Why Most Real Estate Developers Fail Before They Even Start

Every month, someone calls me after it’s already too late.

They’ve secured the land. Investors are on board. Even contractors are lined up. And yet—they’re stuck. Or worse—bleeding money. And it always starts the same way:

They skipped steps.

Not paperwork steps. Thinking steps.

They were built without a real estate development process. There was no structured feasibility study, capital stack strategy, or exit plan—just a vague vision with momentum.

Sound familiar?

It’s how 8 out of 10 mid-market real estate projects underperform. And how billions in investor capital disappear quietly across the globe.

Because this isn’t just construction. It’s orchestration.

The real estate development process isn’t a checklist. It’s a sequence. Each stage feeds the next. Miss one, and the entire system becomes fragile.

But here’s the good news: You don’t need to learn this the hard way.

Introducing the Strategic Framework Behind Every Successful Development

Over the past 25 years, I’ve worked on real estate projects in the Gulf, Africa, and emerging European markets. Urban hubs. Logistics plays. Mixed-use developments. Some generated 30%+ IRR. Others failed—but taught us why.

This post distills those lessons into a seven-phase real estate development process that separates builders from strategists.

Here’s what you’ll get:

- A complete breakdown of the real estate development process from market intelligence to final exit

- Mini case studies from real deals—wins and losses included

- Strategic tools and checklists to refine your own projects

- The questions top developers ask before they break ground

Most importantly, it is a way to think, not just act.

Because execution without insight is expensive. And insight without execution is useless.

What This Is Not

This is not a surface-level guide.

It’s not designed for hobbyists or casual readers.

It’s for real developers—those managing risk, capital, timelines, and legacy—those who understand that strategy isn’t a department—it’s the job.

What Happens If You Skip the Real Estate Development Process?

Let’s be honest.

You can fake your way through the first deal—maybe two. But eventually, the cracks show:

- A missed feasibility assumption kills your IRR.

- The wrong capital stack squeezes your returns.

- A slow entitlement drags your timeline—and costs you 18 months of cash flow.

This guide helps you eliminate those cracks before they form.

Get the Full Blueprint

Want a full, printable version of this framework—including feasibility checklists, financial model templates, and capital stack examples?

Download The Real Estate Development Guide I use the same framework when advising private equity firms and family offices. No fluff. Just structure.

Tip: Read How To Unlock 7× Profit: Real Estate Development Lifecycle Mastery

What’s Next

Here’s the full breakdown of what we’ll cover:

- Market Discovery & Land Acquisition

- Feasibility & Financial Modeling

- Regulatory & Entitlement Strategy

- Capital Stack & Financing

- Construction Risk & Execution

- Marketing & Absorption

- Exit Strategy & Portfolio Planning

This is your playbook.

Not because I said so—but because it’s been tested in real deals, with real stakes.

Now, let’s get to work.

Phase 1 — Market Discovery & Land Acquisition Strategy

Most developers think land comes first.

They’re wrong.

What comes first is intelligence. The kind that tells you what the market wants—not what you hope it wants.

This phase of the real estate development process isn’t just about picking a plot. It’s about identifying the invisible signals telling you where demand will appear before your competitors do.

Let’s be clear: a bad site with excellent execution still fails. A great site with a flawed acquisition strategy fails faster.

You need both vision and verification.

Identifying Real Estate Demand Signals That Matter

Forget the noise—what actually moves a market?

You’re looking for:

- Demographic shifts (young families, students, retirees)

- Policy cues (tax incentives, zoning changes, new infrastructure investment)

- Job centers and capital inflows (especially FDI in emerging economies)

- Historic absorption patterns (how fast inventory gets absorbed at what price)

- Pipeline analysis (Are you competing with 9 similar towers launching next year?)

These signals aren’t in glossy brochures. They’re buried in municipal documents, economic forecasts, and land records.

Pro tip: Follow the money. Where the banks finance projects, growth follows.

How to Avoid Common Land Acquisition Traps

There are three fatal errors in land acquisition:

- Buying emotionally: Falling in love with a parcel because it “feels right.”

- Underestimating regulatory risk: Assuming rezoning will “probably get approved.”

- Overlooking hidden costs: Off-site works, title challenges, and soil remediation that torpedo your budget.

Most developers see the land. You need to see what it will cost you before you break ground.

Checklist: Before acquiring any land, answer these:

- Is it zoned for your intended use?

- Are the surrounding absorption rates consistent with your price point?

