Key Risk Management Strategies for Real Estate Development

Why Risk Management Isn’t Optional in Real Estate

Think of risk as gravity—always present, constantly shaping every move you make. In Risk Management in Real Estate Development, uncertainty is unavoidable, yet it also becomes the raw material for success. Developers face financial risk management pressures, shifting environmental variables, and relentless regulatory compliance risk hurdles. The best teams don’t merely brace for impact—they embed proactive risk mitigation strategies into every decision they make. The Royal Institution of Chartered Surveyors (RICS) outlines globally recognized fundamentals in its RICS Risk, Liability, and Insurance Guide—an essential reference.

What Happens When You Don’t Plan for Risk Management in Real Estate Development?

- Zoning law changes in the middle of a project, freezing all existing permits.

- One of your suppliers collapses, bringing construction to a standstill.

- Over-leverage clashes with rising interest rates, converting potential profits into significant losses.

Critical warning signs showcase the consequences of poor financial risk management and the failure to comply with regulations. Weak risk mitigation strategies will jeopardize your real estate development project. It’s imperative to address these issues head-on to protect timelines and budgets. The U.S. Government Accountability Office highlights these pitfalls in its Schedule Assessment Guide.

What You’ll Learn about Risk Management in Real Estate Development

This guide isn’t about dodging danger; it’s about wielding uncertainty. Step by step, you will see how to:

- Detect hidden threats before breaking ground through disciplined financial risk management and environmental reviews.

- Apply proven matrices to rank each regulatory compliance risk and deploy targeted risk mitigation strategies.

- Safeguard timelines, budgets, and investor trust by making Risk Management in Real Estate Development the backbone of every phase.

By the end, you’ll hold a blueprint that transforms obstacles into competitive advantage—echoing principles from ISO 31000 Risk Management.

To understand the Real Estate Pre-Development Process comprehensively, consult ‘How to Master Pre-Development Strategies in Real Estate: A Comprehensive Guide,’ our definitive guide to mastering Pre-development optimization, which equips professionals with actionable insights and strategic frameworks.

Access the most comprehensive real estate development success kit for free, including step-by-step strategies, high-impact templates, and $35,000 worth of expert insights to help you develop smarter, cut costs, and lead with confidence—whether you’re planning your first project or scaling your next big move—the Real Estate Development Guide.

Book Your 1:1 Strategy Session for Direct Value Creation.

Identifying Risk Factors in Risk Management in Real Estate Development Projects

Financial Risk Management Pressures Developers Can’t Ignore

Money moves mountains—or stops them cold. Solid financial risk management is the first line of defense in risk management for real estate development. Market volatility slashes projected revenues overnight; funding dries up when lenders tighten their standards; liquidity gaps freeze payrolls mid-build. The Urban Land Institute’s Emerging Trends in Real Estate Report tracks these shocks in real time. Proactive cash-flow modeling, interest-rate hedges, and diversified capital stacks rank high on effective risk mitigation strategies. Missing these signals and a single rate hike can cripple returns, turning ambitious towers into distressed assets.

Environmental Threats and Risk Mitigation Strategies That Matter

Nature doesn’t care about schedules. Floods, seismic shifts, or hidden toxins surface without warning. A disciplined environmental risk analysis—soil borings, hydrologic maps, climate forecasts—anchors successful Risk Management in Real Estate Development. FEMA’s Flood Map Service Center is a vital data source when evaluating flood exposure. Developers embed green infrastructure, elevated slabs, and site-specific drainage as core risk mitigation strategies, safeguarding budgets and timelines. Failing to exercise this diligence can result in cost overruns for emergency dewatering, post-storm repairs, and mandated remediation.

