financially viable land use. Developers must align their land acquisition strategy with this analysis to ensure profitability and compliance with local planning requirements.

6. Can you buy land without full entitlement approvals?

Yes, but it’s risky. A disciplined land acquisition strategy either secures entitlements upfront or structures contracts (via options or phased deals) to mitigate risks tied to uncertain land entitlement timelines.

7. How do real estate investors model land cost into financial forecasts?

The land cost typically accounts for 10–20% of the development budget. A strategic land acquisition strategy factors land into IRR models, stress-tests cost variations and ensures DSCR targets are met even if entitlement or market conditions shift.

8. What are the top mistakes developers make during land acquisition?

Common mistakes include skipping due diligence, overestimating site buildability, ignoring community dynamics, and buying without an exit plan. Each of these violates the core of a resilient land acquisition strategy and can compromise the entire project.

9. Should you continuously pursue land in growth corridors?

Not always. While high-growth zones can boost returns, they also come with competition, inflated prices, and entitlement bottlenecks. A strong land acquisition strategy balances location value with buildability, timeline, and project absorption potential.

10. How can developers negotiate better land terms?

Leverage tools like extended due diligence periods, option-to-purchase structures, and phased closings. These tactics are key components of a smart land acquisition strategy and help reduce capital pressure while increasing strategic flexibility.

For a deeper dive into the most effective Real Estate Development Strategies in real estate, prioritize How To Master The Real Estate Development Process — The Complete 36-Step Blueprint From Concept To Boost Your Legacy, the cornerstone resource for Real Estate Development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.