- Can utilities be extended within your cost and timeline?

- Is there a political or tribal ownership risk?

- Who failed on this land before you, and why?

Case Study: Market Misread in Nairobi and Its $1.4M Cost

A midsize developer acquired 11 acres near Nairobi’s outer ring. The plan? Mid-income housing targeting school teachers and young professionals.

What they missed:

- Poor road access meant transport costs were 35% higher than the city average.

- A competing project nearby had just dumped 400 unsold units into the market.

- Their target demographic was migrating closer to tech corridors—not this zone.

Within 14 months, sales stalled. Capital dried up. Internal rate of return (IRR) projections collapsed from 22% to 6%.

They didn’t have a market problem. They had a demand intelligence failure.

Foundational Tools for Early-Stage Development Site Selection

To sharpen your real estate development process, start with the correct data:

- GIS Heatmaps for population and income changes

- Zoning & Infrastructure Maps to identify upcoming corridors

- Absorption Reports from brokers and development councils

- Title Clearance Systems (especially in regions with weak property laws)

- On-the-ground interviews with brokers, city officials, and utility planners

Foundational resource: Harvard Urban Development Diagnostics

Use this to cross-check demand forecasts and infrastructure plans before acquisition.

Key Insight: Don’t Just Acquire—Position

Buying land is tactical.

Positioning it is strategic.

Ask yourself:

- Can you rezone it with less resistance than others in the area?

- Could a slight product shift (e.g., co-living vs flats) dramatically change the numbers?

- What if you staged the site to unlock capital from Phase 1 to fund Phase 2?

Land is the lever. But only if it’s part of a system.

Download the complete 36-step Real Estate Development Process Guide—it includes due diligence, regulatory red flags, political risk, and title clarity steps.

Final Takeaway: Land Is Not the Beginning—It’s the Pivot

Most developers treat land acquisition as the starting point.

It’s not.

It’s the moment of commitment where your thesis meets real risk. If your assumptions are wrong here, nothing downstream can save you.

This phase of the real estate development process is often rushed—but it’s where the profit is truly made or lost.

Use intelligence, not instinct. Use structure, not speculation.

Because once you own the land, you also own the consequences.

For more information read How To Master Land Acquisition Strategy. 7 High Stake Moves For Developers

Phase 2 — Feasibility Study & Financial Risk Analysis

Once you’ve identified the land, you’re not ready to build.

You’re ready to test.

Until your numbers pass inspection, your real estate development process will run blind.

Feasibility isn’t paperwork. It’s a pressure test. It exposes every weakness in your assumptions—before they become irreversible costs.

How to Run a Feasibility Study That Drives Investor Confidence

Your feasibility study isn’t for banks.

It’s for truth.

At a minimum, your study must rigorously evaluate:

- Market feasibility: absorption, demand elasticity, price ceilings

- Technical feasibility: site constraints, infrastructure compatibility, density

- Legal feasibility: title, zoning, entitlement process, and land use alignment

- Financial feasibility: cost modeling, return thresholds, capital stack viability

If even one pillar cracks, your entire structure fails.

Most developers run a cost sheet and call it a study. That’s not analysis—it’s math. Investors don’t fund math. They fund clarity.

IRR, DSCR, and the Metrics That Determine Real Estate ROI

Your internal rate of return (IRR) is your compass, not your map.

Why?

Because IRR can be gamed. It’s sensitive to timing, exit, and unrealistic assumptions.

You need more than IRR to evaluate viability:

| Metric | Why It Matters |

|---|---|

| IRR | Reflects return velocity, time-weighted |

| NPV (Net Present Value) | Captures absolute value creation |

| DSCR (Debt Service Coverage Ratio) | Tests if cash flow can cover debt |

| Equity Multiple | Tells investors how much bang per buck |

| Sensitivity Matrix | Reveals how changes affect profitability |

Use all of them—not one of them.

A solid DSCR (1.3+) signals cash flow strength. A weak one (below 1.1), and your lender walks.

Sensitivity Analysis: The Developer’s Insurance Policy

Most developers skip this step.

Big mistake.

Sensitivity analysis tells you how much your model can bend before it breaks. Change inputs like:

- Interest rates

- Absorption speed

- Sale price per square meter

- Construction delays

- Cost of capital

And watch how your IRR collapses—or holds.

This is where real estate development turns from risky to resilient.

Pro tip: If your deal dies when rent drops 8%, it was never a deal. It was a gamble.