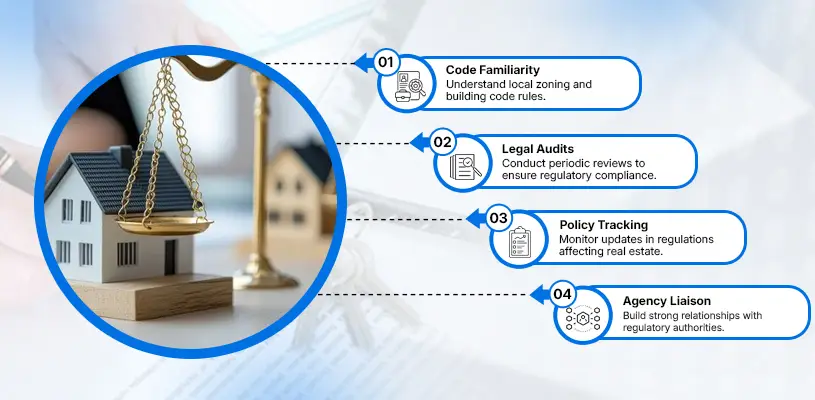

Navigating the Regulatory Compliance Risk Maze

Codes evolve faster than concrete cures. Zoning revisions, building-code amendments, or heritage-site rulings can stall projects indefinitely. Embedding regulatory compliance risk tracking into every phase of Risk Management in Real Estate Development prevents blindsides. The International Code Council publishes the model codes most U.S. jurisdictions adopt or adapt. Early legal audits, municipal partnerships, and rolling permit dashboards transform adversarial red tape into collaborative approvals. When regulations shift mid-construction, adaptive site plans, and pre-negotiated variances serve as critical risk mitigation strategies, keeping crews moving and investors calm.

The High Price of Blind Spots in Risk Management in Real Estate Development

The most dangerous hazards are the ones you never saw coming. Projects that neglect financial risk management, dismiss environmental due diligence or undervalue regulatory compliance risk accumulate silent liabilities—ballooning interest charges, emergency remediation, and stop-work orders. Case studies in the World Economic Forum’s Infrastructure Risk Report prove the point. Conversely, developers who integrate repeatable risk mitigation strategies into daily decisions convert uncertainty into a strategic advantage, reinforcing trust and protecting IRR.

Staying Ahead: A Continuous Cycle of Risk Management in Real Estate Development

Identifying threats isn’t a one-time checklist; it’s an ongoing loop. Weekly matrix reviews realign priorities; quarterly scenario tests validate financial risk management assumptions; real-time monitoring platforms flag emerging regulatory compliance risk. By institutionalizing these feedback loops, teams embed resilient risk mitigation strategies that adapt as fast as markets, weather, and statutes shift—cementing leadership in Risk Management in Real Estate Development. Templates for ongoing review appear in AACE International’s Risk Management Recommended Practice 57R-09.

Tools for Quantifying Real Estate Risk in Risk Management in Real Estate Development

Why Guessing Isn’t Enough for Risk Management in Real Estate Development

In modern Risk Management in Real Estate Development, intuition alone invites loss. Moody’s Analytics outlines robust modeling frameworks in its CRE Risk Measurement Guide. Solid numbers, built from repeatable financial risk management procedures, turn hunches into hard facts. Without quantification, every regulatory compliance risk or hidden cost can destroy timelines before risk mitigation strategies can take effect.

The Power of Risk-Assessment Matrices for Risk Management in Real Estate Development

A live matrix ranks probability against impact, clarifying which threats deserve instant action in your financial risk management model. Color-coded cells flag severe regulatory compliance risk items and highlight moderate hazards that innovative risk mitigation strategies can help mitigate. Update the matrix on a weekly basis to align with evolving risk management conditions in real estate development. The Project Management Institute details matrix construction in the PMBOK® Guide – Risk Chapter.

Software Solutions: Digital Muscle for Risk Management in Real Estate Development

Platforms like Procore, Riskwatch, and Oracle Primavera inject data into every stage of Risk Management in Real Estate Development. Dashboards consolidate financial risk management forecasts, push alerts on emerging regulatory compliance risks, and recommend AI-driven risk mitigation strategies. Cloud records create an audit trail—critical when lenders demand proof that your Risk Management in Real Estate Development workflow is accountable. Platforms like Procore and Oracle Primavera P6 rank highly in Gartner’s Magic Quadrant for Construction Software, particularly for integrating schedule and risk dashboards.