Case Study: How a Missed Variable Wiped 8% Off Project IRR

In 2021, a mid-rise residential developer forecasted a 24% IRR.

The feasibility study missed one variable: revised height restrictions reduced total GFA by 18%.

Impact?

- Lost units

- Higher per-unit land and infrastructure cost

- Sales timeline extended by 7 months

- Final IRR: 16%

- Investor trust: evaporated

Lesson: Your feasibility is only as good as the assumptions it challenges.

Red Flags to Look For in Financial Risk Analysis

- Too much reliance on exit value assumptions

- Underestimating holding costs during delays

- Ignoring escalation in construction risk variables

- Assuming perfect absorption at planned prices

- Missing the capital stack’s impact on return structure

You need to stress test every optimism bias in your model.

If your spreadsheet always looks good, you’re not modeling. You’re dreaming.

Download: Full Feasibility Model Template (Editable Excel)

Download the complete 36-step Real Estate Development Process Guide to present projects to private equity funds and institutional lenders. It includes an IRR waterfall, DSCR test, and construction cost schedule.

Foundational Link

World Bank: Urban Land Market Diagnostics

Use this to validate assumptions in developing markets, infrastructure overlays, and macro-policy trends.

Final Takeaway: Feasibility Doesn’t Predict Success—It Protects Against Failure

In this real estate development phase, you stop gambling and start deciding.

A bulletproof feasibility study doesn’t guarantee success but drastically reduces the odds of strategic failure.

And when millions are on the line, that reduction is everything.

For more information check How To Run Real Estate Development Feasibility. 6 Bullet Proof Tests To Skyrocket Your Business

Phase 3 — The Entitlement Process & Regulatory Strategy

You can own the land.

You can prove the returns.

But if you can’t get approvals—you own a liability, not an asset.

The entitlement process is where the real estate development process either gains traction or gets stuck in purgatory.

It’s not about just getting permits. It’s about engineering alignment—between your vision and the rules that govern it.

How to De-Risk the Permit and Entitlement Process Early

The biggest myth in real estate?

“That’ll get approved.”

Reality check: every jurisdiction has its own maze of zoning overlays, political winds, neighborhood councils, and environmental thresholds.

You’re already late if you’re not planning an entitlement strategy in Phase 1.

Here’s how to front-load your strategy:

- Engage regulatory counsel before the acquisition

- Secure a preliminary use and zoning report

- Map the entitlement process step-by-step

- Identify approval bodies and political influencers

- Timeline your permits against critical path milestones

The sooner you integrate the entitlement process, the fewer surprises—and delays—you’ll face later.

What Regulators Won’t Tell You—But Will Block You For

You’ll never find these in official zoning codes—but they kill projects all the time:

- Community opposition fueled by misinformation

- Off-the-record concerns about density or impact

- Unwritten environmental interpretations that change post-submission

- Timing games where hearing dates keep slipping

The trick? Treat regulators like co-developers, not adversaries. Include them early in your project’s logic. Show alignment. Show impact.

Zoning, Land Use, and the Real Gatekeepers of Real Estate Projects

Zoning isn’t static. It’s political.

You must understand:

- Base zoning vs. overlay zoning

- By-right uses vs conditional uses

- Special permits vs. variances

- Density bonuses, FAR, height caps, and setbacks

- Environmental impact studies (EIS) thresholds

Failing to master this language is like pitching in a dialect your audience doesn’t speak.

Real developers don’t just know how to build. They know how to speak policy.

Case Study: Oman Education Hub — Approvals Secured 2 Months Ahead of Schedule

Project: A multi-building academic and residential campus in Oman.

Challenges:

- Mixed-use zoning in a politically sensitive education corridor

- High-volume water utility integration

- Traffic impact on two arterial roads

- Regional design aesthetic compliance

Actions:

- Engaged local regulatory liaison pre-acquisition

- Staged public meetings to neutralize community resistance

- Pre-submitted design to gain design council buy-in

- Created a phased submission plan that allowed early site works

Outcome:

- Full approvals were received two months ahead of schedule

- Site works began 90 days earlier than the baseline

- IRR increased by 3.7% due to timeline advantage

Entitlements aren’t just permissions. They’re leverage.

Regulatory Strategy: Build Political Capital Before You Need It

If your first meeting with the city is when you need something, you’re already late.

Here’s how real estate developers build strategic goodwill:

- Attend public hearings—before you have a project

- Support local initiatives—without agenda

- Meet stakeholders when there’s nothing on the table

- Frame your project in terms of public benefit, not private gain

This isn’t politics. It’s persuasion. And it’s foundational.

Download: Entitlement Process Tracker (Editable Template)

https://ahmadkhalaf.com/real-estate-development-success-kit/ for multi-agency approval timelines, stakeholder mapping, and submittal coordination.

Foundational Link

RICS Land Use & Regulation Guide

Use this to align your entitlement strategies with global best practices, especially in complex or multi-layer jurisdictions.

Final Takeaway: The Best Developers Speak Two Languages—Finance and Policy

Zoning, permitting, and the entitlement process are not paperwork but rather the predictors of project velocity.

This phase of the real estate development process is where momentum gets made—or lost.

Don’t leave it to chance. Engineer it with precision, foresight, and strength, like a structure.

For more information check How To Master Your Real Estate Entitlement Process. Secure 5 Critical Approvals That Make Or Break Your Development

Phase 4 — Structuring the Capital Stack for Development Financing

At this stage of the real estate development process, your project is a balance sheet, not a blueprint.

And how you structure your capital stack determines three things:

- Who controls the deal

- Who earns the upside

- How risk is absorbed or amplified

You’re not just raising funds. You’re engineering financial architecture. Get it wrong, and you dilute your returns—or your influence. Get it right, and your IRR jumps without laying a single brick.

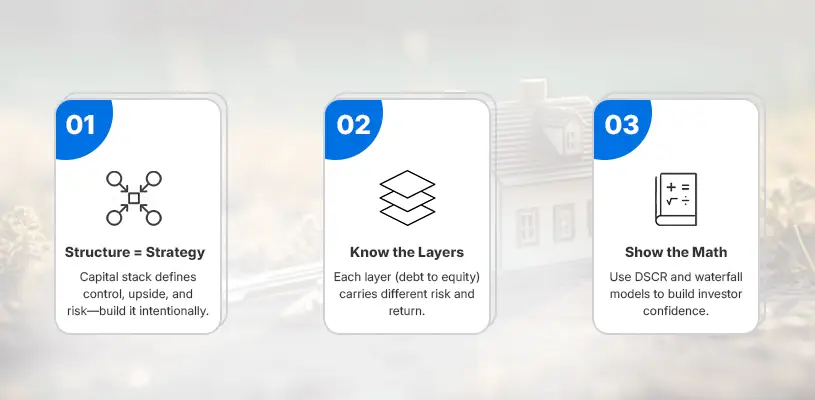

The Anatomy of a Real Estate Capital Stack

Every deal lives within a capital stack—a layered structure of money, risk, and reward.

Here’s the basic architecture:

- Senior Debt – Lowest risk, lowest return, first to be repaid

- Mezzanine Debt – Higher return, second lien position, more expensive

- Preferred Equity – Hybrid debt-equity structure with fixed returns

- Common Equity – Highest risk, highest return, owns the upside

| Layer | Risk | Return Target | Role |

|---|---|---|---|

| Senior Debt | Low | 4–6% | Secured lender |

| Mezzanine Debt | Medium | 8–12% | Fills gap after senior |

| Preferred Equity | High | 10–16% | Often investor-driven |

| Common Equity | Highest | 15%+ | Developer and sponsors |

The most competent developers don’t just raise money—they control its structure.

Common Equity-Debt Structures and How to Pitch Them to Partners

Investors care about two things:

- Security of capital

- Clarity of upside

Here are three tested development financing structures:

- Straight Debt + Equity – Clean and simple; less dilution, more risk

- Debt + Preferred Equity + Common Equity – Balances risk and alignment

- Convertible Debt + Equity – Preserves upside with downside protection

Pitch clarity matters. Use waterfall diagrams to show payout logic. Use stress scenarios to show how DSCR holds up under strain.

If your capital stack isn’t visualized, it won’t be trusted.

Understanding Debt Service Coverage Ratio (DSCR) and Loan Thresholds

Your DSCR signals to lenders: “This project can pay you back—even if things tighten.”

- DSCR = Net Operating Income / Total Debt Service

- A DSCR of 1.25+ is lender-friendly. Below 1.10? You’re high risk.

Don’t just show DSCR in year 1. Show it during construction, lease-up, and stabilization.

Case Study Snapshot:

A Gulf logistics project had strong IRR projections—but DSCR dipped below 1.0 in Year 2 due to backloaded leasing. Result? The lender slashed loan-to-cost by 18%, forcing last-minute equity infusion. Deal survived. The developer’s upside didn’t.