Financial Modelling—Stress-Testing the Future of Risk Management in Real Estate Development

Scenario and sensitivity analyses reveal how a 1% rate hike ripples through the cash flow within the broader financial risk management framework. Pair those projections with Monte Carlo sims to see where regulatory compliance risk delays spike IRR. These predictive outputs inform pre-approved credit lines and layered risk mitigation strategies that protect equity throughout complex risk management cycles in real estate development. The CRE Finance Council publishes best-practice notes on interest-rate stress tests and Monte Carlo simulations.

Turn Data into Decisions with Dynamic Risk Management in Real Estate Development

Numbers matter only if they steer action. Feed matrix rankings and software analytics back into board-room strategy. Convert every financial risk management alert into budget reallocations; transform each flagged regulatory compliance risk into permit-tracking milestones; and deploy responsive risk mitigation strategies that evolve as fast as your Risk Management in Real Estate Development portfolio. Data-driven clarity beats reactive guesswork—every time. Numbers matter only if they steer action—echoed in Deloitte’s Global Real Estate Data Analytics Survey.

Strategies to Mitigate Regulatory and Legal Risks in Risk Management in Real Estate Development

Due Diligence: First Line of Defense against Regulatory Compliance Risk

Ineffective Risk Management in Real Estate Development: Comprehensive Legal Due Diligence Demolishes Surprise Setbacks. Guidance appears in the American Bar Association Real Property Due Diligence Toolkit. Title reviews, zoning audits, and covenant checks spotlight every regulatory compliance risk before the land is acquired. Coupling these findings with disciplined financial risk management models quantifies worst-case cost exposure, letting developers embed precise risk mitigation strategies into pro formas rather than scrambling mid-build.

Stakeholder Engagement: Proactive Risk Mitigation Strategies Pay Dividends

Local officials and neighborhood voices can fast-track or freeze a project. Embedding open forums and design charrettes early signals that Risk Management in Real Estate Development values collaboration. Transparent presentations of environmental safeguards reduce opposition, shrinking permitting timelines and lowering regulatory compliance risk fees. Investors translate that goodwill into favorable loan covenants, reinforcing overall financial risk management discipline. The World Bank’s Stakeholder Engagement Handbook shows how early collaboration shrinks permitting timelines.

Compliance Monitoring: Continuous Guardrails for Risk Management in Real Estate Development

Codes evolve faster than blueprints. Real-time dashboards track ordinance updates, issuing alerts when a new fire-safety clause or wetlands setback impacts scope. This digital vigilance converts potential fines into proactive redesigns, proving that ongoing financial risk management and vigilant regulatory compliance risk monitoring fortify project resilience. Each trigger funnels directly into live risk mitigation strategies, ensuring construction proceeds without costly stop-work orders. Real-time code tracking services such as UL Solutions Code Alerts keep teams current.

Adaptive Contracts: Embedding Risk Mitigation Strategies in Writing

Smart agreements bake flexibility into Risk Management in Real Estate Development. Force-majeure clauses aligned with local statutes, escalation riders for material-price spikes, and milestone-linked retainage safeguard both timelines and cash flow, strengthening the developer’s financial risk management posture. Should a sudden zoning amendment arise, pre-negotiated adjustment protocols neutralize the regulatory compliance risk impact and keep subcontractors mobilized.

Developers who unify rigorous due diligence, stakeholder alliances, tech-driven oversight, and adaptive legal frameworks transform legal hurdles into a competitive advantage—proof that strategic Risk Management in Real Estate Development converts compliance burdens into long-term value. The consensus AIA Document A201-2017 incorporates flexibility into payments, escalation, and force majeure clauses.