Waterfall Models and GP/LP Splits: How You Make Your Money

Waterfall models define how profits flow after return hurdles are met.

A standard split:

- Return of capital to all investors

- Preferred return to LPs (e.g. 8%)

- Catch-up to GP

- Split of remaining profits (e.g., 70/30 LP/GP)

These promote structures matter. They affect behavior. They decide whether you get rich or just stay busy.

Never enter a deal where your promotion is unclear, or your control is diluted.

Red Flags to Watch in Development Financing

- Over-leveraging to boost IRR optics

- Misaligning LP-GP incentives

- Undercapitalizing contingency reserves

- Poor stress testing of interest rate and DSCR shifts

- Unclear exit strategies for each layer of capital

IRR is not created at exit. It’s earned through structure.

Download: Your Ultimate Real Estate Development Process

Foundational Link

Urban Institute: Capital Stack Primer for Real Estate Development

Reference for advanced capital formation strategies, public-private blends, and institutional benchmarks.

Final Takeaway: The Capital Stack Isn’t Just Finance—It’s Strategy

Your structure is your strategy at this point in the real estate development process.

The wrong money at the wrong time with the wrong terms will kill your returns—before the market ever gets the chance.

Build the stack like you’d build the project itself: intentionally, layer by layer, for resilience and reward.

For more information check How To Structure Your Real Estate Capital Stack: Boost Your Returns With 4 Strategic Capital Layers

Phase 5 — Design, Tendering, and Construction Risk Management

Paper turns into pressure at this stage of the real estate development process.

Design becomes scheduled. Tendering becomes cost exposure. And construction becomes the make-or-break moment for your returns.

Developers don’t fail here because they can’t build. They fail because they can’t control how it gets built—on time, budget, and spec.

This phase isn’t about architecture. It’s about accountability.

Value Engineering vs. Value Erosion: Where Developers Go Wrong

Let’s clear something up:

Value engineering means optimizing cost without compromising performance. But most developers treat it like a discount menu.

Here’s the result:

- Cheap facades that spike long-term maintenance

- Smaller lobbies that kill tenant perception

- Mechanical substitutions that trigger regulatory delays

True value engineering is designed with financial fluency. It asks, “Where does every dollar go—and is it buying ROI or just materials?”

Run every design through this filter:

- Does this improve absorption?

- Does this reduce OPEX long-term?

- Does this speed up approvals or leasing?

If not, strip it.

Construction Risk: How to Control Time, Cost, and Quality

Construction risk isn’t just about cost overruns. It’s about compounding effects:

- Delay in materials → delay in cash flow

- Poor supervision → latent defects → Warranty costs

- Contractor mismanagement → site accidents → project shutdowns

Here’s your construction risk playbook:

- Fixed-price contracts with escalation clauses

- Independent project monitoring (3rd party QS or PM)

- Structured site inspections at critical milestones

- Liquidated damages with teeth—not suggestions

- Transparent change order protocols

You can’t outsource control. You can only structure it.

Tendering Strategy: Choosing the Right Contractor Without Regret

Tendering isn’t about the lowest bid. It’s about the lowest risk-adjusted cost.

Avoid these traps:

- Single-source bids with “friendly” contractors

- Rushed timelines that ignore design detailing

- Ambiguous scope packages that invite change orders later

- Unverified capacity (especially in boom markets)

Use a three-tier filter:

- Technical Score – past performance, QA/QC systems, staffing plans

- Commercial Score – pricing transparency, breakdowns, escalation terms

- Financial Score – liquidity, bonding capacity, payment terms

And always pre-qualify before issuing tender docs.

Case Study: The $2.1M Lesson in Construction Oversight

A mid-rise office development in the Gulf awarded a contract based on a strong relationship—without formal tender.

The contractor:

- Lacked manpower depth

- Subcontracted key trades to unvetted vendors

- Overstated capacity on concurrent projects

Results:

- Delay: 6 months

- Change orders: +18% over baseline

- Liquidated damages: uncollected due to poor enforcement

- Final cost impact: $2.1 million overrun

Lesson: Relationships don’t build buildings—systems do.

Red Flags That Signal Future Construction Failure

- Inconsistent pricing between line items

- Missing detail in work breakdown structure (WBS)

- Underpriced preliminaries and mobilization costs

- Loose or missing clauses on material testing and retentions

- Contractors unwilling to provide financials

If your contract isn’t specific, your outcome won’t be either.