Managing Construction-Phase Risks in Risk Management in Real Estate Development

Choose the Right Partners: Contractors Make or Break Risk Management in Real Estate Development

Not all builders share your standards. Thorough vetting and crystal-clear contracts are frontline risk mitigation strategies. Define deliverables, penalties, and schedule triggers to ensure that every partner contributes to solid financial risk management rather than becoming a hidden regulatory compliance risk. Prequalification frameworks from the ConstructSecure Safety Assessment Program verify a contractor’s performance history and track record.

Safety Isn’t an Afterthought—It’s Core to Risk Management in Real Estate Development

A single incident jeopardizes timelines, budgets, and reputation. Embed OSHA protocols, mandatory drills, and on-site audits as standing risk mitigation strategies. A proactive safety culture protects labor continuity, strengthens investor confidence, and underscores disciplined financial risk management. OSHA’s Construction Industry Regulations, 29 CFR 1926, set mandatory baselines.

Supply Chain Stability: Preventing Costly Disruptions through Risk Management in Real Estate Development

Material shortages can paralyze critical paths. Diversify vendors, track shipments with logistics software, and maintain a 10 % buffer inventory. These measures tame volatility and integrate seamlessly into overarching financial risk management plans while also reducing the regulatory compliance risk associated with emergency substitutions. The Chartered Institute of Procurement & Supply (CIPS) Risk Index highlights global material supply volatility.

The Bottom Line: Construction Is the Heartbeat of Risk Management in Real Estate Development

Each day on-site translates to capital deployed. Developers who couple robust contractor screening, strict safety enforcement, and resilient supply networks establish a live framework of risk mitigation strategies. This real-time vigilance ensures budgets remain intact, schedules stay on course, and every regulatory compliance risk is squarely under control—hallmarks of elite Risk Management in Real Estate Development.

Financial Risk Management: Safeguarding Profitability in Risk Management in Real Estate Development

Diversification: A Core Risk Mitigation Strategy for Risk Management in Real Estate Development

Portfolio diversification anchors resilient financial risk management. Mixing residential, commercial, and mixed-use assets across regions reduces exposure when one segment experiences a downturn. This deliberate spread complements other risk mitigation strategies by cushioning revenue streams against sudden market shocks and reducing the long-tail regulatory compliance risk associated with single-asset concentrations. Within holistic Risk Management in Real Estate Development, diversification empowers developers to preserve IRR even when local valuations or ordinances swing unpredictably. Nareit’s REIT Performance Data illustrates how diversified portfolios buffer market shocks.

Hedging Tools for Financial Risk Management within Risk Management in Real Estate Development

Interest-rate swaps, commodity futures, and forward currency contracts transform volatility into planned expense lines. Locking rates before central bank hikes shields loan servicing costs, while currency hedges stabilize cross-border cash flows—essential components of robust financial risk management. When embedded early, these instruments act as proactive risk mitigation strategies, safeguarding debt covenants and satisfying investor mandates. Align each hedge with updated dashboards that flag emerging regulatory compliance risks arising from new derivatives reporting rules. ISDA explains the use of derivatives in real estate finance in its Introduction to Interest-Rate Swaps.

Debt Discipline and Regulatory Compliance Risk Alignment in Risk Management in Real Estate Development

Balanced leverage—tethered to conservative loan-to-value ratios—fortifies liquidity and appeases rating agencies. Maintaining covenants below stress thresholds demonstrates disciplined financial risk management and appeases oversight bodies, thereby reducing regulatory compliance risk associated with capital adequacy audits. Coupled with layered contingency lines, disciplined leverage forms a potent trio of risk mitigation strategies. Collectively, they ensure Risk Management in Real Estate Development remains nimble when credit spreads widen, or statutes introduce tighter lending caps.

Risk Management in Real Estate Development thrives on data-driven funding models, repeated financial risk management audits, vigilant monitoring of regulatory compliance risk, and agile risk mitigation strategies. Developers who institutionalize these practices transform capital volatility from an existential threat into a manageable variable—proving that sustainable profit grows from financial foresight rather than market luck. Basel III leverage guidelines, summarised by the Bank for International Settlements, influence prudent loan-to-value thresholds.

Contingency Planning: The Safety Net of Risk Management in Real Estate Development

Why Every Budget Needs Contingencies in Risk Management in Real Estate Development

Surprises are inevitable; insolvency isn’t. Allocating 10–20 % of project costs to a contingency fund embeds disciplined financial risk management directly into your pro forma. That buffer empowers immediate risk mitigation strategies when supply spikes, adverse weather conditions arise, or a sudden regulatory compliance risk materializes during the build. The Association for the Advancement of Cost Engineering (AACE) RP 64R-11 details contingency-sizing methods.

Structuring Dynamic Contingency Funds for Robust Risk Management in Real Estate Development

- Tiered Reserves – Split the contingency into design, construction, and close-out tranches, releasing each only after milestone audits confirm that no lingering regulatory compliance risk remains.

- Rolling Re-Forecasts – Update in real-time as schedules evolve, anchoring adaptive financial risk management to the current scope.

- Trigger Protocols – Pre-authorize draws when metrics breach thresholds—e.g., 5% materials inflation or a critical permit delay—so risk mitigation strategies can deploy instantly, not after committee lag.

Best-practice tiering models feature in the Construction Management Association of America (CMAA) Time & Cost Guide.

Alternative Paths and Crisis Teams: Live Risk Mitigation Strategies

- Supplier Swaps – Maintain vetted alternates for critical items; switch automatically if lead-time KPIs slip, preserving core Risk Management in Real Estate Development dates.

- Flexible Timelines – Embed float days tied to known seasonal risks; redeploy labor to parallel tasks when storms strike, showcasing agile financial risk management.

- Crisis Teams – Cross-functional squads (including legal, finance, and site operations) conduct quarterly rehearsals. When a new regulatory compliance risk emerges, they pivot their design, remodel budgets, and keep investors informed and calm.

FEMA’s Business Continuity Planning Suite offers templates for crisis-response drills.

Continuous Review Keeps Risk Management in Real Estate Development Resilient

Quarterly scenario drills powered by dashboard analytics recalibrate contingency sizing. Feedback loops link field data to board decisions, ensuring financial risk management remains fluid while every regulatory compliance risk update feeds fresh risk mitigation strategies. Preparedness transforms uncertainty into opportunity—proving that real strength in Risk Management in Real Estate Development lies not in avoiding shocks but in absorbing them without losing momentum.

Real-World Lessons: Risk Management in Real Estate Development in Action

Case Study 1 — Converting Zoning Shifts into Opportunity through Risk Mitigation Strategies

A mixed-use coastal project stalled when new zoning erased planned density. By embedding real-time Risk Management in Real Estate Development dashboards, the team mapped every regulatory compliance risk and launched fast-track charrettes with city planners. Revised massing, the addition of green corridors, and pre-negotiated incentives became decisive risk mitigation strategies. Result: permits were reinstated, the timeline preserved, and the episode became a masterclass in adaptive risk management in real estate development.

Case Study 2 — Supply-Chain Turbulence Tamed by Proactive Financial Risk Management

A high-rise tower faced concrete shortages that threatened penalties. Because the developer’s Risk Management in the Real Estate Development plan already layered hedge contracts and dual-vendor clauses, alternate suppliers mobilized within 48 hours. Parallel procurement and floating contingency funds—core pillars of their financial risk management—kept cranes swinging without cost overruns, demonstrating that disciplined capital buffers translate into operational agility within rigorous risk management in real estate development.

Case Study 3 — Regulatory Chaos Reversed with Precise Regulatory Compliance Risk Controls

A suburban retail center collided with surprise heritage-site rulings. Immediate legal mapping within the overarching risk management framework for real estate development identified statutory gaps. The team’s counsel drafted adaptive easements while site engineers tweaked façades, proving that continuous monitoring of every regulatory compliance risk, combined with swift legal engineering, underpins resilient risk management in real estate development outcomes.