Download: Contractor Due Diligence Checklist

Download Your Free Real Estate Development Process used in my firm’s prequalification process. It includes financial risk filters, capacity indicators, and legal history prompts.

Foundational Link

McKinsey: The Next Normal in Construction

A global benchmark on cost productivity, digital site tools, and construction efficiency.

Final Takeaway: Construction Risk Is Not a Phase—It’s a Permanent Exposure

At this point in the real estate development, you’re either managing the build or reacting to it.

Every mistake is amplified on-site, every delay compounds downstream, and every oversight costs more to fix later than to prevent now.

Build with precision. Or rebuild with regret.

For more information read How To Master Construction Risk Management. Eliminate 8 Costly Construction Risks Before You Break Ground

Phase 6 — Pre-Sales, Project Absorption, and Marketing Execution

Design done. Ground broken. Construction underway.

Now comes the part too many developers treat as an afterthought—sales.

But here’s the truth: in this phase of the real estate development process, the market answers back. In complex numbers, it tells you whether your assumptions were real or just rehearsed.

Sales isn’t about hype. It’s about timing, trust, and testing absorption early.

Designing Your Pre-Sales Funnel Before Breaking Ground

Most developers think pre-sales starts after excavation.

Too late.

You need traction before your shovel hits the soil. Why?

- It validates your pricing assumptions

- It anchors your financing strategy

- It builds momentum that reduces absorption risk

Pre-sales funnel checklist:

- Positioning Matrix – How do you rank vs. comps on price, features, and lifestyle?

- Buyer Personas – Not just demographics—psychographics, motivations, fears

- Pre-Launch Campaigns – Broker activations, email sequences, preview events

- Conversion Triggers – Early-buyer incentives, limited units, phased pricing

Pre-sales isn’t a campaign. It’s a confidence test.

How Absorption Rates Dictate Your Funding, Pricing, and Exit

Your absorption rate isn’t just a sales metric. It’s a risk indicator.

Let’s break it down:

- Slow absorption → reduced cash inflow → funding gaps

- Fast absorption at low prices → margin erosion

- Targeted absorption with staged pricing → control, confidence, and upside

Ideal strategy: Match your release velocity to construction milestones. Phase inventory to capture demand at higher price points.

Case Example:

We released 20% of units in a Gulf residential development at launch. Once 80% were booked, we increased prices by 12% in Phase 2. The result? A controlled sales pace, an extra $3.1M in revenue, and a boosted IRR by 2.4%.

The Psychology of Buyers in Real Estate Developments

Buyers don’t just buy space. They buy stories, status, and security.

Here’s how to speak their language:

- Scarcity – Show what’s limited, not just what’s available

- Social Proof – Highlight who else is buying and why

- Lifestyle Framing – Position the unit as a solution, not a structure

- Risk Reversal – Use guarantees, buy-back offers, or deposit flexibility to de-risk decisions

Stop selling specs. Start selling outcomes.

From Lead to Contract: How We Hit 70% Absorption Pre-Launch

For a mixed-use project, our team structured the following:

- Broker bonus model with real-time leaderboards

- 3D walk-throughs rendered before the foundation pour

- Exclusive early-access event with media coverage

- Buyer referral program that drove 18% of total deals

- CRM automation with a 5-touch nurture sequence

The result?

- 70% of inventory absorbed pre-launch

- $4.7M secured in deposits

- Early take-up was used to restructure the construction drawdown schedule, reducing financing costs by $600K

Marketing done well isn’t just branding—it’s financial leverage.

Red Flags That Signal Sales and Absorption Failure

- No buyer personas were defined before the launch

- Same message across all product types

- Lack of urgency or limited-time offers

- Marketing handled by the construction team

- Failure to test price elasticity early

If your pre-sales aren’t engineered, your project is gambling on the backend.

Download: Absorption Forecast Template + Pre-Sales Funnel Map

Download the complete 36-step Real Estate Development Process + Tools now. A proven system. Zero guesswork. Yours, free.

Foundational Link

National Association of Realtors: Real Estate Demand Forecasts

Use this to track macro absorption trends, buyer behavior shifts, and pricing patterns.

Final Takeaway: Pre-Sales Aren’t Marketing—They’re Risk Management

This phase of the real estate development process isn’t decoration. It’s defense.

Competent developers don’t just build projects—they build markets.