Case Study 4 — Floodplain Success Via Integrated Risk Mitigation Strategies & Financial Risk Management

Building an industrial park inside a flood fringe sounds reckless—unless embedded Risk Management in Real Estate Development treats water as a design datum. Elevated slabs, amphibious utilities, and stormwater credits were costed early on using granular financial risk management models. These forward-costed risk mitigation strategies delivered insurance savings and community praise, underscoring how holistic risk management in real estate development converts environmental threats into a competitive advantage.

Across all stories, the common thread is clear: continuous, data-driven Risk Management in Real Estate Development—anchored by robust financial risk management, vigilant regulatory compliance risk tracking, and agile risk mitigation strategies—transforms shocks into milestones of credibility.

Key Takeaways for Risk Management in Real Estate Development

Ground Every Decision in Financial Risk Management Data

Sound numbers—not instincts—steer profitable Risk Management in Real Estate Development. Convert projections into stress-tested pro formas, layer contingency funds, and hedge rate exposure. When capital markets lurch, disciplined financial risk management preserves liquidity and credibility.

Anticipate and Track Each Regulatory Compliance Risk

Codes change faster than cranes climb. Continuous monitoring of zoning, environmental, and safety statutes keep schedules intact and fines at bay. Embedding automated alerts within your Risk Management in Real Estate Development workflow ensures that emerging regulatory compliance risks are addressed before they threaten permits or valuations.

Deploy Agile, Layered Risk Mitigation Strategies

No single defense suffices. Combine contractual safeguards, diversified suppliers, safety drills, and adaptive design to absorb shocks. These layered risk mitigation strategies transform surprises into manageable line items, proving that proactive planning is the cornerstone of elite Risk Management in Real Estate Development.

Culture of Vigilance Sustains Risk Management in Real Estate Development

Establish feedback loops through weekly matrix reviews, quarterly scenario drills, and real-time dashboard alerts to ensure continuous improvement. When every stakeholder speaks the language of financial risk management, flags each regulatory compliance risk, and tests fresh risk mitigation strategies, resilience becomes institutional rather than situational.

Profit Grows Where Risk Is Managed, Not Avoided

Successful developers treat uncertainty as a strategic asset. By pairing data-driven financial risk management, relentless regulatory compliance risk oversight, and adaptive risk mitigation strategies, today’s projects deliver on time, on budget, and beyond stakeholder expectations—cementing leadership in Risk Management in Real Estate Development.

Conclusion: Risk Management in Real Estate Development as a Catalyst for Success

Turning Uncertainty into Strategic Advantage

In today’s market, developers who master Risk Management in Real Estate Development stand apart. They deploy data-driven financial risk management, monitor every evolving regulatory compliance risk, and activate layered risk mitigation strategies long before crises surface. This mindset doesn’t merely protect capital—it multiplies opportunity and credibility.

Embedding Financial Risk Management into Every Phase

Profitability grows when cash-flow models, hedge instruments, and contingency reserves guide decisions from site acquisition through close-out. Treating capital discipline as the backbone of Risk Management in Real Estate Development shifts teams from reactive cost-cutting to proactive value creation.

Navigating Regulatory Compliance Risk with Confidence

Codes will change; approvals will tighten. Developers who track statutes in real-time, engage officials early and adapt design swiftly convert compliance hurdles into fast-track endorsements—proving that vigilant oversight of every regulatory compliance risk is inseparable from elite Risk Management in Real Estate Development.

Deploying Layered Risk Mitigation Strategies for Resilience

From diversified suppliers and safety drills to adaptive contracts and flood-resistant engineering, multi-tiered risk mitigation strategies absorb shocks without derailing schedules. This resilience cements trust with lenders, tenants, and communities while reinforcing the culture of continuous Risk Management in real estate development.