Sell early. Absorb strategically. Price for tomorrow—not just today.

For more information read How To Apply The Real Estate Value-Add Strategy To Boost Your Profitability: 7 Tactics

Phase 7 — Exit Planning & Portfolio Strategy Optimization

Most developers focus on getting in.

The elite focus on getting out—with leverage, liquidity, and long-term strategy intact.

At this final stage of the real estate development process, the project becomes a portfolio decision. You’re no longer managing construction—you’re managing the capital lifecycle, tax treatment, and reinvestment velocity.

Exit is not a finish line. It’s a pivot.

Exit Strategies: Sell, Hold, Refinance, or Roll into REIT

Every exit path carries a tradeoff:

StrategyUpsideRisk

Sell Immediate liquidity, fast returns, Miss long-term appreciation

Hold Ongoing income, control Tied-up capital, OPEX sensitivity

Refinance Tax-efficient liquidity Rate fluctuation, valuation risk

REIT Roll-In Institutional credibility Complex structuring, governance loss

The correct answer? Depends on your investor profile, capital stack, and market cycle.

Exit should be built into your feasibility model before breaking ground—not figured out in a panic.

Building a Long-Term Portfolio Strategy From Your First Win

One deal can become a system—or a dead end.

Here’s how top developers turn projects into platforms:

- Tax Strategy Integration – Use depreciation, 1031 exchanges, and cost segregation

- Asset Repositioning – Turn underperformers into long-term performers

- Liquidity Layering – Blend short-hold and long-hold assets for risk balance

- Geographic Stacking – Hedge regional cycles with cross-market plays

- Capital Recycling – Use Equity from stabilized assets to fund new developments

Real estate isn’t just about building—it’s about compounding.

Real Estate Legacy: What Separates Builders from Visionaries

Legacy is built on three pillars:

- Reputation – Do investors want in every time you call?

- Resilience – Can your portfolio take a hit and keep delivering yield?

- Repeatability – Can your model scale without burning out or blowing up?

You’re not just developing assets. You’re developing credibility.

Case Study:

A logistics developer in East Africa rolled five stabilized warehouses into a REIT structure. Used the liquidity event to launch a fund. Now manages $110M AUM with recurring fees—and hasn’t poured a foundation in 18 months.

The play wasn’t real estate. The play was platformization.

Logistics Asset: How We Exited at 3x Capital While Reducing Risk

Asset: 87,000 sqm logistics park

Region: GCC

Exit Strategy: Phased lease-up + refinancing + partial portfolio sale

Key Moves:

- Pre-committed leases with rent escalators

- Asset revaluation triggered refinance at 55% LTV

- Sold 49% equity stake to institutional buyer at 3x capital

Outcome:

- Full cost recovery + profit on refinance

- Retained management control

- Cash deployed into two new developments

Exit wasn’t the end. It was the multiplier.

Red Flags That Signal a Weak Exit Strategy

- No exit modeled in financial projections

- Overreliance on one type of buyer or investor

- No tax planning around capital events

- Holding period mismatch with investor timelines

- No plan for management post-sale

Exit isn’t optional. It’s a core part of risk-adjusted return.

Download: Exit Planning Toolkit + Portfolio Strategy Grid.

Download the complete 36-step Real Estate Development Process. A proven system. Zero guesswork. Yours, free.

Foundational Link

MIT Center for Real Estate: Capital Markets and Exit Strategy Research

Provides models and insights on institutional-grade exit mechanics, valuation metrics, and capital cycling.

Final Takeaway: Exit Isn’t the End—It’s the Reinvestment Engine

The final phase of the real estate development process determines whether your project creates a moment… or momentum.

Think bigger than buildings.

Because smart exits don’t just pay you—they fund the future.

For more information read How Navigate The Real Estate Developer Tax Strategy. Master 10 Developer Tax Strategies For Maximum Return

Conclusion — From Builder to Strategist

Now you know the full structure.

Seven interconnected phases. Not steps. Not tasks. But strategic decisions—each one affecting cost, time, trust, and returns.

This isn’t a checklist. It’s a lens.

Because real estate development doesn’t reward effort. It rewards clarity, timing, and precision.

The best developers aren’t the ones who build the most. They’re the ones who build with intent.

If You’ve Read This Far, You’re Not Here for Basics

You’re here to win. To move past guesswork. To build assets that fund your next play, not just your next invoice.