The Final Word on Risk Management in Real Estate Development

Risk is inevitable; loss is not. When developers combine rigorous financial risk management, relentless regulatory compliance risk tracking, and agile risk mitigation strategies, uncertainty becomes a source of competitive leverage. Projects deliver on time, investors stay engaged, and the market recognizes a leader who builds with foresight and fortitude—definitive proof that disciplined Risk Management in Real Estate Development is the blueprint for enduring success.

FAQ: Risk Management in Real Estate Development

How does Risk Management in Real Estate Development improve financial risk management on a project?

Robust Risk Management in real estate development incorporates cash-flow modeling, hedging, and contingency funds into every budget cycle. This data-driven discipline elevates financial risk management by predicting capital needs, shielding against rate hikes, and aligning reserves with live risk mitigation strategies.

Which tools quantify regulatory compliance risk inside Risk Management in Real Estate Development?

Developers integrate permit-tracking dashboards, GIS zoning overlays, and AI-driven code update alerts. These platforms expose emerging regulatory compliance risk, enabling swift risk mitigation strategies while reinforcing the broader framework of Risk Management in Real Estate Development.

What are the top three risk mitigation strategies for schedule shocks?

- Dual-vendor sourcing for critical materials.

- Tiered contingency funds linked to milestone audits.

- Adaptive contracts that auto-adjust for statute shifts.

- All three reside at the core of forward-thinking Risk Management in Real Estate Development and strengthen overall financial risk management.

Why is stakeholder transparency vital in Risk Management in Real Estate Development?

Transparent reporting on financial risk management metrics and real-time regulatory compliance risk updates fosters trust, accelerates approvals, and earns community support—transforming potential pushback into collaborative risk mitigation strategies.

How large should a contingency budget be within Risk Management in Real Estate Development?

Most practitioners allocate 10–20 % of hard costs. The exact reserve ties to quantified financial risk management stress tests and site-specific regulatory compliance risk exposure, ensuring funds match the project’s bespoke risk mitigation strategies.

Can strong Risk Management in Real Estate Development reduce insurance premiums?

Yes. Verified safety protocols and layered risk mitigation strategies demonstrate lower loss expectancy. Carriers translate those metrics—and documented financial risk management safeguards—into meaningful discounts.

How frequently should teams reassess regulatory compliance risk?

Weekly dashboard checks and quarterly legal audits are industry best practices. Continuous updates keep Risk Management in Real Estate Development nimble, embedding live adjustments into budgets and on-site risk mitigation strategies.

What role does technology play in modern Risk Management in Real Estate Development?

BIM clash detection, IoT job-site sensors, and predictive analytics converge to quantify costs, flag regulatory compliance risk, and automate proactive financial risk management actions—forming the digital backbone of integrated risk mitigation strategies.

How do financial risk management tactics support sustainable design goals?

Accurate capital forecasting funds renewable materials, while hedged commodity contracts stabilize pricing. These moves, orchestrated through comprehensive Risk Management in Real Estate Development, secure budgets for eco-aligned risk mitigation strategies without sacrificing ROI.

Where should a new developer start with Risk Management in Real Estate Development?

Begin with a holistic risk matrix: catalog every regulatory compliance risk, quantify cost exposure in a financial risk management model, and assign tailored risk mitigation strategies. Iterate monthly—success grows from disciplined, repeatable practice.

For a deeper dive into the most effective Real Estate Pre-Development Strategies in real estate, How to Master Pre‑Development Strategies in Real Estate: A Comprehensive Guide, the cornerstone resource for Real Estate Pre-Development optimization, where we consolidate advanced strategies, data-driven analysis, and expert methodologies to elevate your expertise.

Access the ultimate real estate development success kit for free! This comprehensive guide includes step-by-step strategies, high-impact templates, and $35,000 worth of expert insights designed to help you develop smarter, reduce costs, and confidently lead. Whether you’re planning your first project or scaling up for your next big venture, the Real Estate Development Guide has you covered?

Book your one-on-one strategy session now to create direct value.