Here’s what you should do next:

- Download the full Real Estate Development Guide

It includes the site vetting checklist, feasibility templates, capital stack models, construction risk tools, and exit planning worksheets. Download the Full Real Estate Development Process Guide Here - Book a Strategy Call With Me

If you’re serious about your next project—and want help sharpening the model, structure, or exit—this is where we start. Schedule a Private Advisory Session

Because Strategy Isn’t a Department. It’s the Whole Job.

And you’re not just building buildings.

You’re building equity. Trust. Reputation. Liquidity. Longevity.

Every great developer makes the same shift at some point: from operator to strategist.

This guide is your map.

Now it’s time to build your edge.

Real Estate Development Process: Top 18 FAQs Every Strategic Developer Should Know

1. What is the real estate development process, and why does it matter?

It’s a multi-phase strategy that transforms raw land into income-generating assets. It matters because every phase—land acquisition, feasibility, entitlement, financing, construction, sales, and Exit—either builds profit or compounds risk.

2. How do I use land acquisition to fit into the real estate development process?

You use land acquisition as a strategic lever, not a starting point. Match zoning, demand, infrastructure, and entitlement feasibility to ensure the site supports your vision and margins.

3. What are the core steps in a proper feasibility study during real estate development?

Market demand, absorption, cost modeling, IRR/NPV, DSCR thresholds, legal/title validation, and stress-tested scenarios. Without these, you’re guessing—not projecting.

4. How do I calculate IRR and DSCR for a real estate development process model?

IRR measures return speed; DSCR tests cash flow against debt. Use a dynamic pro forma with phased inputs—including lease-up periods, exit timelines, and refinancing options.

5. Why is sensitivity analysis critical in the real estate development process?

Because your assumptions are fragile. A 5% rent, cost, or timing shift can kill your IRR. Sensitivity testing shows how real your numbers are—or how exposed they are.

6. How does the entitlement process affect the real estate development process timeline?

It controls your start. No approvals, no build. Misjudge it, and you lose months—or years. Plan it early, align it politically, and phase your permissions like your construction.

7. What regulatory risks exist within the entitlement process of the real estate development process?

Unwritten local rules, shifting zoning interpretations, public opposition, and approval bottlenecks. Ignore these, and you’re not entitled—you’re exposed.

8. How should a capital stack be structured within the real estate development process?

The portfolio is layered by risk: senior debt (low return, high security), mezz debt, preferred Equity, and common Equity (high return, high risk). The structure aligns incentives and shields the downside.

9. What role does a strong capital stack play in reducing risk during real estate development?

It protects returns under pressure. A smart stack absorbs shocks, avoids cash calls, and prevents leverage from killing control. Weak stacks leak profits, while strong ones preserve optionality.

10. How can value engineering reduce construction risk in the real estate development process?

By optimizing design for ROI—not just cost. Cut what doesn’t sell, fund what drives leasing, and avoid materials that look cheap or fail fast.

11. What tendering strategies reduce construction risk in the real estate development process?

Open competitive bidding with prequalification, defined scopes, escalation clauses, milestone-linked payments, and enforceable liquidated damages. Don’t choose cheap—choose accountable.

12. How do pre-sales and project absorption fit into the real estate development process?

They validate demand, fund early stages, and reduce loan exposure. Done right, they front-load revenue and help you control pricing velocity across phases.

13. What factors impact project absorption during the real estate development process?

Price-to-value alignment, buyer psychology, marketing timing, broker engagement, and perceived scarcity. Get this wrong, and units sit. Get it right, and sales drive IRR.

14. How do buyer psychology and marketing affect the real estate development process?

Buyers buy status, story, and security—not specs. Design your brand, visuals, and narrative to speak to aspirations, not just square meters.

15. What exit strategies are common in the real estate development process?

Sale, hold, refinance, or REIT roll-in. Choose based on your capital goals, investor timelines, and market cycle. The best Exit is planned for day one.

16. How do I build a portfolio strategy around the real estate development process?

Recycle Equity, diversify by geography and asset class, balance hold periods, and build systems—not just projects. One deal is short-term; a portfolio is long-term power.

17. What are the red flags at each phase of the real estate development process?

Bad zoning assumptions, soft feasibility models, poor capital stack terms, unclear contracts, a weak absorption strategy, or no exit model are all risk amplifiers.

18. What toolkits or downloads support the real estate development process?

Feasibility pro forma, capital stack builder, entitlement tracker, pre-sales funnel map, and exit planning models. You’ll find them all in this downloadable Real Estate Development Process Guide.